Catalog Number 41167W www.irs.gov

Form

3911 (Rev. 10-2022)

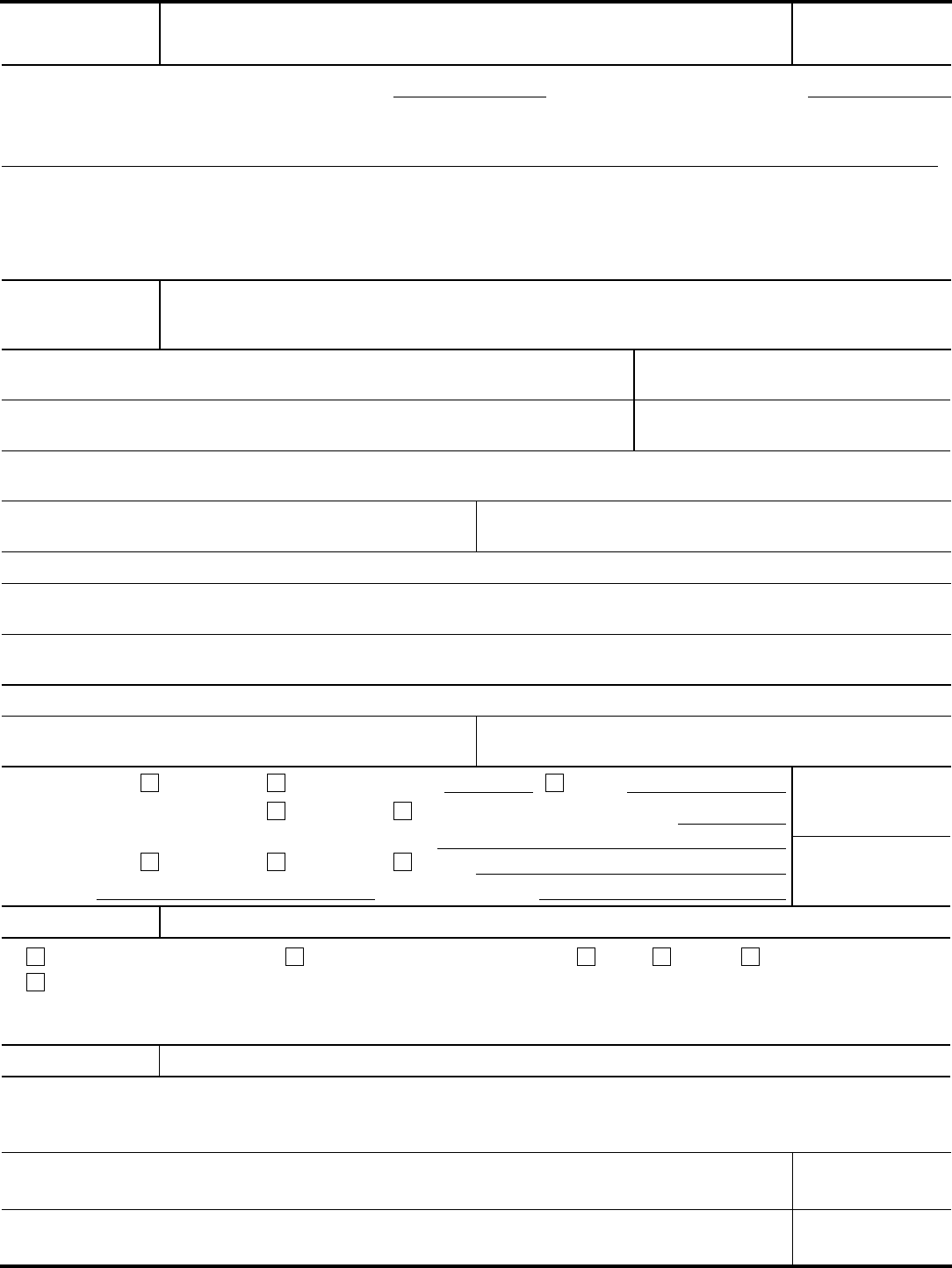

Form 3911

(October 2022)

Department of the Treasury - Internal Revenue Service

Taxpayer Statement Regarding Refund

OMB Number

1545-1384

The information below is in reply to your inquiry on about your Federal tax refund for

If you did not receive your refund or if the refund check you received was lost, stolen or destroyed, complete the entire form. If there are

portions of the form that do not apply to you, you may mark them as N/A. Return to us in the envelope provided or fax the form to

.

Note: You must complete a separate Form 3911 for each refund for which you are requesting information.

Note: If you are in possession of a check which was not cashed within one year of the issue date as the law requires, it can no longer

be cashed, contact the service for instructions on how to return your check.

For information on how to complete or where to send this form, visit www.irs.gov/forms-pubs/about-form-3911-taxpayer-statement-

regarding-refund.

Section I

Print your current name(s), taxpayer identification number (for individuals, this may be your social security

number or your ITIN, for businesses, it is your employer identification number) and address, including ZIP code.

If you filed a joint return, enter the information of both spouses on lines 1 and 2 below.

1. Your name Taxpayer Identification Number

2. Spouse’s name (if a name is entered here, spouse must sign on line 11) Taxpayer Identification Number

3. Current address Apt. No. City State ZIP code

Give us a phone number where you can be reached between

8 a.m. and 4 p.m. Include area code.

Area code Telephone number

Enter the information on line 4 exactly as it appeared on your tax return, if no change from above, enter N/A in fields below.

4. Name(s)

Address on return if different from current address Apt. No. City State ZIP code

If you authorized a representative to receive your refund check, enter his or her name and mailing address below.

5. Name of representative

6. Address (include ZIP code)

7. Type of return Individual Business,

Form

Other

Type of refund requested Check Direct Deposit

Refund amount $

Name of bank (where you normally cash or deposit your checks)

Account type Checking Saving Other

Bank RTN Account number

Tax period

Date filed

Section II Refund Information (check all boxes that apply to you)

8. I didn’t receive a refund. I received a refund check, but it was Lost Stolen Destroyed

9. I received the refund check and signed it.

NOTE: The law doesn’t allow us to issue a replacement check if you endorsed it and someone other than you cashed the check, since

that person didn’t forge your signature.

Section III Certification

Sign below. If this refund was from a joint return, both spouses must sign, before we can begin a trace.

Under penalties of perjury, I declare that I have examined this form, and to the best of my knowledge and belief, the information is true,

correct, and complete. I request that you send a replacement refund, and if I receive two refunds, I will return one.

10. Signature (for business returns, signature of person authorized to sign the check) Date

11. Spouse’s signature, if required (for businesses, enter the title of the person who signed above) Date

Catalog Number 41167W www.irs.gov

Form

3911 (Rev. 10-2022)

Privacy Act and Paperwork Reduction Act Notice

We ask for the information on this form to carry out the Internal Revenue laws of the United States.

You aren’t required to give us the information since the refund you claimed has already been issued. However, without the information we won’t be able

to trace your refund, and may be unable to replace it. You may give us the information we need in a letter.

We need the information to ensure that you are complying with these laws and to allow us to determine the correctness of your refund or the right

amount of payment. Your Social Security Number and the other information are being requested in order that the Department of the Treasury can

process your refund. The authority of requesting your social security number is 26 United States Code, section 6109. If you cannot or will not furnish the

information, the tracing of your refund may be delayed.

You are not required to provide the information requested on a form that is subject to the Paperwork Reduction Act unless the form displays a valid OMB

control number. Books or record relating to a form or its instructions must be retained as long as their contents may become material in the

administration of any Internal Revenue law. Generally, tax returns and return information are confidential, as required by Internal Revenue Code section

6103. The time needed to compete and file this form will vary depending on individual circumstances. The estimated average time is less than 5 minutes.

If you have comments concerning the accuracy of this time estimate or suggestions for making this form simpler, we would be happy to hear from you.

You can write to the Internal Revenue Service, Attention: Tax Products Coordinating Committee, Western Area Distribution Center, Rancho Cordova,

CA 95743-0001.

Do not send this form to this office. Instead, please use the envelope provided or mail the form to the Internal Revenue Service center where you would

normally file a paper tax return.