Rethinking Monetary–Fiscal

Policy Coordination

Edited by Boštjan Jazbec and Biswajit Banerjee

Rethinking Monetary–Fiscal Policy Coordination

Monetary policy has become increasingly accommodative in response

to the global nancial crisis, relying on unconventional policies, such as

large-scale government bond purchases and negative interest rates in some

countries. Yet there is broad agreement that there are limits to the scope

of monetary policy actions and their eectiveness. Sustainable growth

and price stability will require a coherent, integrated policy strategy that

also includes contributions from scal and structural policies – as well as

appropriate policies to contain nancial risks.

This book contains the proceedings of the high-level seminar on

“Rethinking Monetary‒Fiscal Policy Coordination” organised by the

Bank of Slovenia and the International Monetary Fund on 19-20

May 2016 in Portorož, Slovenia. The seminar explored the thinking

of policymakers and academics on the roles and coordination of

monetary and scal policies in the European Union and elsewhere.

Three main topics were taken up in separate sessions: (i) principles and

practical experience in the coordination of monetary and scal policies;

(ii) scal policy implementation in the EU institutional framework and

implications for monetary policy; and (iii) conducting monetary policy

when scal space is limited.

Boštjan Jazbec is Governor and Biswajit Banerjee is Chief Economist

at the Bank of Slovenia, Ljubljana, Slovenia.

Proceedings of a seminar jointly organised by the

Bank of Slovenia and the International Monetary Fund

Rethinking Monetary–Fiscal Policy Coordination Edited by Boštjan Jazbec and Biswajit Banerjee

9 789616 960120

ISBN 978-961-6960-12-0

Rethinking Monetary–Fiscal Policy Coordination

Edited by

Boštjan Jazbec and Biswajit Banerjee

Proceedings of a seminar jointly organised by

the Bank of Slovenia and the International Monetary Fund

© 2017 Bank of Slovenia and International Monetary Fund.

Disclaimer: The views expressed in this book are those of the authors and

do not necessarily represent the views of either the Bank of Slovenia or the

International Monetary Fund (IMF), its Executive Board, or IMF management.

Typesetting and cover design by Anil Shamdasani (www.shamdasani.co.uk).

CIP - Kataložni zapis o publikaciji

Narodna in univerzitetna knjižnica, Ljubljana

336.74(4)(082)(0.034.2)

RETHINKING monetary-scal policy coordination [Elektronski vir]:

proceedings of a seminar jointly organised by the Bank of Slovenia and

the International Monetary Fund / edited by Boštjan Jazbec and Biswajit

Banerjee. - El. knjiga. - Ljubljana : Bank of Slovenia, 2017

Način dostopa (URL):

www.bsi.si/publikacije-in-raziskave.asp?MapaId=2198

ISBN 978-961-6960-12-0 (pdf)

1. Jazbec, Boštjan

289822720

Also available at:

www.bsi.si/publikacije-in-raziskave.asp?MapaId=2198 (page in Slovene)

www.bsi.si/en/publications.asp?MapaId=1867 (page in English)

www.imf.org/external/np/exr/seminars/index.htm

Table of contents

Acknowledgements iv

List of abbreviations v

Foreword vii

Opening remarks 1

Boštjan Jazbec, Governor, Bank of Slovenia

Giovanni Dell’Ariccia, Deputy Director, Research Department, IMF

Panel 1: The coordination of monetary and scal policy –

principles and practical experience

Summary of Panel 1 9

Presentations by Lead Speaker and Panellists 11

General discussion 31

Panel 2: Fiscal policy implementation in the EU institutional

framework and implications for monetary policy

Summary of Panel 2 41

Presentations by Lead Speaker and Panellists 45

General discussion 76

Panel 3: Conducting monetary policy when scal space is

limited

Summary of Panel 3 83

Presentations by Lead Speaker and Panellists 87

General discussion 129

Closing remarks 141

Fabrizio Coricelli, Paris School of Economics and CEPR

About the speakers 144

About the editors 151

Acknowledgements

First, and foremost, we would like to thank Marija Žiher for her painstaking

support in all stages of the preparation of the manuscript. We also thank the

following people for their key role in organising the seminar: Polona Flerin,

Karmen Juren, Tatjana Brunček and Ksenija Berdnik. Our thanks also go to

Anil Shamdasani for overseeing the production of the book.

List of abbreviations

BAMC Bank Asset Management Company

CBA Central Bank of Armenia

CDO collateralised debt obligation

CDS credit default swap

CEE Central and Eastern European

CNB Croatian Central Bank

CSR country-specic recommendations

CZK Czech koruna

EB extended benets

EC European Commission

ECB European Central Bank

ECOFIN Economic and Financial Aairs Council

EDP Excessive Decit Procedure

EFB European Fiscal Board

EFSF European Financial Stability Facility

EFW European Fiscal Watchdog

EMU European Monetary Union

ESA European System of National and Regional Accounts

ESCB European System of Central Banks

ESM European Stability Mechanism

EU European Union

EUC Emergency Unemployment Compensation

FDI foreign direct investment

Fed US Federal Reserve

FX foreign exchange

GDP gross domestic product

HICP Harmonised Index of Consumer Prices

IFI independent scal institution

IMF International Monetary Fund

LTRO longer-term renancing operation

NPL non-performing loan

OECD Organisation for Economic Co-operation and Development

OMT Outright Monetary Transactions

MoF ministry of nance

MTO Medium-term objective

NCB national central bank

SGP Stability and Growth Pact

QE quantitative easing

UK United Kingdom

US United States

ZLB zero lower bound

Foreword

In the aftermath of the global nancial crisis, policymakers in many countries

face considerable challenges in fostering sustained strong growth, price stability

and nancial stability. In general, economic recovery has been slow and ination

has stayed below accepted denitions of price stability. In response, monetary

policy has become increasingly accommodative, relying on unconventional

policies, such as large-scale government bond purchases and negative interest

rates in some countries. Yet there is broad agreement that there are limits

to the scope of monetary policy actions and their eectiveness. Sustainable

growth and price stability will require a coherent, integrated policy strategy

that also includes contributions from scal and structural policies – as well as

appropriate policies to contain nancial risks.

This book contains the proceedings of the high-level seminar on “Rethinking

Monetary‒Fiscal Policy Coordination” organised by the Bank of Slovenia

and the International Monetary Fund on 19-20 May 2016 in Portorož,

Slovenia. The seminar explored the thinking of policymakers and academics

on the roles and coordination of monetary and scal policies in the European

Union and elsewhere. Three main topics were taken up in separate sessions: (i)

principles and practical experience in the coordination of monetary and scal

policies; (ii) scal policy implementation in the EU institutional framework

and implications for monetary policy; and (iii) conducting monetary policy

when scal space is limited.

Speakers in the rst session underscored that central bank independence is a

cornerstone principle of modern economic policymaking. Independence is

critical for central bank credibility, which in turn is of paramount importance

for transmitting policy impulses to the economy. Independence also implies

that monetary–scal policy coordination will be achieved with the monetary

and scal authorities acting independently within their mandates. Participants

recognised the potential advantages, in some circumstances, of using scal

policy to support the demand-stabilising eorts of the central bank – but also

emphasised associated practical risks.

Participants in the second session noted that the EU’s scal policy framework

aims to ensure that no individual member state runs excessive decits or

builds up excessive debts. The increase in public debt experienced by many

European countries after the global nancial crisis – brought on both by the

deep recessions and the need to support their banking systems – constrains

scal policy’s ability to assist in output stabilisation. That said, countries with

scal space are well advised to use it as needed to assist monetary policy in

closing the negative output gaps and raising potential growth. And even in

countries without scal space, scal policy can still support growth by reducing

distortionary taxes and unproductive or poorly targeted expenditure while

increasing productive investment.

Finally, the last seminar session explored the challenges of conducting monetary

policy when scal space is limited, and the special diculties in the European

context. Monetary policy has to full its price stability mandate, keeping

ination close to target. With interest rates near zero, the substantial use of

unconventional monetary measures to stimulate domestic demand has been

appropriate. With such demand support, output gaps in Europe are gradually

closing. To raise growth further, structural policies that raise investment, labour

force participation and productivity need to pick up the torch.

We are grateful to Biswajit Banerjee for taking primary responsibility for

editing the proceedings of the seminar. Our thanks also go to Marija Žiher

for providing invaluable support in the preparation of the manuscript, to

Anil Shamdasani for excellent and swift handling of its production, as well as

to everyone who helped to make the seminar a success, in particular, Polona

Flerin.

Tobias Adrian Boštjan Jazbec

Financial Counsellor & Director Governor

Monetary and Capital Markets Department Bank of Slovenia

International Monetary Fund

Opening remarks

Boštjan Jazbec, Governor, Bank of Slovenia

It is a great pleasure to welcome you all to the high-level seminar on

“Rethinking Monetary‒Fiscal Policy Coordination” organised jointly by the

Bank of Slovenia and the International Monetary Fund. It is a great honour

to have a very distinguished gathering of central bank governors, senior

ocials of governments and international institutions, leading academics

and practitioners to discuss a very critical issue that occupies the minds of

policymakers in the euro area and elsewhere.

The objective of the seminar is to explore current thinking on the roles and

coordination of monetary and scal policies. The presentations and discussion

will focus on three main themes: (i) the principles and practical experience in the

coordination of monetary and scal policies; (ii) scal policy implementation

in the EU institutional framework and implications for monetary policy; and

(iii) conducting monetary policy when scal space is limited. I will now briey

touch on these themes in general terms.

Policymakers in the euro area face considerable challenges in fostering

sustained strong growth, price stability and nancial stability. Following

the onset of the global nancial crisis, economic recovery has been slow

and growth remains lacklustre. Ination is much below the medium-term

objective of lower than, but close to 2%. For some time now, ination has been

continually weaker than expected and market-based measures of ination

expectations stand at historical lows. Therefore, monetary policy has become

increasingly accommodative, relying on several non-standard measures and

negative interest rate policy.

There is broad agreement that in the current setting there are limits to the

scope of monetary policy actions and their eectiveness for lifting the euro area

economy. Concerns are mounting that the outlook may be one of a prolonged

period of low ination and low interest rates, which can adversely aect both

the real and nancial sectors. Therefore, many of us have emphasised on

numerous occasions that “monetary policy cannot be the only game in town”.

Strong sustainable growth, price stability and nancial stability will require

a coherent, integrated policy strategy that also includes scal and structural

policies.

2 Rethinking Monetary–Fiscal Policy Coordination

The message on the importance of scal policy supporting monetary policy

is founded on historical precedence. In 1936, prescribing the way out of the

Great Depression, Keynes wrote:

“It seems unlikely that the inuence of [monetary] policy on the rate of interest

will be sucient by itself. I conceive, therefore, that a somewhat comprehensive

socialization of investment will prove the only means of securing an approximation

to full employment.”

1

These words are very relevant at the current juncture as well.

The ECB has emphasised that scal policies should support the economic

recovery while remaining in full compliance with the EU’s scal rules.

Otherwise, credibility in the scal framework cannot be maintained. A

critical question, therefore, is whether the prevailing rules could be barriers

to achieving the desired coordination of monetary and scal policies.

There are two key prerequisites for obtaining eective scal support to monetary

policy within the Stability and Growth Pact rules. Governments must have

adequate scal space, and scal policy must ensure the sustainability of public

nances. In both respects, there appears to be little room for a meaningful

scal expansion within the existing rules. There is broad agreement that the

scal framework has failed to ensure long-term sustainability while avoiding

procyclical scal behaviour. Countries did not build up sucient scal space

during the pre-crisis expansionary period, and scal space narrowed following

the onset of the nancial crisis. Public debt increased sharply during the

crisis years and the policy focus turned to an austerity mode when market

pressures heightened. Most of the euro area countries still face long-term

scal sustainability issues and are expected to keep their scal consolidation

eorts, in terms of the cyclically adjusted decit, ongoing. In 2016, only four

countries – namely, Germany, Luxembourg, Cyprus and Estonia – have scal

space for additional discretionary measures according to the Stability and

Growth Pact rules.

What then is the way forward? It has been emphasised on many occasions

that for countries without scal space, scal policy can still support demand

by altering the composition of the budget. In particular, it has been pointed

out that consideration should be given to cutting distortionary taxes and

unproductive expenditure and to increasing investments that improve total

factor productivity over the medium term. Investment and structural reforms

that increase the growth potential of the economy create scal space by raising

future government revenues. It should be noted that some of these measures

1 Keynes, J.M. (1936), The General Theory of Employment, Interest and Money, London: Macmillan & Co., Chapter 24.

Opening remarks

3

will require political resolve and social support, as they are likely to aect social

entitlements. Some analysts have remarked that these measures will not have

much impact in the short term.

Should there be a rethinking of the monetary policy framework? In a recent

blog in April 2016, former Chairman of the Federal Reserve, Ben Bernanke,

argued that:

“under certain extreme circumstances - [such as] sharply decient aggregate demand,

exhausted monetary policy, and unwillingness of [scal authorities] to use debt-

nanced scal policies - [money-nanced scal programs, colloquially known as

helicopter drops] may be the best available alternative” and that “it would be

premature to rule them out”.

2

Earlier in this vein, in 2003, Bernanke had recommended that Japan ght

deation through an expansionary scal policy nanced by permanent

purchases of government debt by the central bank. The permanency of central

bank purchases of public debt rules out that the new debt will ever be placed on

the market, thereby eliminating Ricardian equivalence eects and preventing

new public debt accumulation.

However, an essential aspect of money-nanced scal programmes is that they

involve revocation or suspension of central bank independence. Precisely for

this reason, and because governance of money-nanced scal programmes is

inherently dicult (since it creates perverse incentives for legislators to facilitate

tax cuts or spending when such actions no longer make macroeconomic sense),

this option is not something that central banks in general are discussing or

even considering.

In the euro area, the principle of central bank independence is one of the

cornerstones of the economic policy constitution enshrined in the Maastricht

Treaty. A fundamental expectation is that monetary–scal policy coordination

will be achieved with dierent institutions acting independently within their

mandates. To preserve this framework, the focus should be on improving the

governance structure so as to ensure that the euro area does not gradually slide

into a regime of scal dominance. Within the constraint of its given mandate,

the ECB has moved towards improving the policy mix through the expansion

of its balance sheet aimed at stimulating economic activity.

It is my sincere hope that the seminar will provide a useful springboard for

moving forward with bolder policy actions and reforms that will help put the

euro area on a path of strong sustained growth and price stability.

2 www.brookings.edu/blog/ben-bernanke/2016/04/11/what-tools-does-the-fed-have-left-part-3-helicopter-money/.

4 Rethinking Monetary–Fiscal Policy Coordination

Giovanni Dell’Ariccia, Deputy Director, Research Department,

International Monetary Fund

3

Let me start by thanking Governor Jazbec and the Bank of Slovenia for their

hospitality. Let me also welcome you all on behalf of the IMF’s side of the

organising committee. It is a pleasure and a privilege to be at this high-level

seminar with so many distinguished participants.

I would like to discuss three inter-related issues that I am sure will be addressed

in much greater detail in the seminar sessions today and tomorrow. My aim

is more to ask questions than to provide answers, as I feel there are many in

this room far more qualied than me to provide the latter.

The rst issue is central bank independence and how it came to be. I will discuss

in general terms the idea that monetary policy can and should be delegated

to a separate agency protected from short-term political pressures, and that it

should be set independently from the scal stance.

The second issue is how the post-crisis experience has challenged this model.

In particular, I will touch upon how the need to deviate from the pre-crisis

consensus model has reignited pressures on central banks and potentially led

to threats to their independence.

Finally, I would like to reect on the potential role for coordination between

scal and monetary policy when there is limited scal space and conditions

are close to a liquidity trap. In that context, I will briey discuss “helicopter

money”, on which I think my views are in line with those of Governor Jazbec.

The pre-crisis consensus and central bank independence

During the 25 or so years before the crisis, we thought of monetary policy as

having one target (namely, ination) and one instrument (namely, the policy

rate). As long as ination was stable, the output gap was likely to be small and

stable and monetary policy did its job. We thought of scal policy as playing

a secondary countercyclical role, with political-economy constraints sharply

limiting its usefulness. This is a bit of a caricature, but not too far from the

consensus view prevailing at the time.

Looking at it in more detail, monetary policy had a simple mandate: price

stability. Stable and low ination was presented as the primary, if not exclusive,

target of central banks (sometimes with output or unemployment as a secondary

3 The views in this presentation are those of the author and do not necessarily represent those of the IMF, its

management, or its Executive Board.

Opening remarks

5

target). This was the result of a coincidence between the reputational need of

central bankers to focus on ination rather than activity and their desire, at

the time, to decrease ination from the high levels of the 1970s.

This view also was rooted in a strong intellectual framework. First, there was

a well-understood time inconsistency for scal authorities with the temptation

to inate public debt away, as in the Barro-Gordon model.

4

Second, in the

New Keynesian models, typically characterised by nominal rigidities as the

only frictions, a divine coincidence emerged (as Olivier Blanchard and Jordi Gali

called it)

5

– the best monetary policy can do when facing demand shocks

is to maintain ination stable. In practice, this also meant low. This would

automatically guarantee the lowest output gap, or the same level of activity

that would prevail in the absence of nominal rigidities.

Since we had a measurable target – the ination rate – the central bank could

be easily held accountable for its actions while at the same time it could be

vindicated against undue criticism. For instance, the central bank could show

after a tightening that the ination rate was right below the target. Thus,

it could more easily resist ex ante pressures to keep monetary policy on an

excessively easy stance.

There was also another simplication: a mono-dimensional and observable

instrument – the policy rate. This simplication relied on two assumptions.

First, what mattered were prices and interest rates and not the underlying

monetary aggregates or liquidity. Second, well-functioning nancial markets

would transmit the monetary stimulus across the economy. So, all one needed

to do was to move the policy rate and the entire economy would adjust

accordingly. This also meant that the separation from the scal authorities

could be strengthened through explicit limits on central bank action, such as

no monetary nancing of the decit.

To summarise, the pre-crisis consensus framework allowed transparency,

accountability and limits on central bank actions. This led to the delegation

of monetary policy, which became the primary macroeconomic countercyclical

lever, to a politically acceptable non-elected agency. This was the foundation

of the operational independence of central banks.

4 Barro, R.J. and Gordon, D.B. (1983), “A Positive Theory of Monetary Policy in a National-Rate Model”, Journal of

Political Economy 91(4): 589–650.

5 Blanchard, O. and Gali, J. (2007), “Real Wage Rigidities and the New Keynesian Model”, Journal of Money, Credit and

Banking 39(S1): 35–65.

6 Rethinking Monetary–Fiscal Policy Coordination

In contrast, scal policy had a much more limited role from the cyclical point

of view. This was very dierent from earlier decades in which scal policy

was the centre of macroeconomic policy (for instance, as Governor Jazbec

mentioned, in the wake of the Great Depression).

There were several reasons for this limited role of scal policy. First, there

was widespread scepticism about the eects of scal policy, mostly based on

Ricardian equivalence arguments. This was combined with a sense that the

leads and lags associated with the eects of changes in the scal stance were too

long and poorly understood for scal policy to be an eective countercyclical

tool. Second, since monetary policy could maintain a small and stable output

gap, there was little reason to use another instrument. Third, in several

countries, the priority was to stabilise and possibly decrease typically high

levels of debt. Finally, scal policy was seen as highly exposed to risks of

political interference.

Overall, at least until the global nancial crisis, this macroeconomic policy

setup was seen as a highly successful model. It was often credited for the Great

Moderation and explains the prevalence of ination-targeting frameworks

across advanced economies and, increasingly, in emerging market countries.

Post-crisis needs led to new (yet old) mandates and new instruments

With the onset of the nancial crisis, this model was challenged. Central banks

had to do things that were very dierent from what they had been doing in the

previous 25 years (but not that dierent when judged with a longer history in

mind). For example, they provided liquidity to a variety of agents – not only

deposit-taking institutions but also other intermediaries, such as money market

funds and insurance companies. They supported liquidity conditions in several

asset markets and re-established and repaired broken arbitrage conditions.

They also bought massive amounts of sovereign bonds.

These actions were necessary. They were justiable both from a global welfare

point of view and under long-term ination targeting (the so-called exible

IT framework), but they were dramatic deviations from what one was used to

seeing central banks do. More generally, the realisation that a low and stable

ination rate was a necessary but not a sucient condition for macroeconomic

stability led to a re-evaluation of the pre-crisis framework.

If central banks at times needed to do things that were much less transparent

and much less measurable than changes in the policy rate, the political-

economy and governance conditions that had allowed for delegation became

Opening remarks

7

subject to discussion as well. This does not mean that we should reconsider

central bank independence, but it explains why central banks have seen an

increase in political pressure in so many countries.

Let me give an example. Think about macroprudential policy. Imagine

that either the central bank or whatever specialised agency in charge of it

decides to tighten loan-to-value ratios because it sees leverage growing and

is concerned about a potential crisis. If no crisis materialises in the following

year, all the critics are going to say: “See, you were paranoid. There were

no reasons to tighten loan-to-value ratios. There is no problem. There is no

nancial instability.” Of course, it may be that the crisis did not materialise

exactly because the central bank or the macroprudential agency acted. But,

the counterfactual is not observable and it is dicult, if not impossible, to

convince critics that a crisis outcome would have been the state of the world

in the case of inaction.

This is very dierent from what happens with ination. In this case, the central

bank could go out and say: “See, the ination rate is at 1.9% and, if we hadn’t

tightened, we would be above target.” This vindicates the tough choice ex ante.

Once we deviate from a simple price stability target, we have much murkier,

less measureable and less observable mandates. Things are much more dicult

to defend and, hence, there are more pressures on the central bank to act one

way or another.

This brings me to my next point: how monetary policy has to act sometimes

in support of the scal position of a country, and how this again may muddy

the mandate. As an example, consider the situation in Italy or Spain in 2009,

2012 and 2014. From the scal sustainability point of view, the fundamentals

of these countries cannot explain the wild swings in sovereign spreads. Instead,

this can be ascribed to something akin to a Diamond–Dybvig-type bank run.

6

There is a liquidity component to stability in countries that are in a certain

range of the debt-to-GDP ratio, and this component needs to be addressed. So,

what is the role of monetary policy in this context? How can the central bank

help in steering markets away from the bad equilibrium towards the good one?

In that context, President Draghi’s “whatever it takes” speech

7

played the role

that deposit insurance plays in banking models. Essentially, Mr. Draghi was

saying that the ECB was going to do whatever was needed in order to keep

the euro together against the liquidity crisis. In doing so, the ECB averted the

liquidity crisis altogether. Of course, it is dicult to distinguish liquidity from

6 Diamond, D.W. and Dybvig, P.H. (1983), “Bank Runs, Deposit Insurance, and Liquidity”, Journal of Political Economy

91(3): 401–419.

7 www.ecb.europa.eu/press/key/date/2012/html/sp120726.en.html.

8 Rethinking Monetary–Fiscal Policy Coordination

solvency. This raises the question of what kind of governance framework one

should have to ensure that the necessary scal incentives are in place, once

the central bank plays the role of liquidity provider of last resort on sovereign

markets.

Finally, I would like to touch very briey on so-called helicopter money. I

completely share Governor Jazbec’s view that the idea of helicopter money

is a valid one in a model where central bank credibility is not under threat.

It removes public debt from the market. Since the debt will never have to

be repaid, it is more eective than other forms of scal nancing under a

Ricardian equivalence framework. However, there is a signicant danger of

throwing the baby out with the bathwater. The baby here is the degree of

central bank credibility that we have achieved over the past 30 years. To a large

extent, this credibility is the result of the governance framework for monetary

policy and central bank independence adopted in the three decades before

the global nancial crisis.

I would argue that central bank credibility has been of paramount importance

even after the crisis. It has been probably the main factor behind the lack of

severe deationary episodes. We have had very low ination, but we have

not seen major deationary episodes after the crisis. Given the magnitude of

economic contraction that we have witnessed in some countries, that is what

I think any economist would have expected to happen. So, the question is

how much would helicopter money buy you relative to a Nash equilibrium

between the central bank and the scal authorities. In that model, the scal

authorities would provide stimulus and the central bank, in its independence,

would decide to set interest rates where it believed they should be, based on

its mandate. This is essentially the current framework in most countries and

is one that is best equipped to preserve central bank credibility. In terms of

eectiveness, the dierence is that hyper-Ricardian consumers would see the

debt held at the central bank in the same fashion as debt held by the private

sector. But we know (for example, from the experience of Japan) that markets

do not look at the two in the same way. So, the benets of helicopter money

are likely to be very small and the potential costs in terms of governance may

be very large.

I wish all of us a wonderful conference.

Panel 1

The coordination of monetary and scal policy –

principles and practical experience

Chair

Nikolay Gueorguiev, Unit Chief, International Monetary Fund

Lead Speaker

Steven Phillips, Advisor, International Monetary Fund

Panellists

Jan Smets, Governor, National Bank of Belgium

Lars Rohde, Governor, Danmarks Nationalbank

Dimitar Bogov, Governor, National Bank of the Republic of Macedonia

Nerses Yeritsyan, Deputy Chairman, Central Bank of Armenia

Summary of Panel 1

Nikolay Gueorguiev

The lead speaker, Steven Phillips, recalled the general evolution of thinking

of policymakers on monetary policy and scal coordination over the past 50-

60 years. During the Bretton Woods exchange rate system, it was generally

accepted that monetary and scal policies would work together, and that scal

policy had an important role to play in stabilising output. The idea of monetary

policy being capable of, and sucient for, handling stabilisation of output as

well as ination came to prominence later in the 1990s and 2000s. This was

combined with the view, held by many, that scal policy eorts should focus on

avoiding excesses and ensuring sustainability – in other words, steering clear

of “scal dominance”. This thinking led to more independence for central

banks and more constraints (e.g., rules) for scal policy. Today, post-global

nancial crisis, monetary policy’s room for manoeuvre and eectiveness are

diminished, while scal policy is constrained by previously introduced scal

rules and by a lack of scal space, real or perceived. This situation has raised

several questions and debates:

10 Rethinking Monetary–Fiscal Policy Coordination

• Should we now be more concerned about risks of scal dominance, or about

insucient scal policy contribution to output and ination stabilisation?

How do we nd the right balance? If the risk of scal dominance is really

a problem, is there a way that we can address it more eciently than with

rules that are overly simplistic?

• With monetary policy engaged to the limit, exchange rate moves may

be large. While the overall net eect of a monetary easing on the output

of a country’s trading partners is likely to be positive, spillovers through

exchange rate channels may cause certain strains. Is this problematic? If

so, is this an argument for also using scal easing, rather than just monetary

easing, when countercyclical policy is needed?

The panellists noted that the EU policy architecture envisaged that monetary

and scal policies would pursue their assigned objectives without explicit

coordination. In the current environment, however, most saw a need for

scal policy coordination between the euro area member states to ensure

that the desirable euro area scal stance is in place. They noted that small

open economies usually followed the monetary policies of their main trading

partners, irrespective of their formal monetary/exchange rate framework;

thus, scal policy was their only instrument for smoothing cyclical uctuations

in output. The panellists emphasised, however, that a strong overall nancial

position of the government was a prerequisite for a countercyclical scal

stance in a downturn, as it allowed scal easing without harming public debt

sustainability and the sovereign’s access to nancing. They also warned of the

risk of using monetary and scal policies in order to avoid necessary policy

adjustments or structural reforms that would raise productivity and growth.

During the subsequent discussion, the audience touched upon several issues:

(i) Can we devise scal instruments that would have the same eect on the

domestic economy as monetary policy easing? (ii) Fiscal policy easing may be

necessary now, but how can we make it sustainable and avoid the issue of scal

dominance returning? (iii) What constraint does high public debt impose on

stabilisation policies? (iv) What is the eciency of monetary policy at present

in terms of monetary transmission? (v) What are the benets and costs of

quantitative easing (QE), including for the nancial sector as low interest rates

adversely aect banks and insurance companies?

Panel 1: The coordination of monetary and scal policy –

principles and practical experience

11

The panellists’ responses included the following:

i. Fiscal discipline strengthens economic condence. Moreover, a rebalancing

of tax away from direct income taxes towards less distortionary taxes can

be benecial for growth and job creation. In addition, targeted long-term

investments in infrastructure nanced by very low interest rates can support

domestic demand and raise productivity.

ii. At present, the search seems to be for mechanisms to commit scal policy

to medium-term solvency while allowing short-term exibility so that it

can also contribute to macroeconomic stabilisation.

iii. High public debt does constrain the ability of scal policy to provide

stimulus, and there is no easy way to reduce debt quickly. In any case,

debt reduction will require a signicant structural reduction of scal

spending, the success of which depends on the population’s willingness

to bear sacrices.

iv. On the eectiveness of monetary policy, the European Central Bank

(ECB) facilitated credit expansion by improving borrowing conditions for

companies and households, which resulted in stronger growth and higher

ination than otherwise.

v. Regarding the impact of QE on nancial stability, low interest rates cause

diculties for banks, insurance companies and pension funds. However,

if monetary policy were to fail to achieve price stability and allow the

economy to go into a prolonged period of deation and stagnation, the

nancial system would suer even more, as long-term yields would remain

low for a very long time.

Presentations by Lead Speaker and panellists

Lead Speaker: Steven Phillips

It is a pleasure to be here today, to engage with this distinguished panel of

policymakers and experts on the topic of rethinking monetary and scal policy

coordination.

Let me start with a quick outline of my remarks. I begin with the idea that

for us to “rethink”, it is useful to rst recall the history of thought and its

inspirations. After reviewing the main thinking of the past 50 years or so, I

will turn to two areas to talk about in more depth. One area is the problem

of conducting monetary policy in a context of concerns about scal policy

12 Rethinking Monetary–Fiscal Policy Coordination

excesses. The second area looks at some open economy aspects of monetary

and scal policy coordination, particularly exchange rate implications. Finally,

I will suggest a few issues that panel members may want to discuss.

To begin a stylised history of thinking on monetary and scal policy roles

and coordination, let us go back to the 1950s and 1960s, when the Bretton

Woods exchange rate system was in place. At that time, it was generally

accepted that both monetary and scal policies were available tools to be put

to work on the goal of stabilising the economy. Why was this accepted? One

reason, perhaps, is that in those days there was not so much concern about

policy excesses or policy mistakes – the skill, benevolence and credibility of

policymakers were taken for granted. In addition, when the Bretton Woods

system of xed exchange rates was serving as a nominal anchor on the price

level, it constrained monetary policy’s room for manoeuvre. So, there was not

a sense that monetary policy was fully capable and unlikely ever to need help

from scal policy. Since both monetary and scal policy tools could inuence

demand, why not use both, in a coordinated manner?

A very dierent thinking had emerged by the 1990s and continued into the

2000s. By then, a combination of factors had led many to favour a specialisation

of monetary and scal policy roles and eorts to separate and also constrain

both policies. One factor was that many more countries had exible exchange

rates following the end of the Bretton Woods system. This made monetary

policy more capable, as it had more freedom. There was a view among many

economists that monetary policy instruments were sucient for demand

management goals, without need for help from a less agile, slow-to-move

scal policy. Also, there was a growing belief in the “divine coincidence” of

output and ination stabilisation goals.

Moreover, there was more concern that monetary and scal policies could go

very wrong, for example, if policymakers yielded to inappropriate pressures.

Most notably for our purposes, there was a fear of scal policy excesses, even

to the point of “scal dominance”. There also was a concern that without clear

policy mandates and accountability, the risks of policy excesses would be high.

Such risks were not just possibilities; they sometimes had materialised. There

were cases where one could look back and say that ination had become high,

and judge that scal policy excess and monetary policy accommodation of

this excess were to blame. However, I should note that not all experiences of

excessive ination can be attributed to slippage in scal discipline.

Three other developments likely contributed to concerns about policy excesses.

First, the expanding size of the public sector in many economies gave rise

to greater potential tensions between decit nancing and price stability.

Panel 1: The coordination of monetary and scal policy –

principles and practical experience

13

Second, the deregulation of domestic nancial systems (the end of the so-

called nancial repression) made it less easy for a government to fund its decit

from the private sector, and correspondingly made nancing from the central

bank more attractive. Third, an opening of the external capital accounts

provided governments with a new source of decit nancing – but not on an

unlimited basis. When a government decit is nanced externally, there is risk

of a sudden stop, and even a reversal, of net external nancing. So, a new

concern was that the new availability of external nancing would facilitate

scal indiscipline for a while only to later end in an external nancing crisis,

a crash in output and perhaps an ination‒depreciation spiral.

Thus, there were plenty of worries, especially about scal policy excesses. The

worries were not only about ination but also about large current account

decits and nancial instability and crises, not to mention crowding-out of

private-sector investment and limiting potential growth. Faced with all these

concerns, one might conclude that the single most important job of scal

policy from a macroeconomic perspective was not to make things right, but

to avoid doing harm.

Such concerns fuelled policy and institutional changes that allowed less

discretion for scal policy, with scal rules and constraints on public debt and

decits, and in some cases limits on direct central bank credit to government.

We also saw important moves to clarify responsibilities and accountability of

central banks, together with more independence for central banks and freedom

to act within their mandate – the so-called constrained discretion of ination

targeting. All these changes seemed logical steps to address the diagnoses that

had motivated them.

But, then came the global nancial crisis. The crisis led to rethinking on many

fronts, including a rethinking of macro policy roles, as it gave rise to some

special circumstances and problems for monetary and scal policy. Monetary

policy found its room for manoeuvre reduced and its eectiveness diminished.

It was hampered by the zero lower bound problem, and by the problem of

damaged balance sheets reducing the transmission of monetary policy. Then

there was a concern that keeping interest rates “low for long”, while it might

have a desirable stimulating eect in the short run, would lead to excessive

risk taking and eventually to a crash and a worse outcome. In addition, for

some countries, deploying their own monetary policy had ceased to be an

option, as they no longer had their own currency or had chosen to adopt a

currency board.

14 Rethinking Monetary–Fiscal Policy Coordination

Meanwhile, the potential for scal policy to play a supportive role also

diminished, as it was constrained in many cases by previously established scal

rules and/or by a lack of scal space. By the latter, I mean either policymakers’

own judgement that remaining scal space was negligible, or a judgement by

nancial markets that government debt had become very risky.

Thus, we have had both monetary and scal policy being constrained and,

with their eectiveness diminished, a recovery from the Great Recession that

has been weaker than it would have been otherwise. This raises the question

of whether the constraints on monetary and scal policy in the aftermath

of the global nancial crisis could, and should, be relieved in some way, or

whether that would be too risky.

I want to focus on the question of the role of scal policy when monetary

policy is constrained. In the current context, should we be more worried about

an easing of scal policy causing harm, or should we be more worried about

scal policy not making a greater countercyclical eort?

Many debates about monetary and scal policy coordination and interaction

come down to diering judgements of the seriousness of the risk of scal

dominance or of a sudden loss of condence in public nances. Surely, we

can all agree with the principle that sound, sustainable public nances are

essential – a necessary, though not a sucient, condition for stability and

economic welfare. The problem is that the concepts of public sector solvency,

sound nances and scal space are dicult to pin down in operational terms.

We know that there must exist limits on scal decit nancing, but we do not

know the precise limits. So, it is a matter of judging the distribution of risks

and how close we are to a danger zone.

At times, nancial markets seem to clarify the matter for us by stopping

nancing the decit or nancing it only at very high interest rates. However, we

cannot count on markets to give us an early warning or to provide disciplinary

pressure. Too often, it seems that markets do not provide pressure and then

suddenly provide too much pressure, in a panic that is self-fullling. Considering

that markets are prone to sudden switches, one may argue that a government

should be extra careful to ensure it will not lose the condence of markets.

But, how careful? One may also argue that during a panic, central banks

should step in and support government debt, though some will worry that this

undermines incentives for scal discipline. Similarly, regarding quantitative

monetary easing that involves the purchase of government debt, even if that

policy is chosen by an independent central bank and is motivated only by

Panel 1: The coordination of monetary and scal policy –

principles and practical experience

15

its pursuit of its ination target, such purchases have the appearance of the

central bank doing a favour for the government. To some, this brings the risk

that such generosity undermines incentives for scal discipline.

As I have emphasised, the diculty is that reasonable people can come to very

dierent operational judgements on how policies should proceed because the

true distribution of policy risks is not known, and we perceive risks dierently.

In that light, we must ask what more could be done to make the picture

of scal solvency clear, and thus to avoid sudden deteriorations in market

perceptions and jumps in the risk premium on public debt. We have to think

hard about possible commitment devices that would credibly ensure the state

of future public nances without excessively constraining scal policy in special

circumstances.

Perhaps we can nd ways to appropriately constrain monetary and scal

policies, but at the same time let them have the room to ease at the right time

without their action being misunderstood and triggering an unnecessary loss

of condence. That doesn’t mean abandoning scal rules, but it may mean

making them more complex – letting them give exceptions, say, when ination

is very much below target, when there is deation, when there is a sizeable

negative output gap or when the forecast from an independent, credible

central bank is for a persistent negative output gap and deation. Of course,

more complex scal rules could open up new areas for scepticism about their

application (think, for example, of disagreements about the output gap and

rate of growth of potential output).

Let me touch briey on two exchange rate aspects of monetary‒scal policy

coordination and easing that are especially relevant now. One is that with

diminished transmission of monetary policy through domestic channels, an

absence of stimulating help from scal policy means more monetary easing,

a lower interest rate for a longer period of time, and so a larger eect on the

exchange rate. Such currency eects are a normal part of how monetary

policy works, but there is a question of how far they should go. Taking an

international perspective, a policy mix in one country that leads to more

currency depreciation than would some alternative mix may be a sensitive

issue if it diverts demand from other countries that may also have negative

output gaps. A similar sensitive issue arises when, in the pursuit of easing,

monetary policy takes the form of a central bank purchasing the debt of

another country’s government. This can be perceived as a form of foreign

exchange market intervention, as it has a larger exchange rate eect than other

forms of monetary easing. Again, if scal policy stimulus is not available, we

will see greater monetary easing eort and large exchange rate eects. That

16 Rethinking Monetary–Fiscal Policy Coordination

may be an acceptable outcome (particularly if other economies are able to

use their own monetary policy to oset spillover eects), or it may lead us to

reconsider the constraints we have chosen to place on scal easing.

In closing, I admit that I have raised many questions without providing concrete

answers. Let me suggest several questions that the panellists might wish to take

up. First, do we agree that concerns over scal dominance and credibility of

public nances are a key issue in monetary‒scal policy coordination debates?

If such concerns are not overstated, are there ways that we could address

them more eciently than under current rules? Second, do we think that

monetary policy spillovers to the exchange rate are very problematic? If so,

is this a reason to use scal policy easing more to take some of the burden o

monetary policy? Finally, on a subject I did not touch on – namely, the stability

of an economy’s nancial system – do the lessons from the global nancial

crisis have implications for monetary‒scal policy coordination?

Panellist 1: Jan Smets

I am honoured to participate in this seminar and want to thank the Bank

of Slovenia, the International Monetary Fund and, in particular, Governor

Jazbec for having invited me.

When preparing my remarks, I also strolled through the literature on monetary

and scal coordination, focusing on what it has to say about coordination in a

monetary union. In contrast to Steven Phillips, I only went back as far as 1999

where a paper by Chris Sims, the 2011 Nobel Laureate in Economics, drew

my attention.

1

Back then, Sims was already agging the institutional gaps in

the design of EMU threatening the union’s long-term success. The title of the

paper is telling: “The precarious scal foundations of EMU”.

Sims derived his insights from a theoretical framework

2

which explicitly

incorporates monetary–scal interactions. This framework deviated from

the economic paradigm of the 1990s, which prescribed a strict separation

between scal and monetary policy. This was prompted by the belief that the

1 Sims, C.A. (1999), “The Precarious Fiscal Foundations of EMU”, De Economist 147(4): 415-436.

2 This unconventional perspective is labelled “the scal theory (or more descriptively, the real theory) of the price

level”. This theory grew out of the following work: Leeper, E.M. (1991), “Equilibria under ‘Active’ and ‘Passive’

Monetary and Fiscal Policies”, Journal of Monetary Economics 27(1), 129-147; Sims, C.A. (1994), “A Simple Model for

Study of the Determination of the Price Level and the Interaction of Monetary and Fiscal Policy”, Economic Theory

4(3): 381 399; Woodford, M. (1995), “Price-Level Determinacy without Control of a Monetary Aggregate”, Carnegie

Rochester Conference Series on Public Policy 43: 1-46; and Cochrane, J.H. (1998), “A Frictionless View of U.S. Ination”,

NBER Macroeconomics Annual 13: 323-384.

Panel 1: The coordination of monetary and scal policy –

principles and practical experience

17

main interaction between the two policy domains was in the form of attempts

by the scal authority to get the central bank to nance government debt. A

belief that is still widely present today, but that needs nuancing.

This conventional view inspired the institutional set-up of the euro area

whereby an independent central bank at the union level focuses primarily

on price stability for the area as a whole, while national scal policies ensure

sound public nances in each country. Each authority alone should take care

of its assigned objective, without relying on or needing a helping hand from

the other. In order to constrain scal free-riding incentives that arise in a

monetary union, disciplining scal rules were even put into law. They entail

the prohibition of monetary nancing of public debt, a no-bailout clause and

decit and debt rules.

3

EMU architects thus put everything to work to ensure

a maximum degree of monetary dominance.

During the pre-crisis period, the Eurosystem indeed delivered on its price

stability mandate. In contrast, national compliance with the Stability and

Growth Pact rules was far from perfect. Nevertheless, this did not appear to

have impacted the Eurosystem’s stabilisation role.

The crisis altered this view. Not only did it teach us that strict compliance

with rules is necessary, but also that for policies to be eective, they require

an appropriate response from other policies, especially in exceptional

circumstances. We need to let policies have the room to do the right thing at

the right time for the right reason. This may be even more true for countries in

a monetary union. In what follows, I will illustrate two areas where the original

design of EMU limited the synergies between policies, making members more

vulnerable to adverse shocks.

First, euro area countries eectively issue real instead of nominal debt, making

them more susceptible to shocks which can have feedbacks on monetary policy.

Indeed, governments no longer issue debt in their own currency but in euros,

over which they have no direct control. Consequently, in the absence of an

ination cushion, the only option available to resolve unsustainable debt is

outright default. Possibly based on the strong principles enshrined in the Treaty,

markets assumed the Eurosystem had no role to play in sovereign insolvency

and was expected not to act as lender of last resort in the government bond

market – a function that a central bank in a stand-alone country implicitly does

assume. This made countries, possibly even those with sound public nances,

prone to self-fullling market expectations that threatened to turn a sovereign

liquidity crisis into a solvency crisis.

3 See Articles 123, 125 and 126(2) to (14) of the Treaty on the Functioning of the European Union; the latter also

reinforced by the Stability and Growth Pact.

18 Rethinking Monetary–Fiscal Policy Coordination

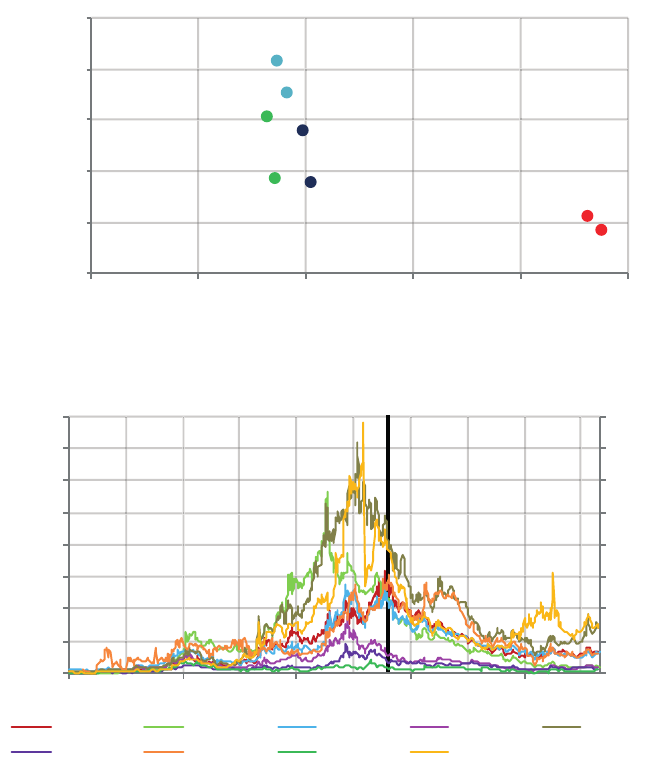

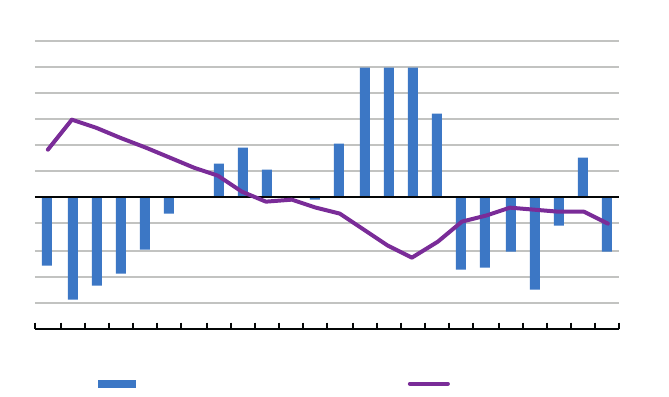

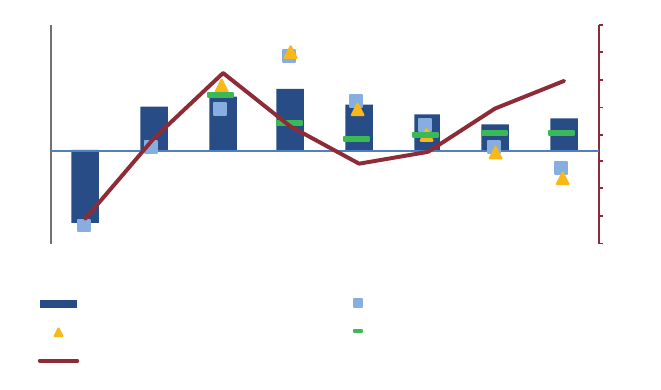

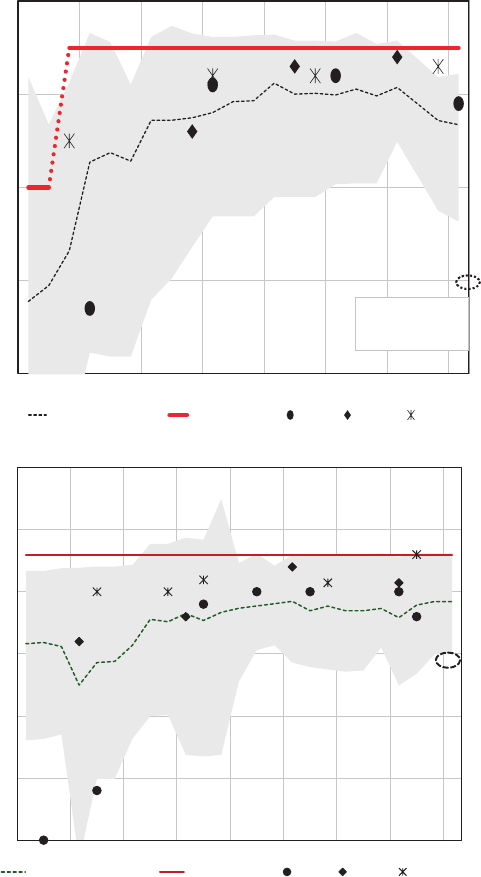

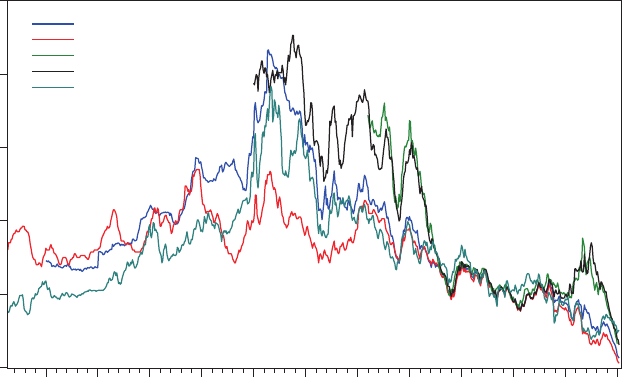

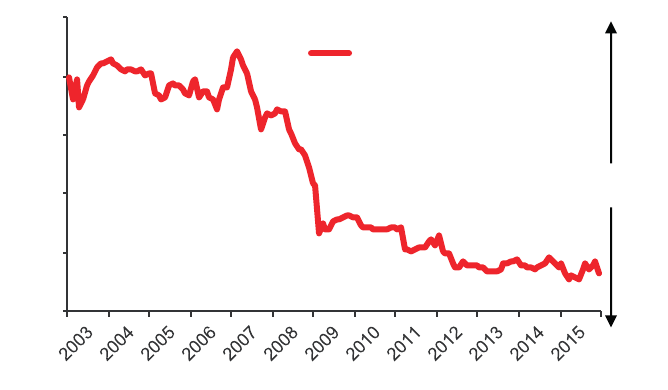

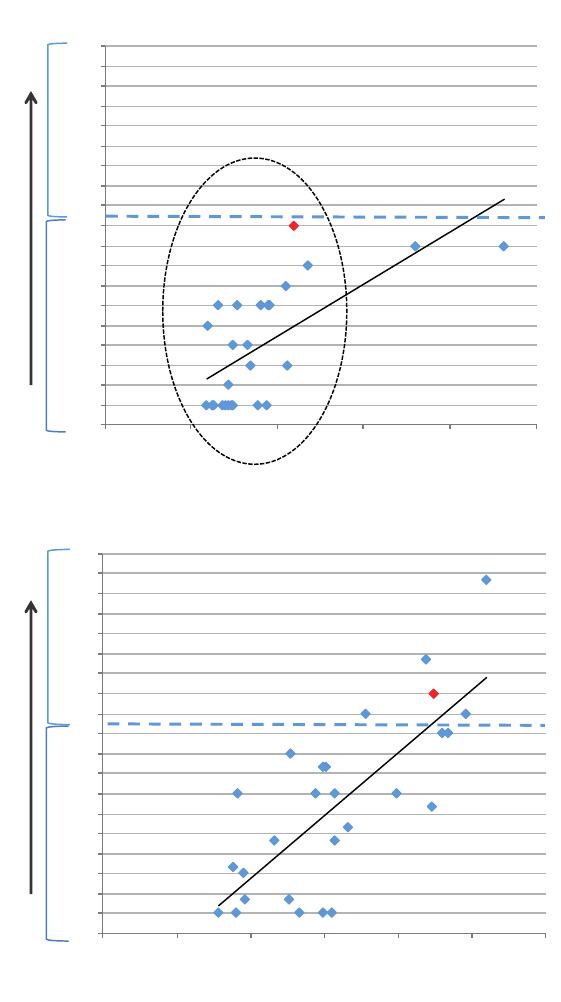

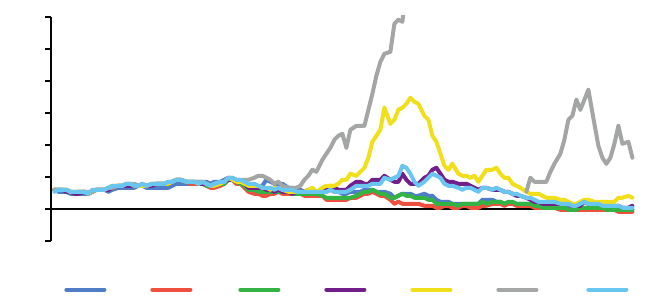

Figure 1: Government bond yields and spreads versus the German bund

!"##

!"#!

!"##

!"#!

!"##

!"#!

!"##

!"#!

"

#

!

$

%

&

" &" #"" #&" !"" !&"

#"'()*+,-./,.0(1*.2

'3,425(678

9-*55(2,10(67(*:(9;<8

=>

?<@

AB>

9CD

!

"!!

#$!!

#%!!

$&!!

'!!!

'"!!

&$!!

&%!!

!

$!!

&!!

"!!

%!!

#!!!

#$!!

#&!!

#"!!

$!!( $!!) $!## $!#' $!#*

#!y+,-./012/13+4-15+670/856+.6+9/0281+:;15+<=1+47>

Spain

Breland Btaly :elgium

Aortugal

Grance @lovenia Ietherlands 9reece+ <0L6>

MNE

Sources: ECB; IMF; Thomson Reuters Datastream.

The euro sovereign debt crisis has taught us this the painful way. Fiscal

fundamentals for the union as a whole were certainly no worse than those

for other major advanced economies, but its borrowing costs were clearly

higher as self-fullling market panic was allowed to gain footing. True, debt

sustainability concerns were justied for some members, but certainly not for

all those under pressure. In 2012, with the Outright Monetary Transactions

Panel 1: The coordination of monetary and scal policy –

principles and practical experience

19

(OMT), the Eurosystem provided a backstop for government funding, breaking

down the vicious circle between market expectations and government debt

dynamics.

Let me be clear: OMT is not enough. Safeguarding long-run solvency requires

decisive action by governments. In general, and as already accounted for in

the original EMU design, a governance framework that ensures sound scal

policies is needed. I therefore count on the reformed Stability and Growth

Pact to deliver better results than its predecessor.

Let me now turn to a second fragility of the original design of EMU, namely,

the lack of coordination among scal policies of individual member states

and its repercussions for the conduct of monetary policy.

During and in the aftermath of the sovereign debt turmoil, several euro area

countries were forced to quickly undertake scal consolidation which was not

compensated by scal loosening in other countries, making the area-wide scal

stance weigh on domestic demand. Since the strengthened scal governance

framework places a dominant emphasis on individual countries’ scal discipline

rather than on area-wide business cycle stabilisation, this left monetary policy

as the key player for macroeconomic stabilisation, requiring the Eurosystem

to resort to hitherto unseen stimulus measures. That may be one reason why

the recovery has been lacklustre so far. Hence the observation, in line with

that of Steven Phillips, that scal policy probably has a bigger role to play in

stabilisation than was originally acknowledged by the Stability and Growth

Pact.

However, one should not be too pessimistic in this regard, because the scal

rules do allow for some support to aggregate demand. First, when interest rates

fall, governments’ interest expenses fall as well, implying that there is more

room for scal expansion before the headline decit limit is crossed. Indeed,

the framework uses headline balances and not primary balances. Second, on top

of that, the scal requirements are formulated in structural terms, implying

that the economic cycle is taken into account and less scal eort is required

during recessions.

Moreover, some improvements to the framework have been introduced and are

to be welcomed. In 2015, by introducing its famous “matrix”, the European

Commission allowed for more exibility in the rules, leaving more leeway for

scal policy regarding stabilisation. With this increased exibility, we should

now of course guard against the risk that those who cannot aord spend it,

while those who can aord it do not. The “cannot” group is large and not

only limited to countries that have been severely aected by the crisis. A case

in point is Belgium, where high legacy debt leaves no room for embarking

20 Rethinking Monetary–Fiscal Policy Coordination

upon scal stimulus. Instead, intelligent adjustment towards its medium-term

budgetary objective is required and aimed for. This again highlights the careful

balance between stabilisation and debt sustainability that scal authorities

need to strike.

This brings me to a more specic, yet related aspect of the current framework

that can be improved: its narrow focus on national scal stances, leaving the

aggregate scal stance for the euro area undetermined. To improve welfare

for the union as a whole, it seems preferable that not only monetary but also

aggregate scal policy be determined at the euro area level. Especially when

monetary policy is constrained, there appears to be a premium in coordination

and better balanced scal actions.

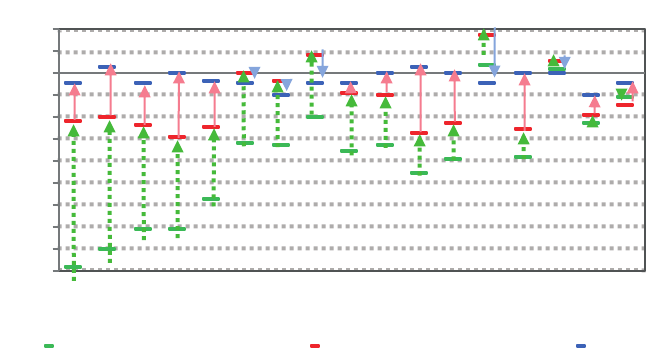

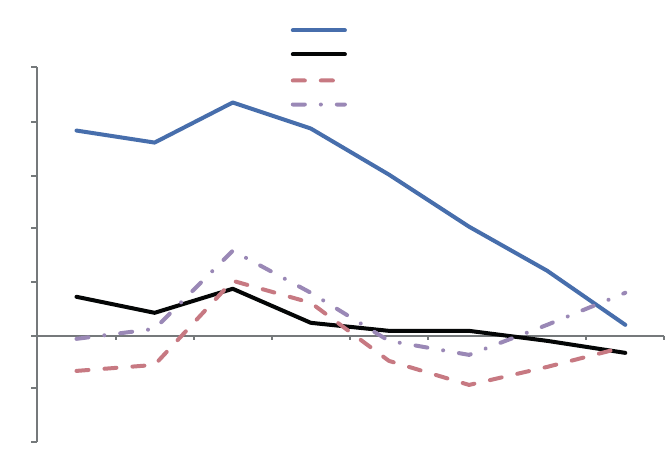

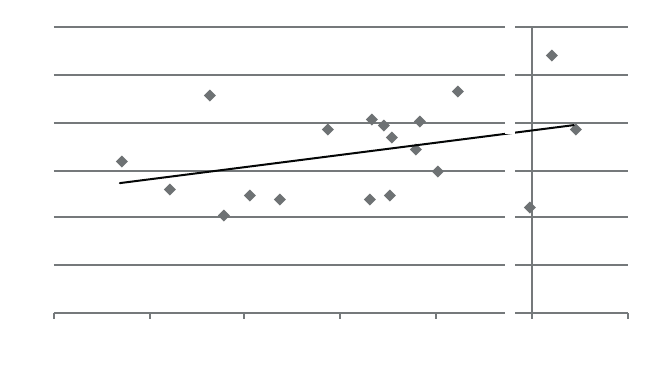

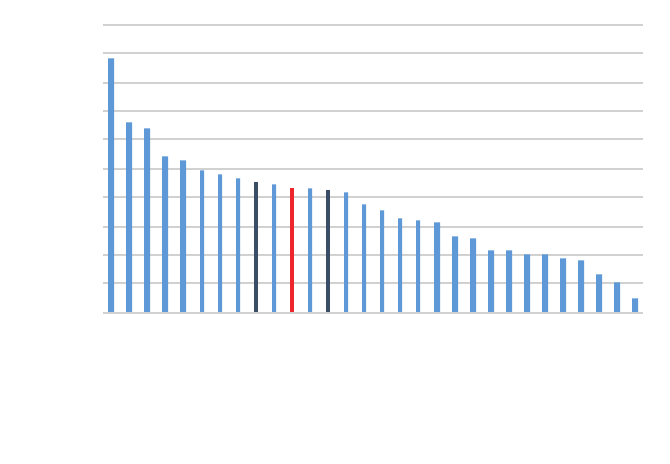

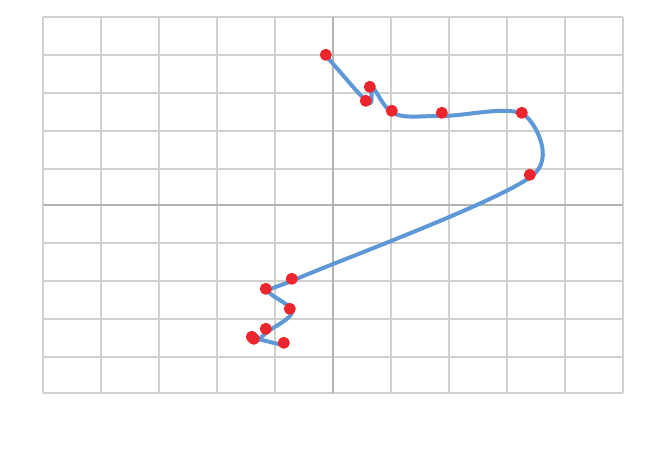

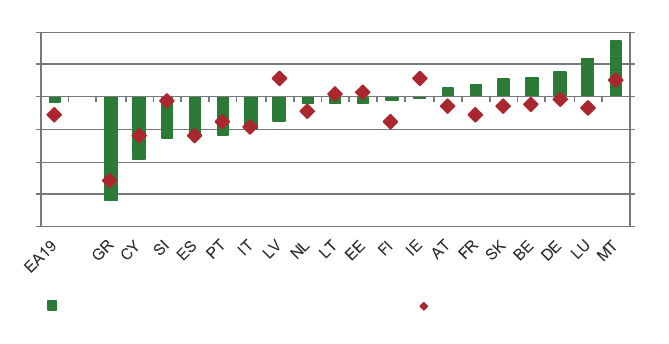

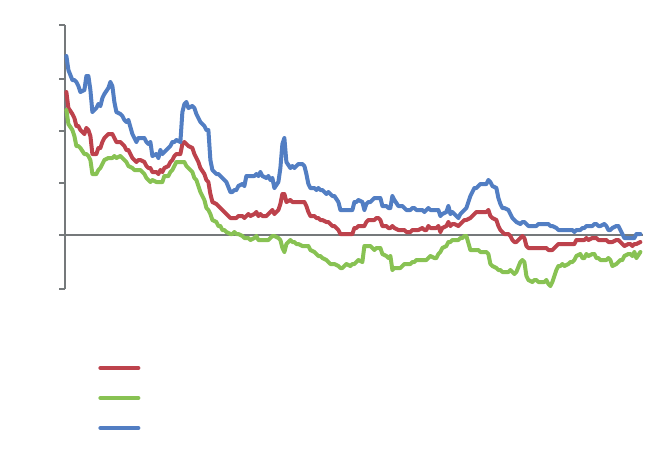

Figure 2: Structural scal balances and medium-term objectives (% of GDP)

!"

!#

!$

!%

!&

!'

!(

!)

!*

+

*

)

, -.

/-0

123

41/

5-6

670

.07

847

9.8

, 06

129

:.0

.7;

<4.

410

.26

5, 9

1=>?@=?>ABCDABAE@FCIEC)+*+ 1=>?@=?>ABCDABAE@FCIEC)+*&

:0K

Notes: MTO = medium-term objective. Countries are sorted according to the size of the scal

improvement shown over the period 2010-2015. Greece and Cyprus were not included as the

former is still subject to an adjustment programme and the latter has only recently exited it.

MTOs as dened in the Assessment of the 2016 Stability Programmes for the period 2017-2019.

Source: European Commission.

One should not be too pessimistic in this regard either, as here also we see new

initiatives that I applaud. By coordinating national scal councils, the newly

created European Fiscal Board

4

is taking a rst step towards tackling this issue.

4 The European Fiscal Board was established in October 2015, in line with recommendations in the Five Presidents’

Report, and became operational in October 2016.

Panel 1: The coordination of monetary and scal policy –

principles and practical experience

21

To conclude, I would like to underscore that we have to look beyond the

negative consequences of monetary–scal interactions emphasised by the

conventional macro view, and acknowledge the positive spillovers that both

policy domains could have on each other. Both could enable each other to

better realise their specic objective, especially when one policy is constrained.

Fortunately, institutional gaps in the euro area are beginning to be addressed,

acknowledging the subtle interactions between monetary and scal policy and

hence allowing for a more optimal policy mix in which monetary dominance

remains key.

Panellist 2: Lars Rohde

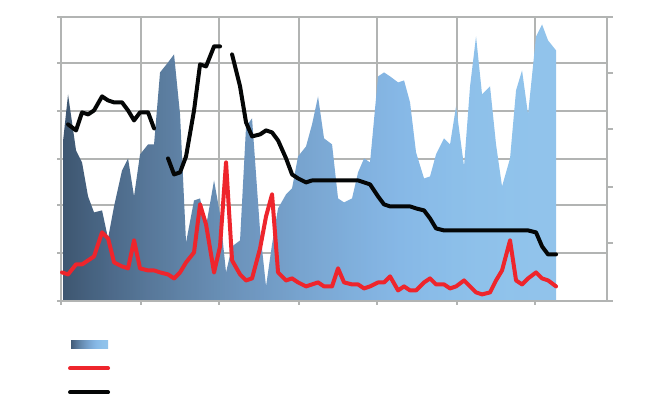

Denmark is the odd case out because of the xed exchange rate regime that

it followed. Let me elaborate on this.

Monetary and scal policy in Denmark

Since the early 1980s, Denmark has conducted a xed exchange rate policy,

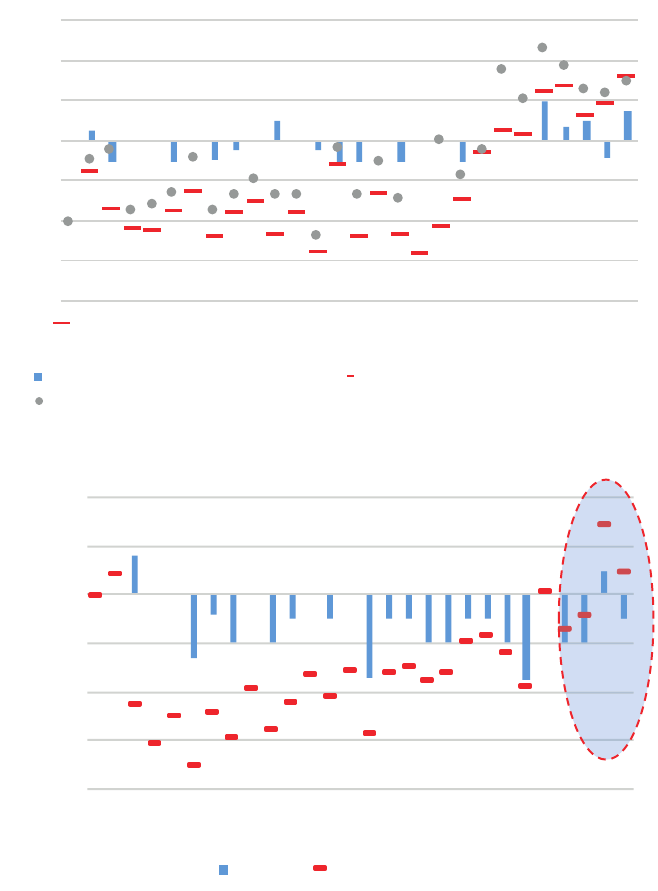

rst against the Deutsche mark and since 1999 against the euro (Figure 1, top

panel). Over time, linking the Danish krone to the euro created a basis for

achieving the same level of ination and ination expectations in Denmark

as in the euro area. If ination is higher in Denmark than in the euro area,

Denmark’s competitiveness will, all other things being equal, deteriorate.

This is well understood by both labour unions and employers’ associations. The

xed exchange rate policy has therefore helped to achieve wage agreements

that have supported Denmark’s competitiveness.

As the exchange rate is xed, large current account imbalances are corrected

by the relative wage growth in Denmark and abroad. The present large Danish

current account surplus gives room for larger wage increases in Denmark

relative to abroad.

The xed exchange rate policy implies a clear distribution of responsibilities

between monetary and scal policies. Monetary and exchange rate policies are

aimed at keeping the krone stable vis-à-vis the euro (Figure 1, bottom panel),

while any specic need to stabilise cyclical uctuations in Denmark is handled

via scal policy or other economic policies.

22 Rethinking Monetary–Fiscal Policy Coordination

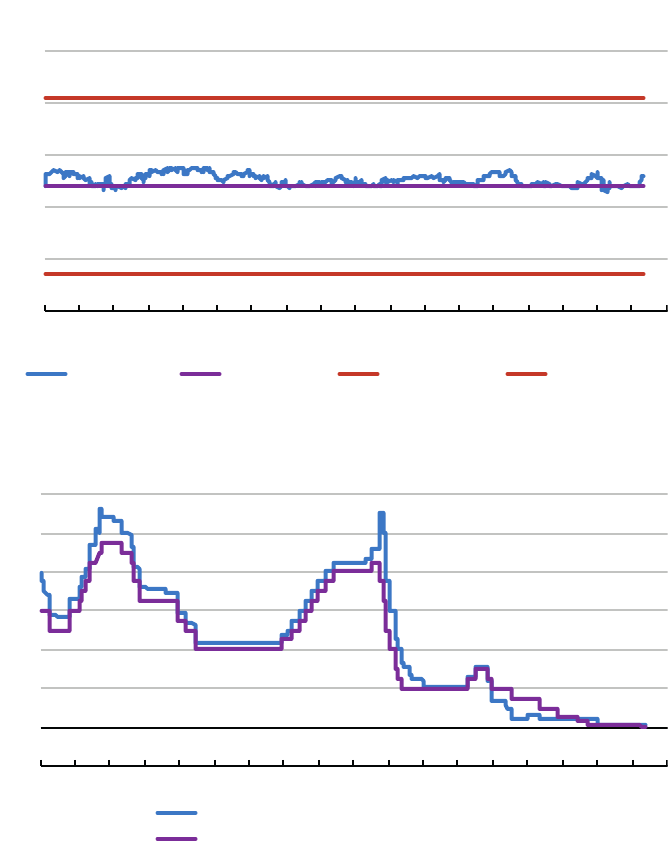

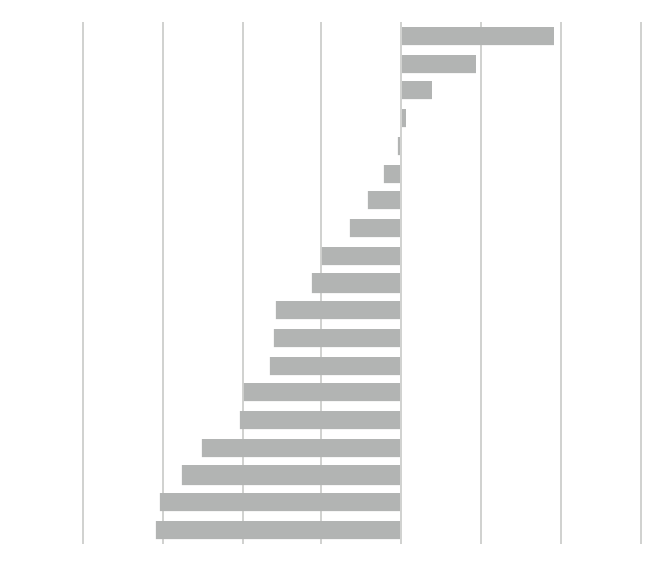

Figure 1: Denmark: Exchange rate and policy interest rate

Danish kroner vis-a-vis euro

!"#

!"$

!"%

!"&

!"'

!"!

()*+,-.*)-, /,0-*)1.*)-, 234,*.53607

899,* 53607

;*30,*.9,*.,6*3

99

01

03

05

07

09

11

13

15

Policy rate in Denmark and the euro area

!"

#

"

$

%

&

'

(

)anmarks Nationalbank lending rate

;CB rate on main refinancing operations

A

er cent

99

01

03

05

07

09

11

13

15

Source: Macrobond.

Panel 1: The coordination of monetary and scal policy –

principles and practical experience

23

Fiscal policy has to be disciplined and sustainable

Going into an economic downturn, the initial position of the public budget

has to be so strong that, inter alia, the automatic stabilisers can take full eect

without jeopardising long-run sustainability. This is a precondition for scal

policy to be able to stabilise cyclical uctuations. Furthermore, it is crucial that

nancial markets have condence in scal policy. Hence, in Denmark it is very

important that scal policy is both disciplined and sustainable.

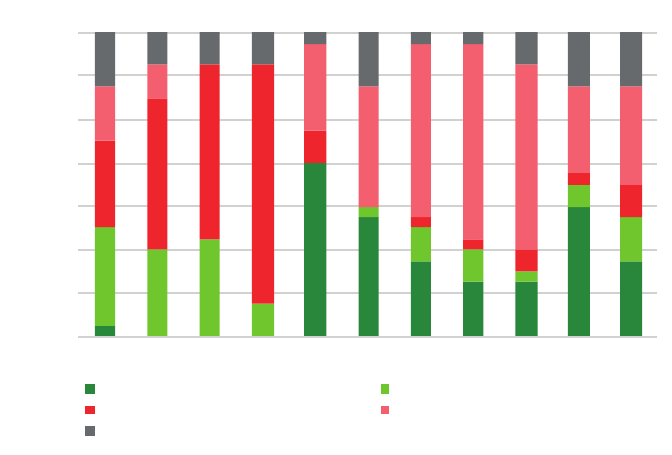

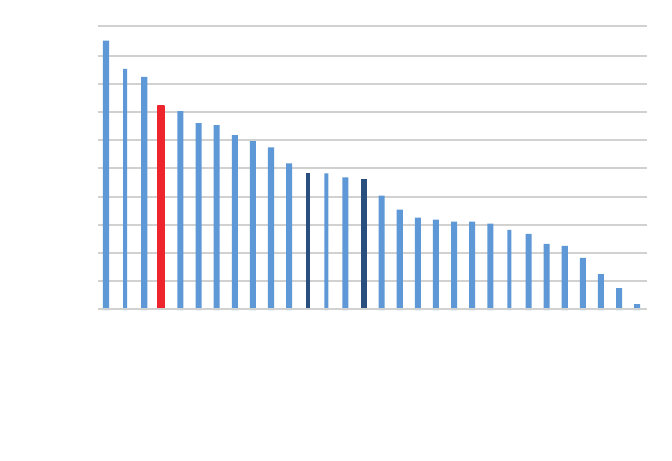

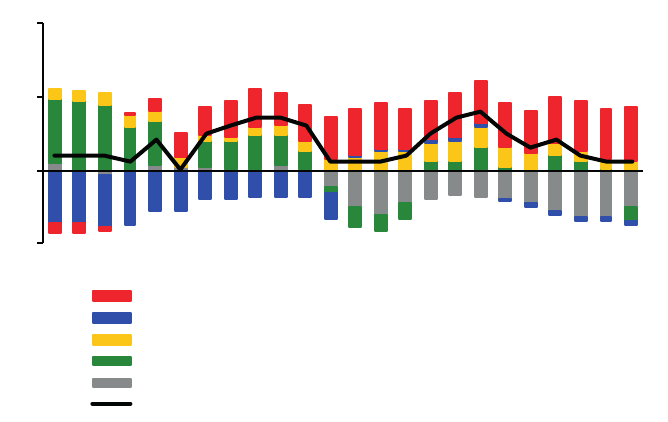

Denmark has strong public nances (Figure 2) achieved through, inter alia,

a budget law and medium-term scal plans. The xed exchange rate policy

has probably helped in achieving this, as politicians cannot rely on monetary

policy to correct lax scal policy.

Figure 2: Denmark: Fiscal balance and public debt

!" !# !$ !% !& !' !( !! )) )* )" )# )$ )% )& )' )( )! *) ** *" *# *$ *%

)

*)

")

#)

$)

%)

&)

')

()

!)

*))

**)

+%

+$

+#

+"

+*

)

*

"

#

$

%

&

,-ficit (-)/-Surplus (+) Debt (right axis)

Ber cent of GDP

Per cent of GDP

Notes: Government EMU-Debt and EMU-Decit (-)/-Surplus (+).

Source: Macrobond.

An independent monetary policy is not a necessary condition for

achieving stability

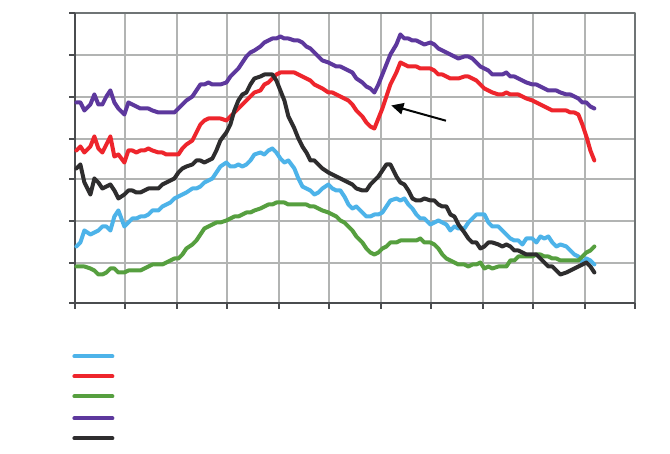

When comparing Denmark with euro area countries or countries similar to

Denmark outside the euro area (such as Sweden), there is nothing indicating

that the Danish economy has performed worse with respect to the stability of

output and ination (Figure 3). This is in part because the Danish business cycle

is to a large extent synchronous with that of the euro area. Furthermore, scal

policy in Denmark reacts quickly to shocks through large automatic stabilisers.

24 Rethinking Monetary–Fiscal Policy Coordination

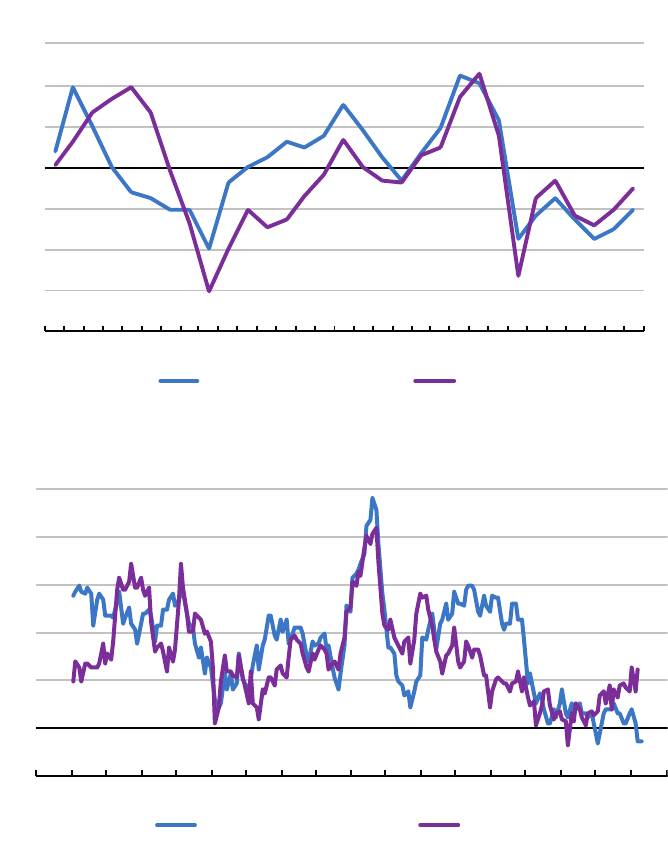

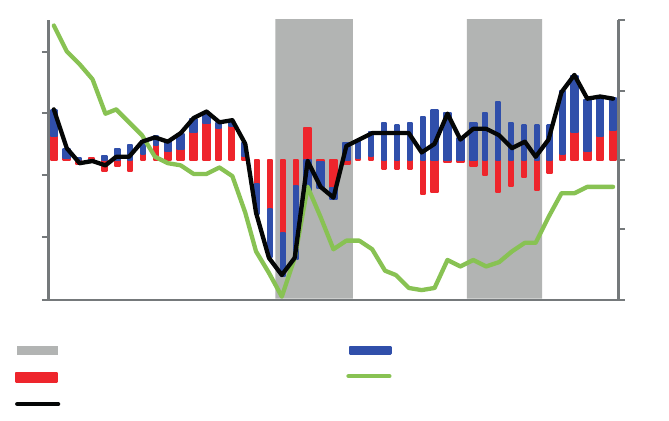

Figure 3: Output gap and ination in Denmark and Sweden

Output gap in Denmark and Sweden

!"

!#

!$

!%

&

%

$

#

"' "( ") )* )+ )' )( )) &* &+ &' &( &) ** *+ *'

,-./012 34-5-.

6-178-.97:;7<,6

Ination in Denmark and Sweden

!"

#

"

$

%

&

()*+,-. /0)1)*

2)-34)*5

99

#"

#%

#'

#:

#9

""

"%

"'

Source: Macrobond.

So, an independent monetary policy is not a necessary condition for achieving

stability. However, it is required that other policies – i.e., scal – are disciplined

and sustainable.

Panel 1: The coordination of monetary and scal policy –

principles and practical experience

25

The loss of exibility in a xed exchange rate regime is probably

minor for small open economies

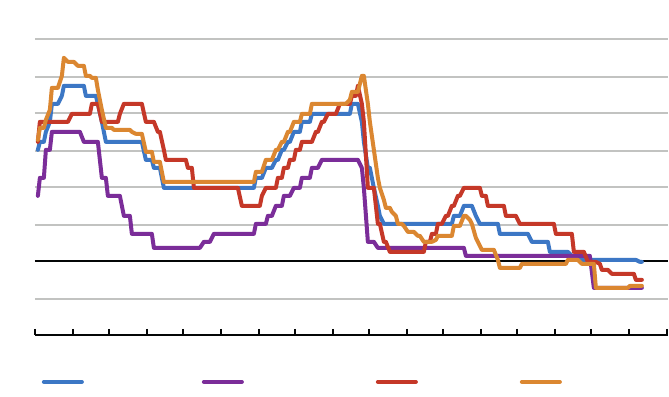

Advanced small open economies such as Denmark and Sweden are strongly

inuenced by the world economy, especially the euro area. Studies, such as

those from the Bank for International Settlements, have shown that the policy

rates of small open economies follow those of the euro area and the United

States more closely than can be explained by output gaps and ination (i.e.,

the Taylor rule) (Figure 4). One reason could be that large currency shocks

can create nancial stability issues, for example if a country has large liabilities

in a foreign currency that are not hedged.

So, in practice, for small open economies “ination targeting” and “xed

exchange rate policy” lead to very similar monetary policy. Consequently, the

loss of monetary policy exibility in a xed exchange rate regime is probably

small – or at least smaller than is predicted by textbook theoretical models.

Figure 4: Monetary policy rates in selected small advanced open economies

!"

!#

$

#

"

%

&

'

(

)*+,-.+/. 01234/+5.67 01/7/6 8/69.+:

;/+-</63

$$

$"

$&

$(

$=

#$

#"

#&

#(

Note: Euro Area: main renancing operations rate; Switzerland: three-month LIBOR target

range; Sweden: repo rate; Denmark: lending rate.

Source: Macrobond.

26 Rethinking Monetary–Fiscal Policy Coordination

Panellist 3: Dimitar Bogov

Macedonia, similarly to Denmark, has its exchange rate pegged to the euro,

having previously been pegged to the Deutsche mark. The country has pursued

this policy from 1995 onwards, and since a one-o devaluation in 1997, the

exchange rate has been stable. Of course, we have been challenged several

times, but successfully overcame these challenges. I like what Lars Rohde

said, as it is in line with the view that I very often express in Macedonia: for

small open economies, it doesn’t matter whether the monetary framework

is ination targeting or an exchange rate peg. In the end, you have to have

the same prudent policies. Otherwise, although the transmission channels

may be dierent, the outcome will always be the same. If you have upward

pressures on the foreign exchange market, eventually you will end up with

higher interest rates – regardless of whether you achieve this through exchange

rate depreciation or through interest rate increases to defend the exchange

rate. Maybe the large economies have a choice, but small economies do not

have much freedom in choosing the right monetary policy.

What is the experience of Macedonia regarding the coordination of monetary

and scal policies? An exchange rate peg means having a constraint on

monetary policy. In the case of Macedonia, it is not a full constraint because

the “impossible trinity” is not present, since we do not have capital mobility for

various reasons. One reason is that the capital account still has some restrictions;

but more importantly, in my opinion, it is the general political instability of

the country which is not very favourable to capital inows. Constraints to

capital inows enable some degree of independence to monetary policy in a

xed exchange rate regime. Anyway, it is scal policy that should take on the

burden of adjustment when one has an exchange rate peg. This means that

scal policy must be disciplined. When we analyse the 19 years from 1994

to 2012, we nd that in half of these years scal policy was countercyclical,

while in the other half it was procyclical. When we look at dominance, whether

scal or monetary, we nd that in and around the years Macedonia suered

shocks – 2001, when we had an internal security crisis; and 2008, when the

global nancial crisis started – we had scal dominance. Otherwise, scal policy

was quite disciplined, especially in the period before 2001. Maybe it helped

that Macedonia always had some arrangements with the IMF, and that the

exchange rate peg pushed scal policy to be very disciplined. Before 2001,

scal policy was subordinated to monetary policy, supporting the stability of

the peg. In 2001, this was disturbed as other priorities emerged. After scal

stabilisation in 2003, however, coordination of monetary and scal policy

was restored and scal policy supported the exchange rate peg and monetary

Panel 1: The coordination of monetary and scal policy –

principles and practical experience

27

policy. It should be noted that before 2008, scal decits in Macedonia were

very small – the country’s budgets were always either balanced or had a decit

of no more than 1% of GDP.

Before 2008, when the economy was booming, the government made two

decisions – one favourable and one not so. The rst decision was to reduce the

tax burden, with corporate tax and income tax rates reduced substantially to

10%. Social contributions (the tax wedge) were also reduced. This appeared

to be very benecial after the crisis. The unfavourable development was that

the windfall in the budget at that time tempted the government into spending

more on higher public sector salaries, more generous pensions, increased social

welfare and higher subsidies for farmers. At that time, this did not place a

burden on the budget because it was in surplus. However, after 2008–2009

when there was a sharp deceleration in capital ows and foreign trade and GDP

also declined, a shortfall in the budget emerged. Fortunately, scal policy did

not reverse the action on taxes, and this proved to be supportive for businesses

and the economy after 2009. There also was room for scal stimulus in 2009.

Because budget decits had historically been low, public debt was extremely

low (at around 23% of GDP), creating the space for scal stimulus. Hence,

scal policy supported economic growth in Macedonia after the onset of the

global nancial crisis in 2008. However, scal stimulus worsened the public

nances, and public debt rose very quickly to the current level of 45% of

GDP – public debt has thus doubled in seven years.

Monetary policy had to take the opposite stance: it had to tighten. First,

because in 2009 Macedonia had to defend its exchange rate through very high

interest rates. Once the situation stabilised and as economic growth picked

up and the external balance was restored, monetary policy was loosened. It

remained in this loosening cycle until early May 2016. Why was this possible?

Because there were structural changes in the economy and the balance-of-

payment position improved substantially thanks to policies aimed at attracting

foreign direct investment. The policy rate of the central bank was reduced

to an historically low level of 3.25%. At that time, many asked why the rate

could not be lowered to 0%, as the ECB had done. We could go close to zero

if scal policy were more balanced, but in a context in which scal decits

since 2008 had been between 3% and 4%, monetary policy had to keep the

balances in the economy. So 3.25% is Macedonia’s “zero lower bound”. We

have to have this spread vis-à-vis the ECB’s policy rate in order to preserve

the exchange rate peg.

28 Rethinking Monetary–Fiscal Policy Coordination

The lesson from this is that when you have disciplined scal policy and there

is scal space, scal policy can support the economy when it is faced with a

shock without endangering monetary policy. Monetary policy could tighten if

necessary, but not by much. If the scal space were exhausted, however, then

support from scal policy would be very dicult. Now we are wondering what

will happen if Macedonia is hit by another shock. Fiscal policy has no room

for expansion – our debt level is over 45%, and our limit is obviously much

lower than that of the euro area countries.