A Guide to

Federal Government

ACH Payments

On-Line

A Guide to Federal Government ACH Payments

Table of content

Green Book

II

A Guide to Federal Government ACH Payments

Introduction

Welcome to the Green Book — a comprehensive guide for financial institutions that receive

ACH payments from the federal government.

Today, most federal payments are made via the Automated Clearing House (ACH). With

very few exceptions, federal government ACH transactions continue to be subject to the

same rules as private industry ACH payments. As a result, the Green Book continues to get

smaller in size and is designed to deal primarily with exceptions or issues unique to federal

government operations.

Federal agency contact information is included, and since so much information is available

via the Internet, website addresses are included where appropriate. The Green Book

continues to be available on the Internet and chapters can be printed as Portable Display

Format (PDF) documents. We no longer print and mail hard copies. So, we encourage you

to visit the website for updates and news relevant to federal government ACH transactions.

Title 31 CFR part 210 provides the basis for most of the information contained in the Green

Book. However, there are other regulations that impact federal government ACH payments.

The following table summarizes the relevant regulations:

Regulation

Governs

31 CFR part 210

Federal Government Participation in the Automated Clearing House

31 CFR part 208

Management of Federal Agency Disbursements

31 CFR part 370

Electronic Transactions and Funds Transfers Relating to United

States Securities

We still occasionally get asked, “Why green?” It is simple. The first publication issued in

1975 dealing with the Direct Deposit of federal government payments, when the

ACH network was in its infancy, had a green cover. More than 45 years later, the world of

federal government payments has changed, but the Green Book is still green! We hope you

incorporate the Green Book into your daily operations and visit us frequently.

Department of the Treasury

Bureau of the Fiscal Service

January 2021

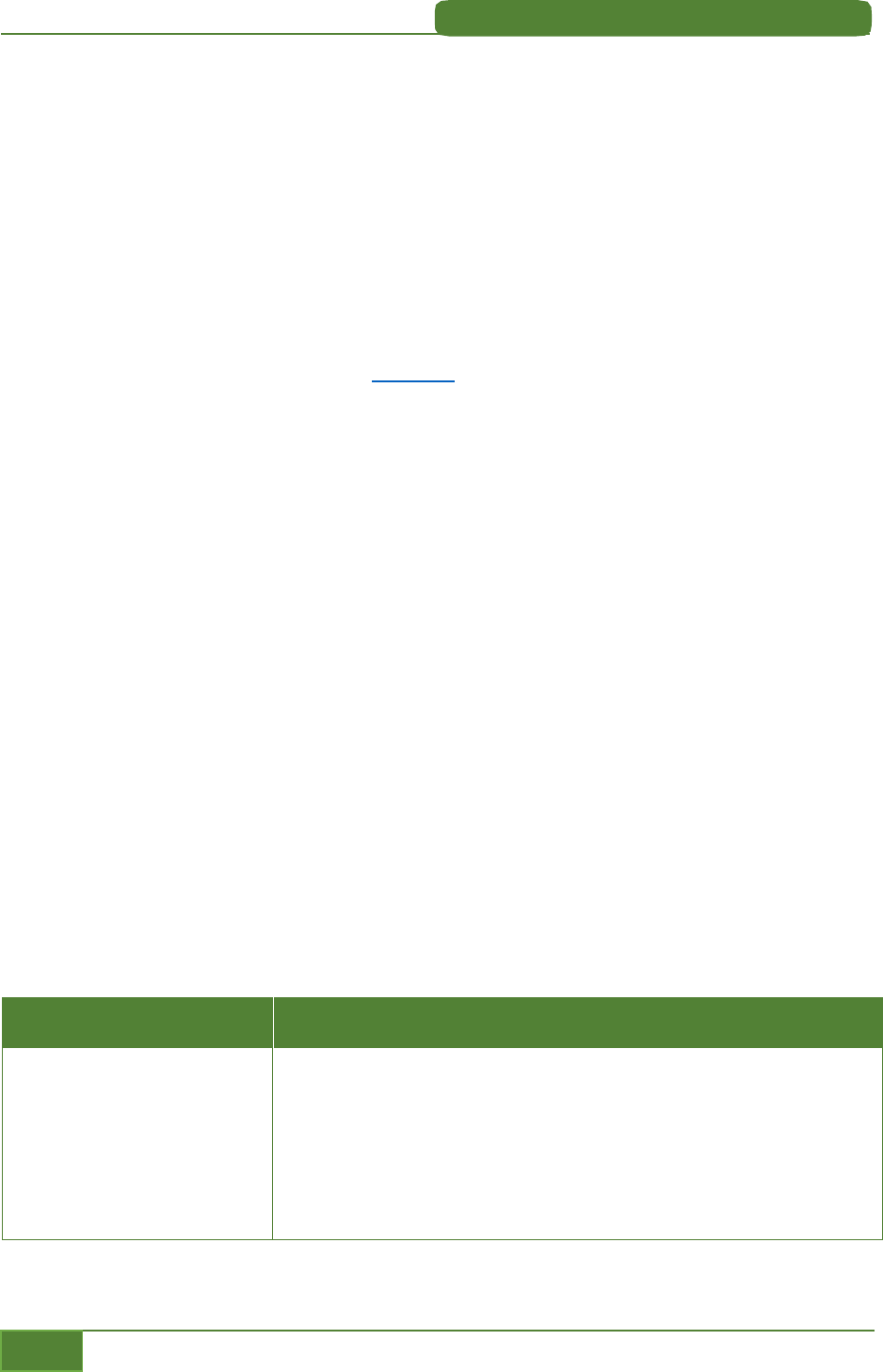

Table of Contents

Green Book

III

A Guide to Federal Government ACH Payments

Table of Contents

Chapters

Revised on

1. Enrollment

January 2023

2. ACH Payment Processing

January 2023

3. Non-Receipt Claims

January 2023

4. Returns

January 2023

5. Reclamations

January 2023

6. Notification of Change

January 2023

7. Contacts

January 2023

8. Glossary

January 2023

9. Forms

January 2023

Online Book Location:

https://www.fiscal.treasury.gov/fsreports/ref/greenBook/greenbook_home.htm

1-1

A Guide to Federal Government ACH Payments

Enrollment for

Federal Payments

Overview

In this chapter…

A: Automated Enrollment (ENR) ............................................................................................................... 1-4

Go Direct Online Enrollment Option for Financial Institutions ................................................................ 1-4

Social Security Administration (SSA) Payment Cycling .............................................................................. 1-4

B: Simplified Enrollment ............................................................................................................................. 1-5

Telephone Enrollment .............................................................................................................................................. 1-5

Paper Form Enrollment ........................................................................................................................................... 1-5

Enrollment Methods for Specific Payments ..................................................................................................... 1-5

1

Financial institutions can play a key role in assisting recipients of federal payments to enroll in

Direct Deposit with their paying agency. This chapter is a guide to the various enrollment methods

available for both consumer and corporate recipients.

There are several enrollment options:

1.

Enroll customers in lobby, batch and submit ENR enrollments through ACH from the financial

institution.

2.

Financial institution can enroll on the Go Direct® website to enter enrollments for customers.

3.

Financial institution can call the U.S. Treasury Electronic Payment Solution Center (EPSC) at

1-800-333-1795 for immediate enrollment of customers.

4.

Enrollment using Bureau of the Fiscal Service (Fiscal Service) Direct Deposit Sign-Up Form FS

Form 1200 for Social Security benefits or disability payments, Supplemental Security Income

payments, Railroad Retirement Board annuities, and Office of Personnel Management (OPM)

Civil Service annuities and Direct Deposit Sign Up Form FS Form 1199A for other federal

payments, or the ACH Vendor/Miscellaneous Payment Enrollment Form SF 3881 for corporate

vendor payments.

Errors in the Direct Deposit enrollment process are the primary cause of misdirected payments.

Financial institutions will be held liable for providing incorrect enrollment information and should,

therefore, carefully review all Direct Deposit enrollment procedures.

1-2

A Guide to Federal Government ACH Payments

1. Enrollment

Green Book

Allotments, Federal Salary, and Federal Employment Related Payments ........................................... 1-7

When Should Direct Deposit Begin Once It Has Been Initiated? ............................................................. 1-8

IRS Tax Refunds .......................................................................................................................................................... 1-8

Railroad Retirement Board ..................................................................................................................................... 1-9

Social Security Administration .............................................................................................................................. 1-9

Office of Personnel Management ......................................................................................................................... 1-9

TreasuryDirect (Bureau of the Fiscal Service) ..............................................................................................1-10

Simplified Enrollment for Series H/HH Savings Bond Interest Payments (Bureau of the Fiscal

Service) .........................................................................................................................................................................1-10

Department of Veterans Affairs Direct Deposit ............................................................................................1-10

C: Paper Enrollment Methods ................................................................................................................. 1-11

Fiscal Service Direct Deposit Sign-Up Form (FS Form 1200) .................................................................1-11

Direct Deposit Sign-Up Form (FS Form 1200) ..............................................................................................1-11

How to Complete the FS Form 1200 .................................................................................................................1-11

Federal Benefit Recipient Information ............................................................................................................1-12

Bank or Credit Union Information

.....................................................................................................................1-1

2

Type of Payment .......................................................................................................................................................1-12

SSA – Single Payee Example .................................................................................................................................1-14

SSA– Representative Payee Example................................................................................................................1-15

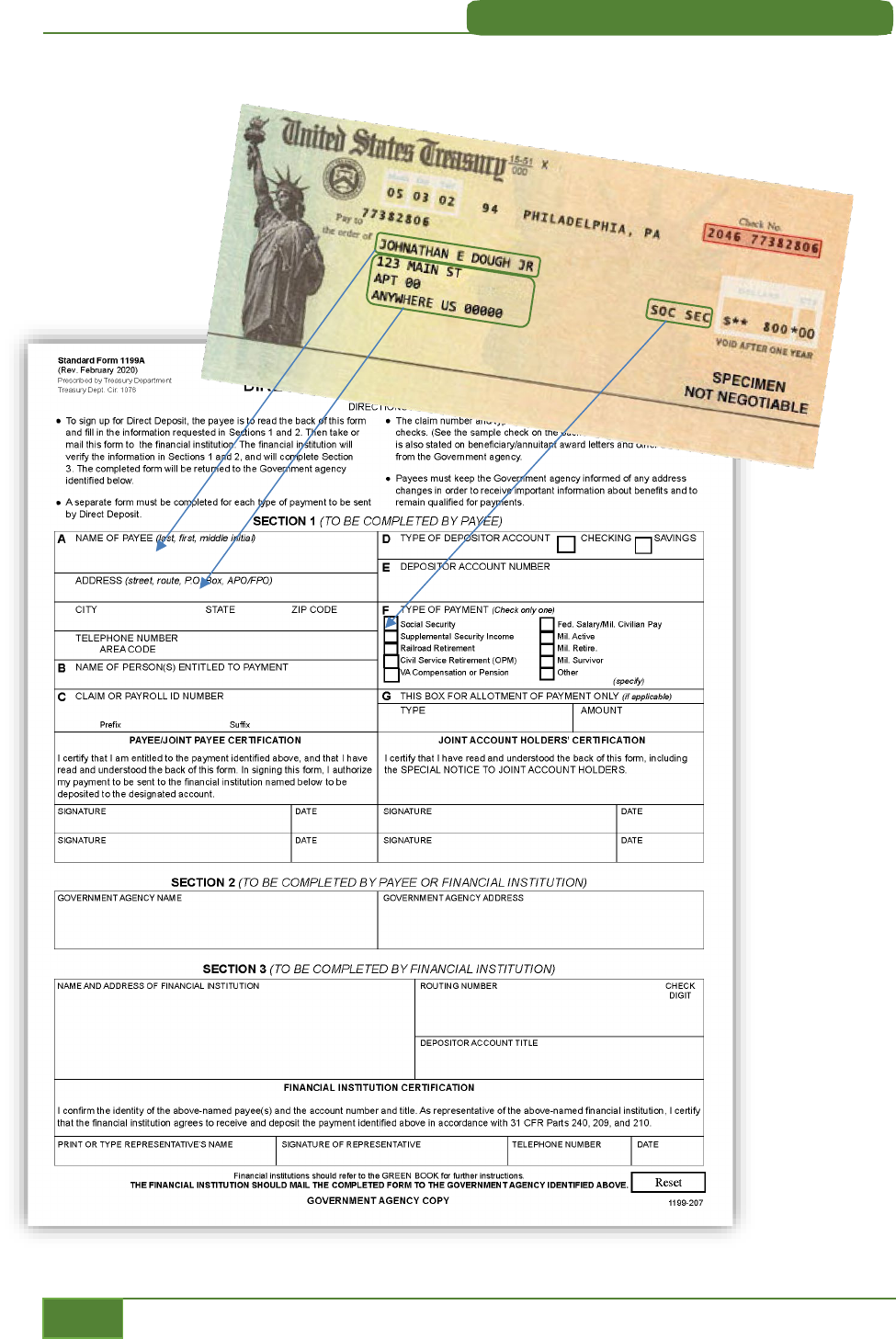

D: Direct Deposit Sign-Up Form (FS Form 1199A) .......................................................................... 1-16

How to Complete the FS Form 1199A ..............................................................................................................1-16

Section 1- To be completed by the payee ........................................................................................................1-16

Name of the Person(s) Entitled to Payment (Box B) ..................................................................................... 1-16

Claim or Payroll ID Number (Box C) .................................................................................................................... 1-16

Claim/Payroll ID Table ............................................................................................................................................... 1-17

Depositor Account Number (Box E) ...................................................................................................................... 1-17

Type of Payment (Box F) ............................................................................................................................................ 1-18

Payee/Joint Payee Certification (Box F) ............................................................................................................. 1-18

Joint Account Holders’ Certification (Optional) ............................................................................................... 1-18

When Using Witnesses ................................................................................................................................................ 1-18

Po

wer-of-Attorney ........................................................................................................................................................ 1-18

Section 2 - To Be Completed by the Payee or the Financial Institution ..............................................1-18

Section 3 - To Be Completed by the Financial Institution ........................................................................1-19

What Actions Should Take Place Before Filing the FS Form 1199A? ...................................................1-19

Important Information for New Direct Deposit Recipients .....................................................................1-19

How Are Forms Distributed? ...............................................................................................................................1-20

What to do if Direct Deposit does not begin ..................................................................................................1-20

FS Form 1199A Example .......................................................................................................................................1-21

E: Federal Financial EDI (FEDI) Payments/Vendor Payments .................................................... 1-22

Overview ......................................................................................................................................................................1-22

Delivery of Remittance (Addenda) Information ..........................................................................................1-22

1-3

A Guide to Federal Government ACH Payments

1. Enrollment

Green Book

Enrollment .................................................................................................................................................................. 1-22

Enrollment Checklist ............................................................................................................................................... 1-23

How to Complete the SF 3881 ............................................................................................................................. 1-23

Agency Information...................................................................................................................................................... 1-23

Payee/Company Information .................................................................................................................................. 1-23

Financial Institution Information .......................................................................................................................... 1-23

Form Distribution ......................................................................................................................................................... 1-24

Pointers for Completing the SF 3881 Form ................................................................................................... 1-24

F: Enrollment Guidance ............................................................................................................................. 1-24

ENR (Automated Enrollment) Entry Detail Record .................................................................................... 1-27

ENR Addenda Record .............................................................................................................................................. 1-27

Representative Payee ............................................................................................................................................. 1-28

Return Reason Codes .............................................................................................................................................. 1-28

ENR Tips and Information Checklist ................................................................................................................. 1-29

General Questions/Information: ............................................................................................................................. 1-29

Benefit Recipient Information ................................................................................................................................. 1-29

Information Needed for Direct Deposit Enrollment ...................................................................................... 1-30

Helpful Numbers and Websites ............................................................................................................................... 1-30

Federal Agency Addresses and Phone Numbers.......................................................................................... 1-31

G: Termination of Enrollment ................................................................................................................. 1-36

Termination by the Recipient .............................................................................................................................. 1-36

Courtesy Notice ......................................................................................................................................................... 1-36

Termination by the Financial Institution ........................................................................................................ 1-37

Recipient Notice to the Federal Agency ........................................................................................................... 1-37

1. Enrollment

Green Book

1-4

A Guide to Federal Government ACH Payments

A: Automated Enrollment (ENR)

ENR is a convenient method for financial institutions to use the ACH network to transmit Direct

Deposit enrollment information to federal agencies for benefit payments. An ENR entry is a non-

monetary entry sent through the ACH by any Receiving Depository Financial Institution (RDFI) to a

federal government benefit agency participating in the ENR program.

ENR is the enrollment method preferred by participating federal benefit agencies. The ENR reduces

errors in the enrollment process and may expedite delivery of Direct Deposit payments as

compared to paper enrollment methods.

An ENR should be used when the recipient is requesting to initiate direct deposit for their federal

benefits. This may include, but is not limited to a first-time sign-up for Direct Deposit, a change to

an existing Direct Deposit enrollment (e.g. new bank account number) with the current financial

institution, or a change from one financial institution to another new financial institution.

Enrollments received and accepted by the paying agency at least 10 business days prior to the

benefit recipient’s next scheduled payment date will generally allow the recipient’s next month’s

payment by Direct Deposit.

To change financial institution data for an existing Direct Deposit enrollment within a financial

institution where an authorization exists, a Standard Entry Code (COR) entry, commonly known as

a Notification of Change (NOC), may be used. (Refer to Chapter 6 for more information on NOCs.)

Go Direct Online Enrollment Option for Financial Institutions

In addition to the Automated ENR option, financial Institutions can also choose to take advantage of

enrollment via the Go Direct w

ebsite. The Go Direct campaign was a national marketing and public

education campaign sponsored by the U.S. Department of the Treasury, Bureau of the Fiscal Service

and the Federal Reserve System that increased the use of Direct Deposit for federal benefit check

recipients. Although the Go Direct campaign has officially concluded, financial institutions can

continue to utilize the enrollment website. Please review the Go Direct Reference Guide for

Financial Institutions and Corporations for more details.

Enrollments submitted through the Go Direct enrollment site will be validated and submitted to the

respective paying agencies by the Electronic Payment Solutions Center (EPSC). The U.S. Treasury

EPSC is operated in a secure Federal Reserve site. Financial Institution customers whose

enrollments cannot be verified or processed will be contacted by the U.S. Treasury Electronic

Payment Solutions Center via letter delivered by USPS.

All reject or return item processing for these items is handled by the Operations and Research

Division of the EPSC. Financial institutions electing to submit enrollments electronically through Go

Direct are relieved of the obligation of processing ENR return items.

Social Security Administration (SSA) Payment Cycling

The payment date for newly enrolled Social Security beneficiaries is either the second, third, or

fourth Wednesday of the month. These additional payment days alleviate the workload peaks for

SSA, Fiscal Service, and financial and business communities.

1. Enrollment

Green Book

A Guide to Federal Government ACH Payments

1-5

However, in instances where the beneficiary receives both Social Security benefit or disability

payments and Supplemental Security Income (SSI) payments, the payments are issued on the

standard 1st and 3rd schedule.

B: Simplified Enrollment

There are a variety of ways for federal payment recipients to enroll for Direct Deposit without

visiting a financial institution.

Telephone Enrollment

Federal benefit recipients can be enrolled by calling the U.S. Treasury Electronic Payment Solution

Center at 1-800-333-1795, by visiting the Go Direct w

ebsite, or by completing Fiscal Service Direct

Deposit Sign-Up Form FS Form 1200. The U.S. Treasury Electronic Payment Solution Center hours

of operation are 8:00 a.m. - 8:00 p.m. Eastern Time (ET), Monday through Friday, excluding federal

holidays.

Financial institution representatives can also assist their recipients who wish to enroll by phone.

H

owever, when doing so, the benefit recipient - or their representative - must be present when the

phone call is made. U.S. Treasury Electronic Payment Solutions Center personnel will ask to speak

to the recipient or their representative and obtain approval for the 3rd party banking

representative to provide their enrollment information. Financial institutions that elect to capture

enrollment information on paper or through other means and process after hours or in a back-

office environment may not use U.S. Treasury Electronic Payment Solutions Center telephone

enrollment on behalf of their customer.

Paper Form Enrollment

Recipients who elect to complete Fiscal Service paper Form FS 1200 should complete it on their

own or with the assistance of a financial Institution representative for the Routing Transit Numbers

(RTN) and account number and mail to:

U.S. Treasury Electronic Payment Solution Center

P.O. Box 650527

Dallas, Texas 75265-0527

The table below shows the Simplified Enrollment procedures for specific payment types.

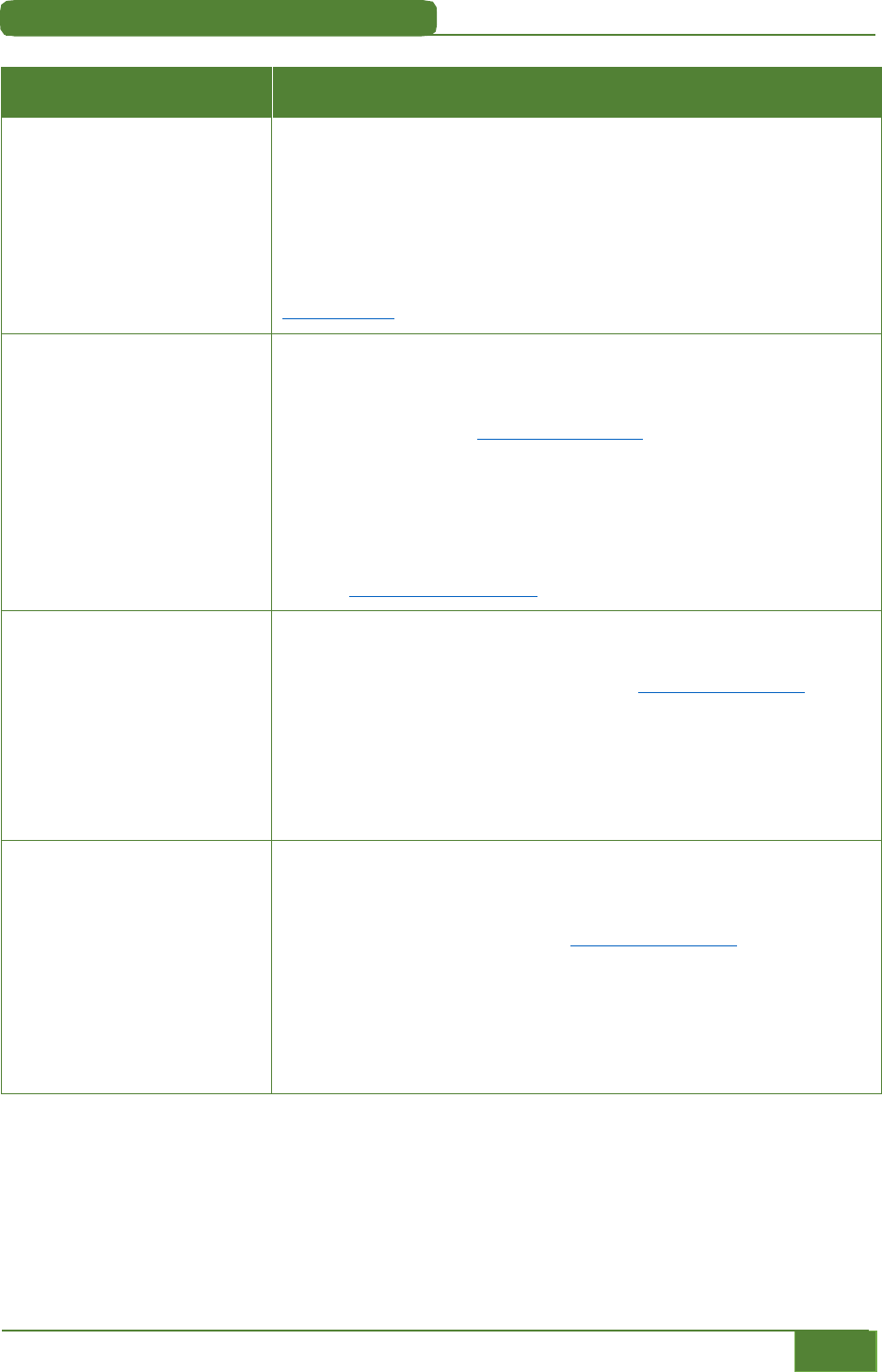

Enrollment Methods for Specific Payments

Payment Type Recipient

Allotments

Federal Salary

Federal Employment-

Related Payments (i.e.,

Travel Reimbursement,

Uniform Allowance, etc.)

Completes an approved form at their federal agency personnel

office (e.g., FS Form 2231, FastStart Direct Deposit). Some federal

employees are able to make changes to Direct Deposit information

via telephone using Employee Express.

Recipients should contact their servicing personnel office for more

information.

1. Enrollment

Green Book

1-6

A Guide to Federal Government ACH Payments

Payment Type Recipient

IRS Tax Refunds Completes the financial institution information section of the IRS

Form 1040 during tax preparation.

For paper filing completes a U.S. Individual Income Tax

Declaration (IRS Form 8453). For electronic filing via IRS e-file

completes an 8453-OL.

Recipients should contact the IRS at 1-800-829-1040 or visit

www.irs.gov

f

or more details.

Office of Personnel

Management (OPM)

Form

Note: OPM does not allow

ENR enrollments for

representative payees.

Financial institutions can enroll their customers or recipients can

enroll individually by calling the U.S. Treasury Electronic Payment

Solution Center at 1-800- 333-1795 (English) / 1-800-333-1792

(Spanish), by visiting www.GoDirect.gov, or

by completing FS

Form 1200. The U.S. Treasury Electronic Payment Solution Center

hours of operation are 8:00 am - 8:00 pm ET, Monday through

Friday, excluding federal holidays.

Additionally, Financial Institutions a

nd/or recipients can call OPM

at 1-888-767-6738 or 202-606-0500 in the Washington, DC area

or visit www.opm.gov/retire f

or details.

Railroad Retirement Board

(RRB)

Financial institutions can enroll their customers and/or recipients

can enroll individually by calling 1-800- 333-1795 (English)/ 1-

800-333-1792 (Spanish), or by visiting www.GoDirect.gov,

completing FS Form 1200. The U.S. Treasury Electronic Payment

Solution Center hours of operation are 8:00 a.m. - 8:00 p.m. ET,

Monday through Friday, excluding federal holidays.

Additionally, f

inancial institutions and/or recipients can contact

RRB’s toll-free telephone number at 1-877-772-5772.

Social Security (SSA) and

Supplemental Security

Income (SSI)

Financial institutions can enroll their customers and/or recipients

can enroll individually by calling the U.S. Treasury Electronic

Payment Solution Center at 1-800- 333-1795 (English)/ 1-800-

333-1792 (Spanish), by visiting www.GoDirect.gov, or

by

completing FS Form 1200. The U.S. Treasury Electronic Payment

Solution Center hours of operation are 8:00 a.m. - 8:00 p.m. ET,

Monday through Friday, excluding federal holidays.

Additionally, f

inancial institutions and/or recipients can enroll by

contacting the SSA at 1-800-SSA-1213 (1-800-772-1213).

1. Enrollment

Green Book

A Guide to Federal Government ACH Payments

1-7

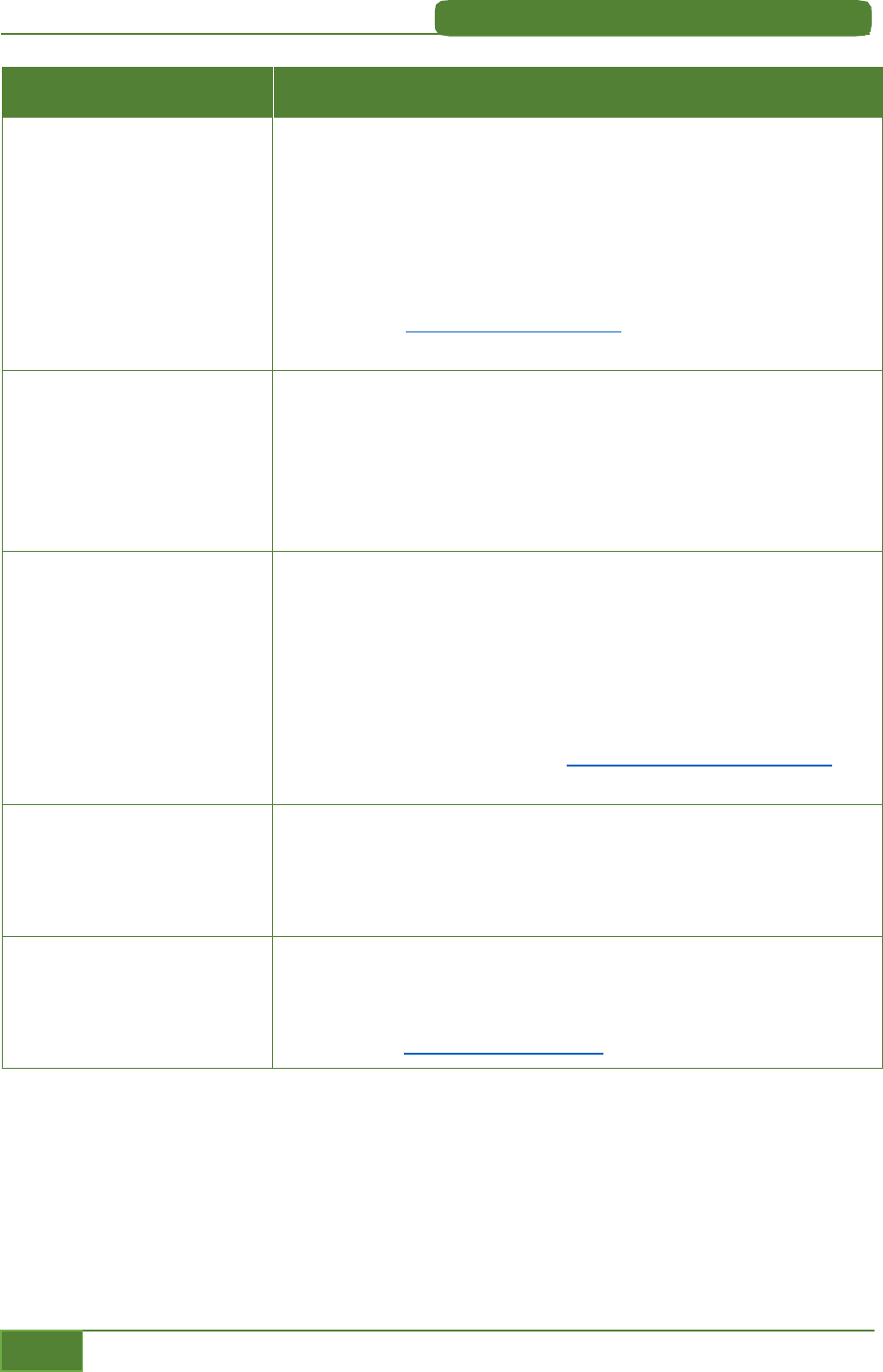

Payment Type Recipient

Bureau of the Fiscal Service

TreasuryDirect

Recipient is automatically enrolled in the TreasuryDirect account

for purchasing Treasury bills, notes, and bonds. Investors use

Form PD F 5182, New Account Request, to establish a

TreasuryDirect account and to provide Direct Deposit information.

Investors use Form PD F 5178, Transaction Request, to change

Direct Deposit information.

Recipients should contact a designated TreasuryDirect Servicing

Office or visit www.treasurydirect.gov

f

or forms and other

information.

Vendor/Misc. The ACH Vendor/Miscellaneous Payment Enrollment Form (SF

3881) is an optional three-part form that federal agencies may use

to enroll their vendors in the Financial Electronic Data

Interchange (FEDI) program.

Recipients should contact the federal agency they are providing

goods or services to for more information.

Veterans Compensation and

Pension

Note: VA does not allow ENR

enrollments for

representative payees.

Financial institutions can enroll their customers and/or recipients

can enroll individually by calling 1-800- 333-1795 (English)/ 1-

800-333-1792 (Spanish), or by visiting www.GoDirect.gov, or b

y

c

ompleting FS Form 1200. The U.S. Treasury Electronic Payment

Solution Center hours of operation are 8:00 a.m. - 8:00 p.m. E

T,

Mond

ay through Friday, excluding federal holidays.

Recipients can also contact the VA National Direct Deposit EFT

line at 1-800-827-1000 or visit www.benefits.va.gov/benefits

f

or

further details.

Veterans Education

Note: VA does not allow ENR

enrollments for

representative payees.

Enrolls at the same time recipient applies for benefits at the VA or

at any time after recipient begins receiving benefits. Recipients

already receiving benefits should contact the VA Education Direct

Deposit EFT line at 1-888-442-4551.

Veterans Life Insurance

Note: VA does not allow ENR

enrollments for

representative payees.

Enrolls at the same time recipient applies for benefits at the VA or

at any time after recipient begins receiving benefits.

Recipients should contact the VA Insurance office at 1-800-669-

8477 or visit www.insurance.va.gov f

or further details.

Allotments, Federal Salary, and Federal Employment Related Payments

Current federal employees can complete an approved form at their agency personnel office, or

servicing pay office. This form may be a FS Form 1199A (Direct Deposit Sign Up), a FS Form 2231

(FastStart Direct Deposit Sign Up), or a similar form used by the employee’s agency. The Direct

Deposit payments may be for federal salaries, allotments, or for employment related payments for

travel reimbursement or uniform allowance.

1. Enrollment

Green Book

1-8

A Guide to Federal Government ACH Payments

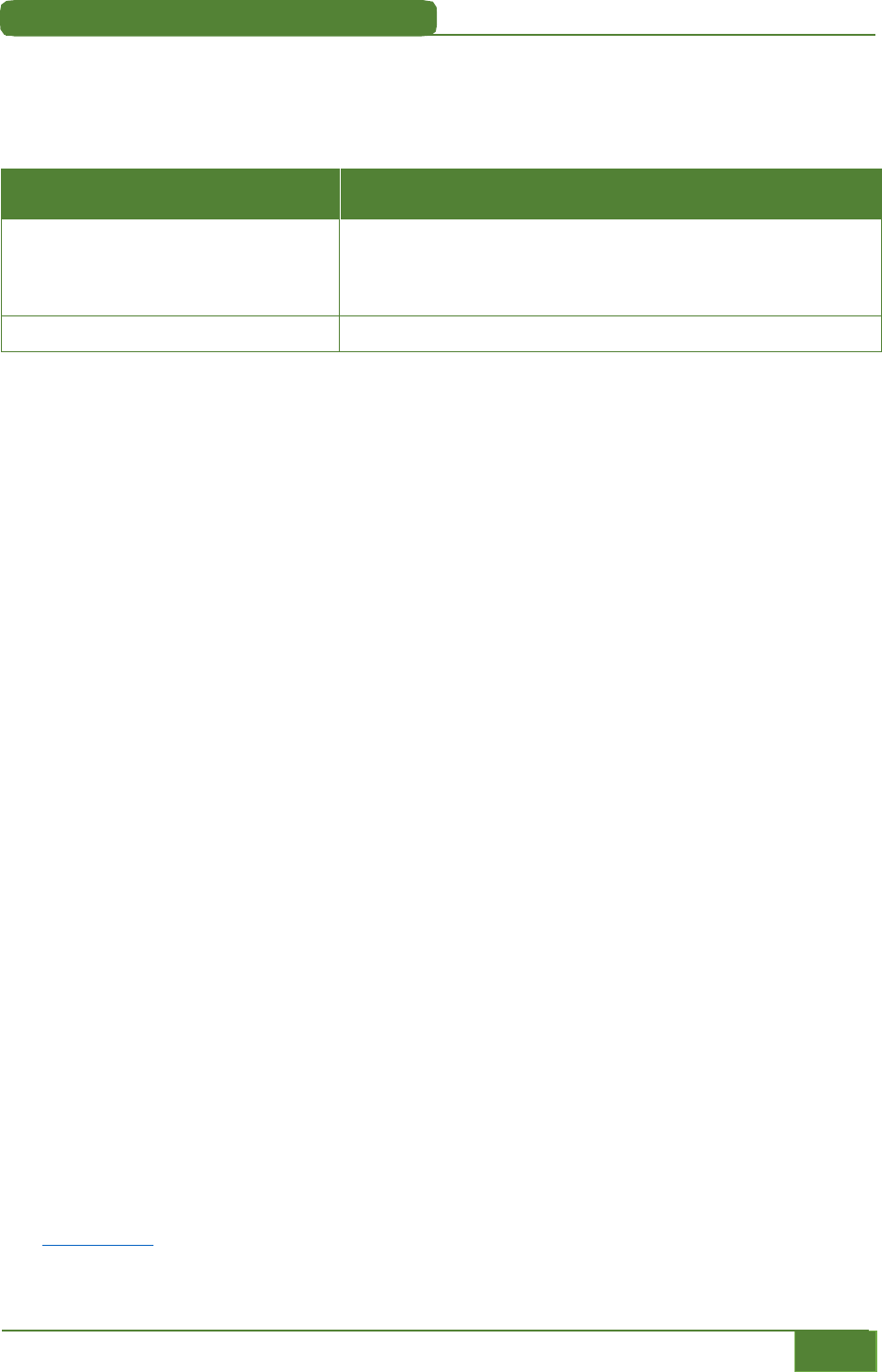

When Should Direct Deposit Begin Once It Has Been Initiated?

Use the table below to determine when Direct Deposit should begin once the enrollment form is

forwarded to the federal agency.

IF the payment type is... THEN Direct Deposit should begin within...

Federal salary

Military civilian pay

Military active duty Allotments

2-3 pay periods

Military retirement/annuity

60-90 days

D

etails of Each Payment Type

IRS Tax Refunds

The Internal Revenue Service (IRS) offers the Direct Deposit of IRS Form 1040 tax refunds for both

paper and electronically filed returns.

For IRS Form 1040 paper returns, taxpayers receiving refunds and electing Direct Deposit simply

complete the financial institution information section of the form and mail the form to the IRS.

For electronically filed returns using an authorized IRS e-file provider, the taxpayer will complete a

U.S. Individual Income Tax Declaration for Electronic Filing (IRS Form 8453) for refunds by Direct

Deposit. This form authorizes the tax preparer to transmit the return and allows the choice of

having the refund deposited into a checking or savings account.

Taxpayers preparing returns on a personal computer using commercial tax preparation software or

the IRS Free Online Filing and transmitting the information via the internet to the IRS complete

Form 8453-OL, U.S. Individual Income Tax Declaration for On-Line Filing. This form allows the

taxpayer to choose Direct Deposit for the refund. The financial institution will not receive copies of

these forms.

The financial institution should be aware of the following:

1.

Enrollment in Direct Deposit for an income tax refund is not a permanent election by the

taxpayer. Taxpayers must elect Direct Deposit each filing year.

2.

Payments must be returned when they cannot be properly posted by the financial institution.

NOCs cannot be used to correct any information. In the instance where a Direct Deposit IRS tax

refund is unpostable and returned, taxpayers will receive a check in place of a Direct Deposit

payment.

3.

The financial institution’s responsibility is to post the Direct Deposit payment to the account

indicated on the ACH record. If the funds are posted to a valid account that turns out to be

incorrect, the financial institution is not liable to the government for the return of the funds. If the

taxpayer or the taxpayer’s agent gave the incorrect account information, neither Fiscal Service

nor the IRS will assist the taxpayer with recovering the funds. The taxpayer is free to pursue civil

action. If, however, the IRS made the error, it will make the taxpayer whole.

For further information, contact the IRS at 1-800-829-1040; contact the local IRS District Office, or

visit www.irs.gov.

1. Enrollment

Green Book

A Guide to Federal Government ACH Payments

1-9

For IRS tax refund status, the recipient should go to www.irs.gov and select “Get Your Refund

Status.”

Railroad Retirement Board

Financial institutions can enroll their customers and/or recipients can enroll individually by:

1.

Calling the U.S. Treasury Electronic Payment Solution Center at 1-800-333-1795 (English)/1-

800-333-1792 (Spanish), or by visiting the Go Direct w

ebsite, or by completing FS Form 1200.

The call center hours of operation are 8:00 a.m. - 8:00 p.m. ET, Monday through Friday,

excluding federal holidays, or

2.

Calling the Railroad Retirement Board at 1-877-772-5772, or

3.

Sending a written request to enroll in Direct Deposit to the local Railroad Retirement Board

field office. The letter should include the recipient’s name and the following:

A: Account Number,

B: Account type (checking or savings), and

C: RTN of the financial institution.

Social Security Administration

Financial institutions can enroll their customers and/or recipients can enroll individually by calling

the U.S. Treasury Electronic Payment Solution Center at 1-800- 333-1795 (English)/ 1-800-333-

1792 (Spanish), or by visiting the Go Direct w

ebsite, or by completing FS Form 1200. The U.S.

Treasury Electronic Payment Solution Center hours of operation are 8:00 a.m. - 8:00 p.m. ET,

Monday through Friday, excluding federal holidays.

The financial institution may make the call on behalf of the recipient and may provide the

e

nrollment information; however, SSA will request to speak to the recipient to verify their identity.

Recipients who already are receiving Social Security and SSI benefits by check may also enroll in

Direct Deposit by calling 1-800-SSA-1213 (1-800-772-1213).

SSA’s toll-free telephone service is available from 7:00 a.m. to 7:00 p.m. ET, Monday through Friday.

Due to the high volume of calls, the best times to telephone are in the early morning and during the

latter parts of the week and month.

Office of Personnel Management

Financial institutions can enroll their customers or recipients can enroll individually by calling the

U.S. Treasury Electronic Payment Solution Center at 1-800- 333-1795 (English)/ 1-800-333-1792

(Spanish), by visiting the Go Direct w

ebsite, or by completing FS Form 1200. The U.S. Treasury

Electronic Payment Solution Center hours of operation are 8:00 a.m. - 8:00 p.m. ET, Monday

through Friday, excluding federal holidays.

Additiona

lly, new retirees, annuitants, and survivor annuitants may enroll in Direct Deposit by

calling the toll-free customer service number at 1-888-767-6378. Those in the Washington, DC

area are encouraged to call 202-606-0500. Recipients may also visit www.opm.gov/retire f

or

instructions on how to change their payment address on-line.

Note: T

he Office of Personnel Management does not allow ENR enrollments for representative payees.

1. Enrollment

Green Book

1-10

A Guide to Federal Government ACH Payments

TreasuryDirect (Bureau of the Fiscal Service)

TreasuryDirect is a book-entry securities system in which investors’ accounts of book-entry

Treasury marketable securities are maintained. TreasuryDirect is designed for investors who

purchase Treasury securities and intend to hold them until maturity. Investors can establish a

TreasuryDirect account and hold all their bills, notes, and bonds in one TreasuryDirect account

showing the same ownership for all their securities, or they can establish multiple accounts

reflecting different ownership. Investors will receive a TreasuryDirect Statement of Account when

they open a new account, when changes are made to the account, upon request, or if they have not

received one during the calendar year.

TreasuryDirect principal and interest payments are made electronically by Direct Deposit to a

checking or savings account at a financial institution designated by the investor. When establishing

a TreasuryDirect account, investors will complete Form PDF 5182, New Account Request, and will

include Direct Deposit information. Investors are not required to fill out an FS Form 1199A.

Investors can also establish an account when they complete Form PDF 5381, Treasury Bill, Note &

Bond Tender to purchase a security. Investors use Form PDF 5178, Transaction Request, to change

Direct Deposit information for the TreasuryDirect account. Financial institutions may be asked by

customers to furnish the account number, routing transit number, account type, and/or the

financial institution’s name. The investor should contact a designated TreasuryDirect Servicing

Office or visit the TreasuryDirect

w

ebsite for forms and other information.

Simplified Enrollment for Series H/HH Savings Bond Interest Payments

(Bureau of the Fiscal Service)

Series H/HH savings bonds are current income securities that pay interest semiannually. Interest

on bonds issued since October 1989 to the present must be paid by Direct Deposit. Unless a

recipient claims that it will cause a hardship, interest on bonds issued prior to October 1989 must

also be paid by Direct Deposit.

To enroll in Direct Deposit or to change their enrollment, recipients may:

1.

Download PDF 5396 from the TreasuryDirect website, complete and mail the form as instructed,

or

Send a letter to the T

reasury Retail Securities Services, P.O. Box 9150, Minneapolis, MN 55480-9150. The

letter should include the following:

A.

Recipient’s name,

B.

Social Security number,

C.

Account number,

D.

Account type (checking or savings), and

E.

RTN number of the financial institution.

Department of Veterans Affairs Direct Deposit

Veterans Compensation and Pension, and Vocational Rehabilitation and Employment recipients

already receiving benefits may enroll in Direct Deposit by calling 1-800-827-1000. Compensation

1. Enrollment

Green Book

A Guide to Federal Government ACH Payments

1-11

and Pension Beneficiaries may also enroll in Direct Deposit through VA’s eBenefits self-service

portal (www.ebenefits.va.gov/ebenefits).

VA Education recipients already receiving benefits may enroll in Direct Deposit by calling 1-888-

442-4551.

New VA benefits recipients should provide Direct Deposit information at the time of application.

Recipients of VA benefits may also enroll by submitting VA Form 24-0296 (Direct Deposit

Enrollment) and mailing it to the Station of Jurisdiction over the claim. To locate the Station of

Jurisdiction over the claim, visit http://www.benefits.va.gov/benefits/offices.asp.

Veterans Life Insurance recipients may enroll in Direct Deposit by calling 1-800-669-8477. A

Direct Deposit enrollment form and further details are also available by visiting

www.insurance.va.gov or

by writing to:

VAROIC – DD

P.O. Box 7208

Philadelphia, PA 19101-7208

New recipients should provide Direct Deposit information at the time of application.

Note: The Department of Veterans Affairs does not allow ENR enrollments for representative payees.

C: Paper Enrollment Methods

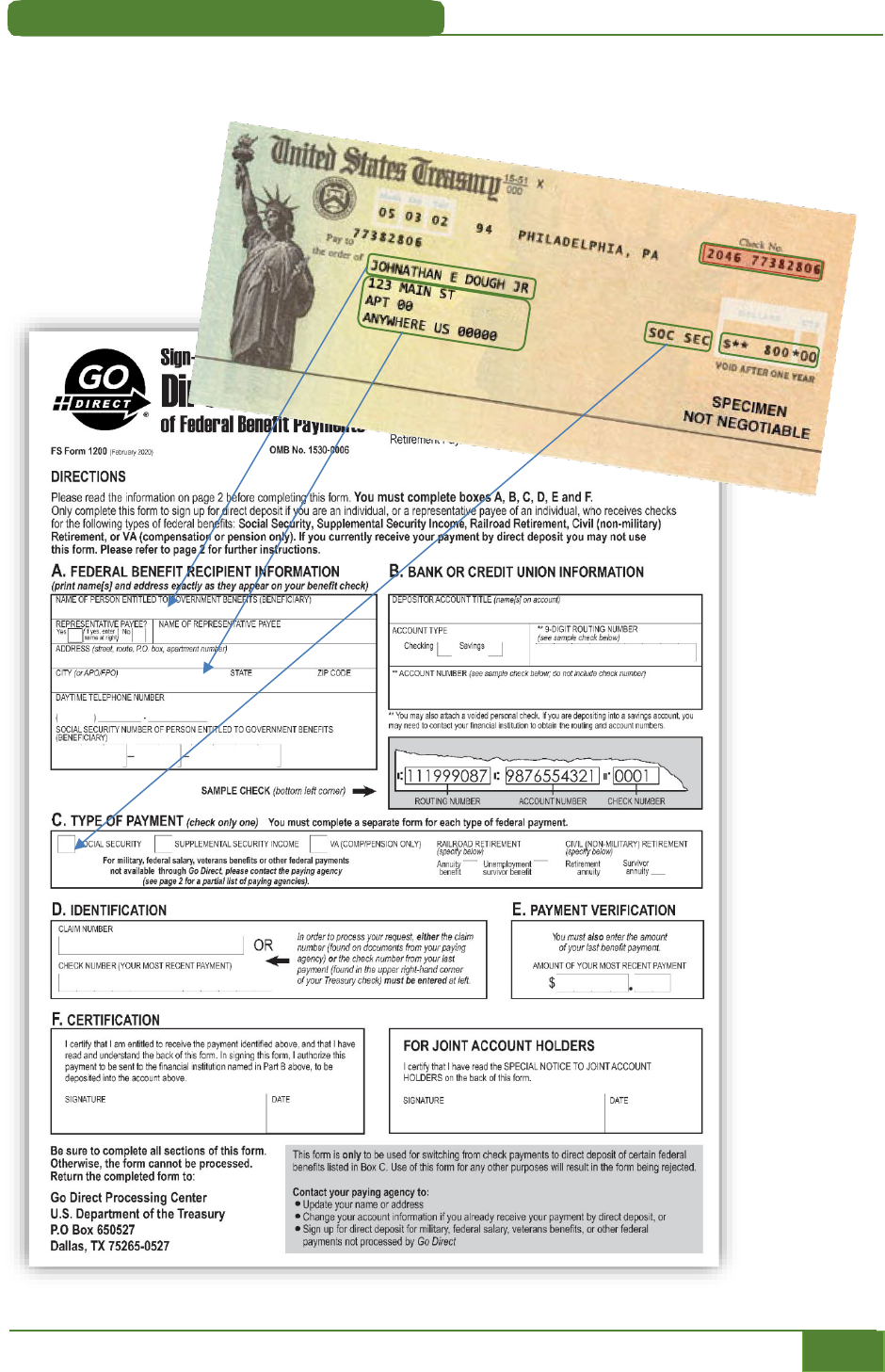

Fiscal Service Direct Deposit Sign-Up Form (FS Form 1200)

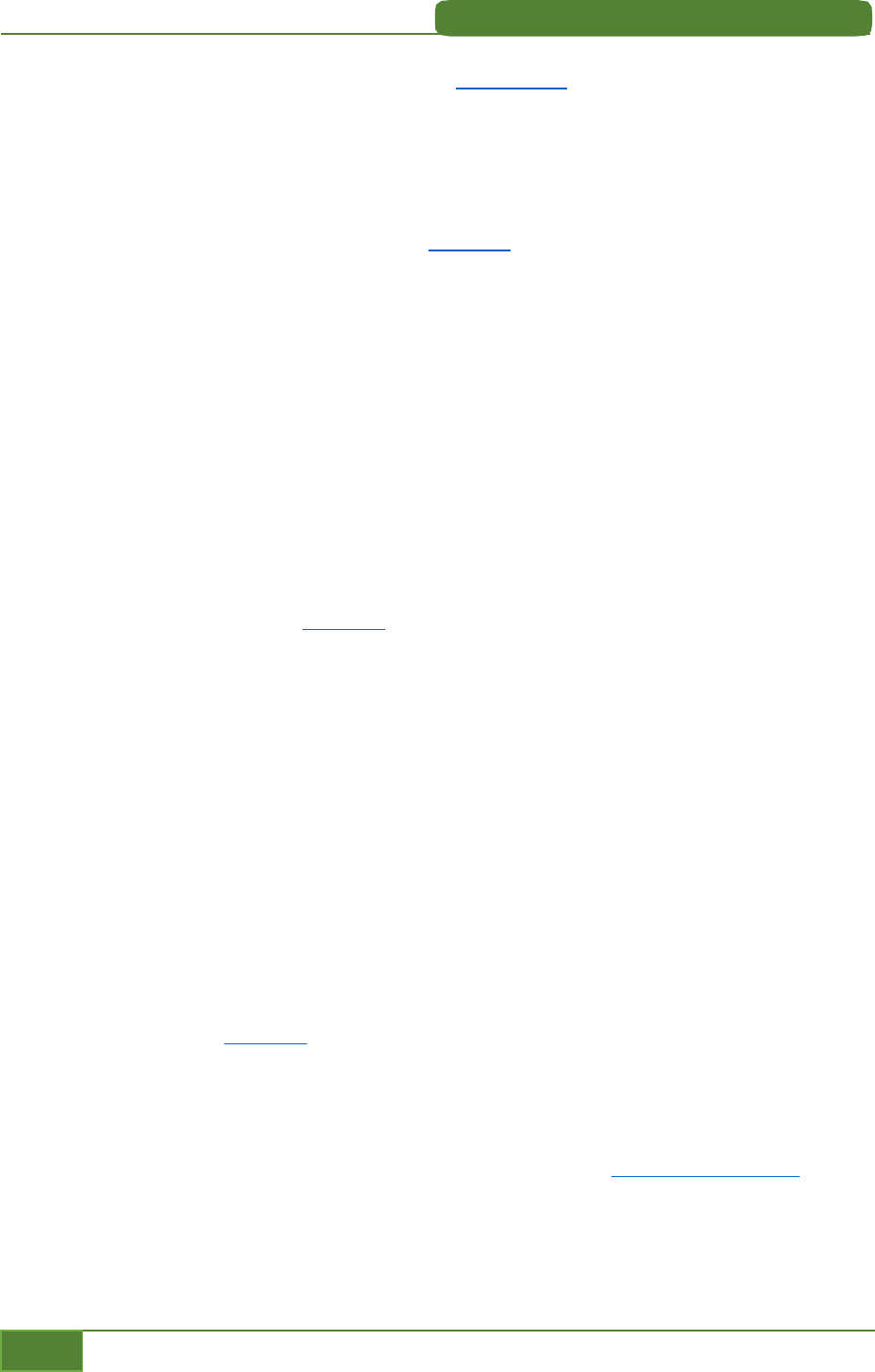

The table below identifies those agencies and payment types where the FS Form 1200 is the proper

form to use, in situations when a paper enrollment is needed:

Agency I Payment Type

Recipient

Social Security Administration

and

• Social Security

• Supplemental Security Income

Recipients should complete Fiscal Service FS Form

1200. Send completed form to:

U.S. Treasury Electronic Payment Solution Center

P.O. Box 650527

Dallas, TX 75265-0527

Office of Personnel Management

and

• Annuity

• Retirement Annuity or Survivor Annuity

Railroad Retirement Board

and

• Railroad Retirement Annuity Benefit

• Railroad Retirement

Unemployment/Sickness

Direct Deposit Sign-Up Form (FS Form 1200)

The Direct Deposit Sign-Up Form (FS Form 1200) is available in Chapter 9, Forms.

How to Complete the FS Form 1200

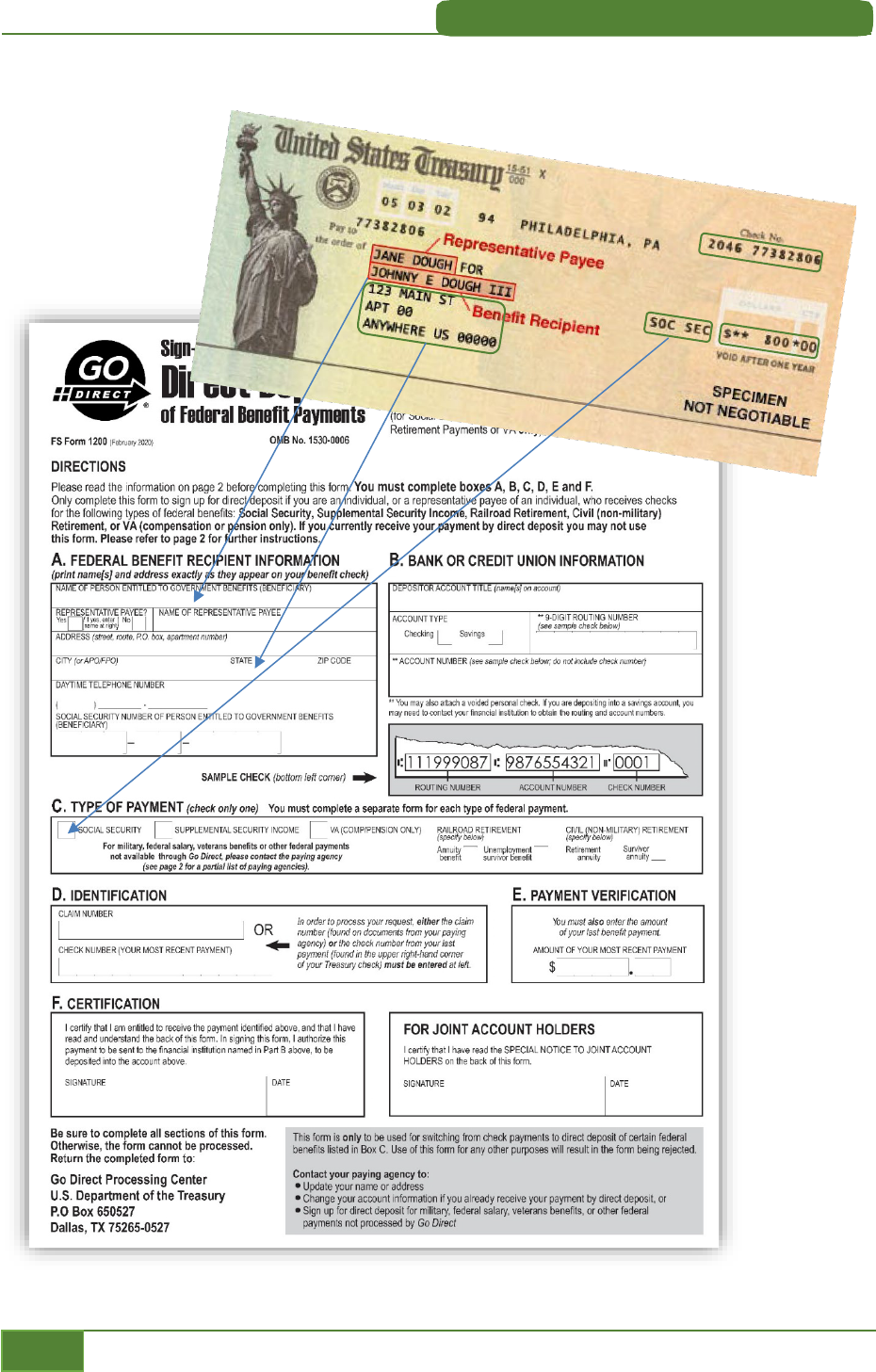

Payee must complete boxes A, B, C, D, E, and F.

Clearly print all information. Provide name(s) and address exactly as they appear on the federal

benefit recipient’s benefit check.

1. Enrollment

Green Book

1-12

A Guide to Federal Government ACH Payments

Federal Benefit Recipient Information

Name of person entitled to government benefits (beneficiary).

If there is more than one person named on the check, such as a parent and a minor child, this will be

the name of the minor child.

Representative Payee? Check appropriate box Yes or No.

If yes, enter Name of Representative Payee.

A representative payee is a person or institution that is legally entitled to receive payments on behalf

of a beneficiary who has been deemed incapable of handing their own financial affairs. When a

representative payee is present, both names will appear on the benefit check. Minor children receiving

federal benefits should always have a representative payee. An example of a representative check

payee is Mary Smith for Jane R. Doe.

Provide name(s) and address exactly as they appear on the most recent benefit check.

Social Security Number (SSN) of persons entitled to government benefits (beneficiary). If the

benefits are for a minor child, this will be the child’s SSN. This is never the representative payee’s

SSN.

Daytime Telephone Number of the person to contact if there are questions regarding the

enrollment information provided on the form.

Bank or Credit Union Information

Depositor’s account title must include the name of the person authorized to receive the payment,

(e.g. representative payee if applicable), and an account type (either Checking or Savings).

The 9-digit routing number is a 9-digit number used to denote which financial institution will

receive the deposit.

Account Numbers may be up to 17 characters long. It may contain both numeric 0-9 and alphabetic

characters A to Z.

Type of Payment

(check only one box)

The a

ppropriate box should be checked. Refer to the examples that follow to determine how to

identify the appropriate payment type

Note: You must use a separate form for each payment type or individual that is being enrolled.

For payment types not listed on the FS Form 1200 please refer to the next section, Direct Deposit

Sign-up Form (FS Form 1199A) for instruction on submitting enrollments for other payment types.

Either a claim number or check number is required.

Claim number is an identifying number assigned by the paying agency to the benefit recipient. In many

cases, this is the SSN the benefits are drawn upon followed by a series of letters or letters and numbers.

For some agencies this may be a unique number that does not use the SSN. Claim numbers can

typically be found on award letters issued by the paying agency, correspondence sent by the agency, or

year-end tax statements.

Check number is the 12-digit check number of the recipient’s most recent benefit payment.

1. Enrollment

Green Book

A Guide to Federal Government ACH Payments

1-13

The check number is located in the upper right-hand corner of the check. It is formatted as 4-digits a

space and then 8-digits. (example: 2053 87654321)

Dollar amount of most recent benefit payment is required.

When Us

ing Witnesses

When witnesses are used, they should sign to the right of the mark “X” and print the word

“Witness” above their signature.

Power-of-A

ttorney

A person appointed as a power-of-attorney cannot sign the FS Form 1200 for the payee. The FS

Form 1200 can only be signed by the designated recipient or a representative payee. Questions

regarding this item should be directed to the appropriate federal agency.

Agency I Payment Type

Recipient

Federal Housing Administration

Debentures (Fiscal Service)

The Federal Housing Administration (FHA) issues these

debentures in settlement of defaulted mortgages. For more

information, recipients should contact Housing and Urban

Development at (202) 708- 3423, or write to:

HUD

451 7th Street, SW

Washington, DC 20410

Attn: multi-family or single-family claims

Series H/HH Savings Bond

Interest Payments (Fiscal

Service)

Completes PD F 5396. Recipients should visit the

TreasuryDirect website to download the form or contact:

Bureau of the Fiscal Service

Treasury Retail Securities Services

P.O. Box 9150

Minneapolis, MN 55480-9150

Note: Only send completed FS Form 1199A forms to the federal agency responsible for issuing the

payment. The U.S. Treasury Electronic Payment Solution Center is unable to process the FS Form

1199A form and will be forced to reject them.

1. Enrollment

Green Book

1-14

A Guide to Federal Government ACH Payments

SSA – Single Payee Example

Example 1:

Social Security

Administration

Single Payee

1. Enrollment

Green Book

A Guide to Federal Government ACH Payments

1-15

SSA– Representative Payee Example

Example 2:

Social Security

Administration

Representative

Payee

1. Enrollment

Green Book

1-16

A Guide to Federal Government ACH Payments

D: Direct Deposit Sign-Up Form (FS Form 1199A)

A Direct Deposit Sign-Up Form (FS Form 1199A) is available in Chapter 9, Forms.

How to Complete the FS Form 1199A

Section 1- To be completed by the payee

The financial institution should verify that all information on this portion of the form is correct.

The financial institution needs to be aware of the following special items:

Name of the Person(s) Entitled to Payment (Box B)

This will be the name of the payee. Refer to the appropriate federal agency examples to determine

what information to enter for recurring benefit payments.

Claim or Payroll ID Number (Box C)

Claim numbers may be found on documents provided by the recipient’s paying agency(s) such as:

award letters, yearly tax statements, or general correspondence.

Claim Number Prefix

A claim number prefix is one or more letters preceding the claim number. These characters indicate

the type of claim for which benefits are being paid. For an explanation of the meaning of a prefix,

contact the federal agency authorizing the payment.

Claim Number

A claim number identifies the recipient’s records at the federal agency that authorizes the payment.

Claim Number Suffix

A claim number suffix is one or more characters (letters or numbers) following a claim number.

These characters indicate the payment type or the payee’s relationship to the individual who the

benefits are being drawn. For a full explanation of a suffix, contact the federal agency authorizing

the payment.

Example:

VA Compensation, Pension and Education. .123-45-6789 00

1. Enrollment

Green Book

A Guide to Federal Government ACH Payments

1-17

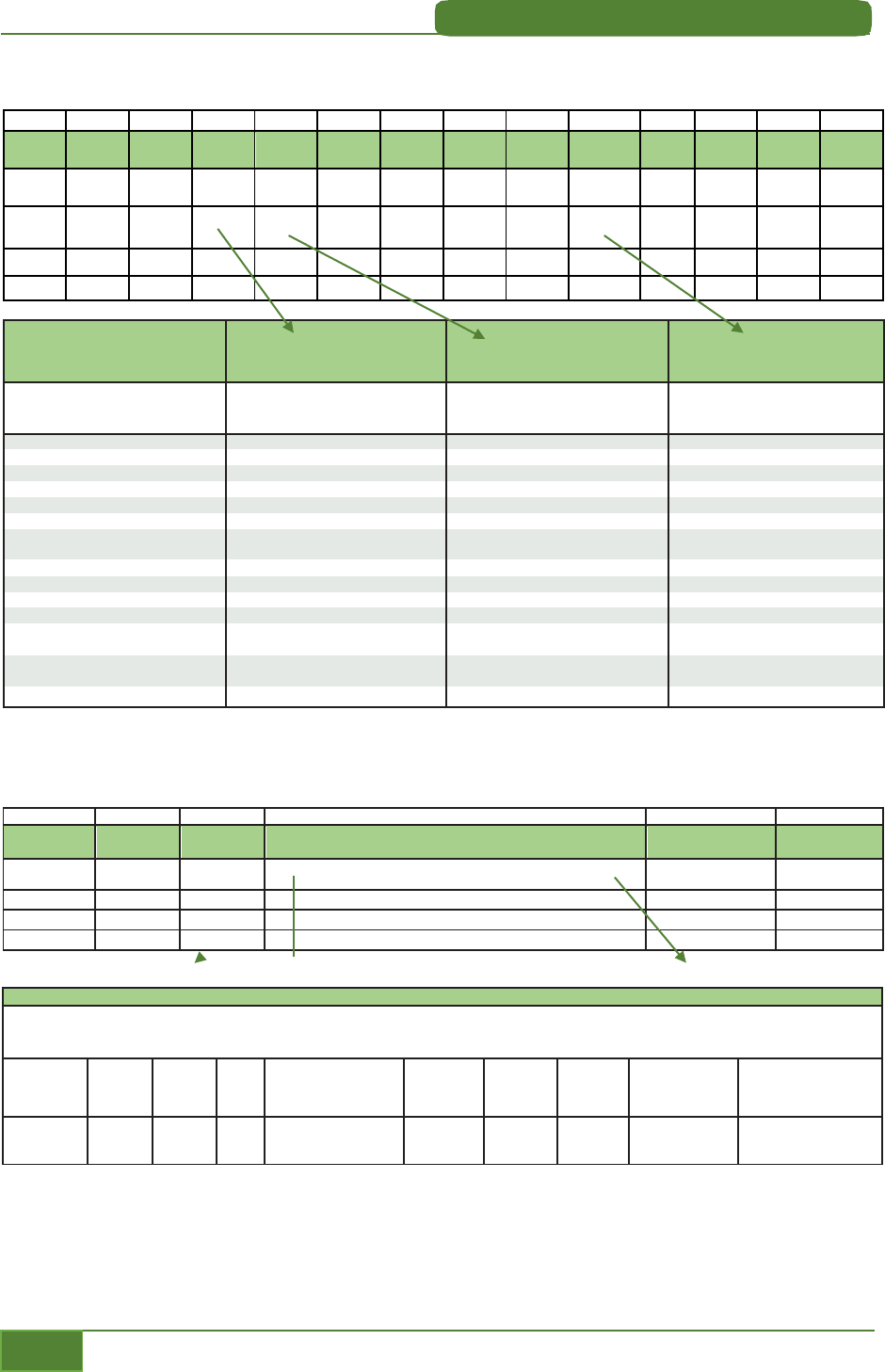

Claim/Payroll ID Table

The table below highlights what to enter on the FS Form 1199A for the Claim or Payroll ID Number

(BOX C) for the various payment types.

Payment Type Prefix Claim Number Suffix

Allotments (Savings and

Discretionary)

Leave Blank

SSN or Payroll ID Number

Leave Blank

Black Lung

(Department of Labor)

Leave Blank

SSN

2 characters

following the SSN

Central Intelligence Agency

/Annuity

Leave Blank

SSN

Leave Blank

Federal Employee

Workers’ Compensation

(Department of Labor)

Leave Blank

Case number assigned by

the federal agency

Leave Blank

Federal Salary/Military

Civilian Pay

Leave Blank

SSN or Payroll ID Number

Leave Blank

Longshore and Harbor

Workers’ Compensation

(Department of Labor)

Leave Blank

File number assigned by

the federal agency

Leave Blank

Military Active Duty and

Allotments

Leave Blank

SSN

Leave Blank

Military Retirement and

Annuity

Leave Blank

SSN

Leave Blank

Miner’s Benefit

(Department of Labor)

Leave Blank

SSN

Leave Blank

Savings Bond Agency’s Fee

(Fiscal Service)

Leave Blank

Issuing or paying agency

code assigned to the

financial institution

1- or 2-digit number

following the SSN

Series H/HH Savings Bond

Interest Payments (Fiscal

Service)

Leave Blank

SSN

Leave Blank

Veterans Compensation,

Pension or Education

Leave Blank

8-digit or 9-digit SSN

Always a 2-digit

number

Veterans Life Insurance

1 to 2 letters

4- to 8-digit number

None or a 2-digit

number

Depositor Account Number (Box E)

•

If account numbers are not used, then insert name or other identification in the box.

•

Use only letters A-Z and digits 0-9

•

Up to 17 characters

1. Enrollment

Green Book

1-18

A Guide to Federal Government ACH Payments

Type of Payment (Box F)

The appropriate box should be checked

If payment type is not included in the list, then check “Other” and enter the payment type in the

blank.

For military payments, enter the name of the military branch in the blank next to the payment type

checked.

Payee/Joint Payee Certification (Box F)

IF...

THEN...

there is only one payee, who could be a

representative payee*

only the payee signature is required

joint payees complete the form

both must sign the form

the payee’s signature is made be a mark “X”

it must be witnessed by two persons who sign and

date the form.

* See Glossary, Chapter 8

Joint Account Holders’ Certification (Optional)

Federal agencies do not require signatures in this block; however, some financial institutions do.

If the signature is made by a mark “X”, it must be witnessed by two persons who sign and date the

form.

When Using Witnesses

When witnesses are used, they should sign to the right of the mark “X” and print the word

“Witness” above their signature.

Power-of-Attorney

A person appointed as a power-of-attorney by the court cannot sign the FS Form 1199A for the

payee. The FS Form 1199A can only be signed by the designated recipient or a representative

payee. Questions regarding this item should be directed to the appropriate federal agency.

Section 2 - To Be Completed by the Payee or the Financial Institution

The financial institution should verify that the name and address of the federal agency that

authorized the payment is used.

For a listing of addresses, refer to Chapter 7, Contacts.

Note: Do not send enrollment forms to Fiscal Service. Fiscal Service does not process enrollment forms

except for its own employees.

1. Enrollment

Green Book

A Guide to Federal Government ACH Payments

1-19

Section 3 - To Be Completed by the Financial Institution

ENTER the...

•

financial institution’s name and address

•

financial institution’s routing number

•

depositor’s account title

(this title must include the name of the person authorized to receive the payment)

•

financial institution representative’s name, signature, telephone number, and current date.

What Actions Should Take Place Before Filing the FS Form 1199A?

This checklist can be used to verify that all information entered on the enrollment form is complete

and accurate.

❑

Name of person(s) entitled to payment*

❑

Claim or payroll ID table*

❑

Type of depositor account

❑

Account number

❑

Type of payment

❑

Proper signatures

❑

Federal agency name and address*

❑

Name and address of financial institution

❑

RTN and check digit

❑

Depositor account title*

Make sure it includes the name of the person authorized to receive the payment

Note: Make sure the federal agency that authorizes the payment is entered, not the Fiscal Service.

Note: Items marked with an asterisk (*) are where most errors occur.

Important Information for New Direct Deposit Recipients

1.

The financial institution should inform the recipient that they will continue to receive checks or

deposits at their current payment address of record until the Direct Deposit enrollment is

processed.

2.

The financial institution should inform the recipient on how to verify receipt of a Direct Deposit

payment.

3.

The financial institution should inform the recipient to notify the federal agency of any address

changes after Direct Deposit begins, since important information about the payment will be sent

to the individual’s home address.

4.

The financial institution should inform the recipient that it is important to notify both the federal

agency and the financial institution if the recipient or beneficiary dies or becomes legally

incapacitated. (Legal Incapacity is defined as a legal declaration that an individual is unable to

m

anage his/her affairs properly)

1. Enrollment

Green Book

1-20

A Guide to Federal Government ACH Payments

5.

The financial institution should inform the recipient that if they change financial institutions, the

old account should not be closed until Direct Deposit begins into the new account. Make sure the

recipient understands that changing financial institutions requires filling out a new Direct

Deposit enrollment.

How Are Forms Distributed?

Government Agency Copy

Delivered by the employee to the federal agency that authorizes the payment.

Financial Institution Copy

Held by the financial institution

There is no official retention period for the FS Form 1199A. It is recommended that financial institutions

retain this form at least until receipt of the first payment.

Payee(s) Copy

Held by the recipient.

What to do if Direct Deposit does not begin

Follow these steps if Direct Deposit does not begin within the specified time period.

1

Ask recipient if the enrollment authorization has been revoked.

If yes, no further action is required.

If no, and Direct Deposit is still desired, go to Step 2.

2

Make a copy of the completed enrollment form from the financial institution’s file copy.

Note: Verify that all the information on the form is correct.

3

Send a copy of the form and a letter stating that the recipient still wants to receive Direct

Deposit to the federal agency that authorizes the payment.

4

Remind recipient(s) that checks will continue to be sent to their home address of record until

Direct Deposit begins.

1. Enrollment

Green Book

A Guide to Federal Government ACH Payments

1-21

FS Form 1199A Example

Example 1:

Social Security

Administration

Single Payee

1. Enrollment

Green Book

1-22

A Guide to Federal Government ACH Payments

E: Federal Financial EDI (FEDI) Payments/Vendor Payments

Overview

Federal payments made using Financial Electronic Data Interchange (FEDI), the electronic transfer

of funds and payment-related information. The federal government uses FEDI for payments it

makes to businesses, which provide goods and services to federal agencies, and other payment

recipients.

Provisions of the Debt Collection Improvement Act of 1996 require that the majority of federal

payments be made by Electronic Funds Transfer (EFT). These payments include corporate

payments to companies providing goods or services to the federal government. This requirement

impacts every federal government vendor regardless of the size of the company or the goods or

services provided.

The federal government currently uses the two Nacha corporate payment formats for vendor

payments. These formats are:

•

CCD+ for single invoice payments. Contains one optional 80-character addenda record for

transmitting the invoice information.

•

CTX for single or multiple payments. Allows for 9,999 optional addends records, each carrying

80-characters, for the consolidation of multiple invoices in one payment.

Delivery of Remittance (Addenda) Information

The Nacha Operating Rules & Guidelines address the delivery of remittance information contained

in the addenda record. At the recipient’s request, financial institutions must provide the remittance

information by the opening of business on the second banking day following the settlement date of

the entry. This impacts all financial institutions processing ACH payments. The remittance

information may be provided via a paper report, fax, e-mail, electronic transmission, or any other

means negotiated between the recipient and the financial institution.

To perform this key role, it is imperative that the financial institution work closely with its

corporate customers who may have business relationships with the federal government. The

following issues should be discussed with your corporate customers:

•

How to deliver the remittance information to the customer,

•

When to deliver the remittance information to the customer,

•

What specific information to provide to the customer, and

•

What fees, if any, are associated with this service.

Enrollment

The ACH Vendor/Miscellaneous Payment Enrollment Form (SF 3881) is an optional three-part

form that federal agencies may use to enroll their vendors in the FEDI program. Federal agencies

will stock the form and provide the form to vendors to initiate the enrollment process. Federal

agencies will discuss with the vendor the ACH payment format (CCD+ or CTX) to be used to

transmit the payment. They will also work with the vendor to determine the remittance

information (e.g., the invoice number, discount terms) to be included in the addenda record.

1. Enrollment

Green Book

A Guide to Federal Government ACH Payments

1-23

The ACH Vendor/Miscellaneous Payment Enrollment Form (SF 3881) is available in Chapter 9,

Forms.

Enrollment Checklist

Use this checklist to assist the financial institution in enrolling a vendor in the FEDI program.

❑

Verify that the ACH format selected in the Agency Information section on the SF 3881 can be

accepted and processed by the financial institution Agree on HOW and WHEN remittance

information (e.g., invoice number) provided by the federal agency in the addenda record

will be passed to the vendor once it is received by the financial institution.

Not

e: The agreement is reached by analyzing recipient requirements and comparing those

requirements against the level of support the institution can provide.

❑

Provide an example of how the addenda information will appear; or,

Explain what type(s) of information to look for when the addenda information is received.

Not

e: The vendor must be able to understand the information to properly identify the

payment.

❑

Complete the financial institution Information section of the SF 3881.

How to Complete the SF 3881

Agency Information

The Agency Information section of the form is completed by the federal agency.

Payee/Company Information

The Payee/Company Information of the form is completed by the vendor or the financial

institution.

Financial Institution Information

The Financial Institution Information section of the form can be completed by the financial

institution as follows:

•

the name and address of the financial institution,

•

the name and telephone number of the ACH contact,

•

the RTN used to receive ACH payments,

•

the depositor account title,

•

the depositor account number, lockbox number (if applicable),

•

an “X” in the appropriate type of account box, and

•

the signature, title, and telephone number of the financial institution representative.

1. Enrollment

Green Book

1-24

A Guide to Federal Government ACH Payments

Form Distribution

The vendor will return the original SF 3881 to the federal agency. The financial institution and

the vendor each keep one copy of the form.

Pointers for Completing the SF 3881 Form

Additional Pointers:

•

The federal agency initiates the SF 3881 form to enroll its vendors to receive payment by

electronic funds transfer (EFT),

•

A vendor must complete a separate enrollment form (SF 3881) for each agency with which it

does business,

•

In the Agency Information Section, the term “AGENCY IDENTIFIER” means the acronym by

which the agency is known. For example, the “AGENCY IDENTIFIER” for the Bureau of the Fiscal

Service is Fiscal Service,

•

In the Payee/Company Information Section, it should be noted that the “TAXPAYER ID NO.” may

be used by the government to collect and report on any delinquent amounts arising out of the

offeror’s relationship with the government (31 U.S.C. 7701(c)(3)),

•

The financial institution and the vendor should each keep a copy of the completed form, and

•

The vendor should return the completed SF 3881 to the agency that initiated the form.

F: Enrollment Guidance

This section of the Green Book is a helpful tool for financial institutions who are trying to understand

the differences between the Nacha Operating Rules and the rules specifically for federal government

payments. Use this guidance in conjunction with the ACH Standard Entry Class Code ENR to enroll

recipients of federal benefit payments for Direct Deposit. It can be used to for the following payments:

Social Security; SSI; Veterans compensation and pension, education MGIB, education/selected reserve,

life insurance and vocational rehabilitation and employment benefits; Civil Service retirement and

survivor annuity; Railroad Retirement annuity and unemployment/sickness.

The ACH Standard Entry Class Code ENR is an enrollment process that allows financial institutions

to use the ACH to enroll beneficiaries for the receipt of future Direct Deposit payments.

Enrollments received and accepted by the paying agency at least 10 business days prior to the

customer’s next scheduled payment date will generally allow the recipient’s next month’s payment

by Direct Deposit.

The ENR Standard Entry Class is a no

n-monetary transaction. It must contain at least one

addendum record and may contain as many as 9,999 addenda records. There are two conditions

that must exist for multiple addenda to be included with one ENR.

1.

All Direct Deposit enrollments must be for the same federal agency benefit program. For

example, enrollments for Veterans benefits cannot be combined with Social Security benefits.

2.

Third-party processors that transmit ENR entries on behalf of financial institutions must make a

discrete batch transmission for each financial institution. Addenda records pertaining to one

financial institution should not be included under the same ENR entry as addenda records

pertaining to another financial institution’s Direct Deposit enrollments.

1. Enrollment

Green Book

A Guide to Federal Government ACH Payments

1-25

An ENR should be used when the recipient is requesting to initiate Direct Deposit for their federal

benefits. This may include but is not limited to a first-time sign-up for Direct Deposit, a change to

an existing Direct Deposit enrollment, or a change to a new financial institution. It is not to be used

in place of the Notification of Change (NOC) process to change the routing or account numbers for

existing records. Financial institutions should remind customers of the importance of reporting

address changes to the benefit program agency.

1. Enrollment

Green Book

1-26

A Guide to Federal Government ACH Payments

Approved OMB No. 0960-0564

Required Enrollment Information

The following information is required for the enrollment of a recipient in Direct Deposit using the Standard Entry Class

Code ENR. This information will be transmitted in the entry detail and the addenda record of an ENR transaction. This

page may be duplicated and used for data collection. DO NOT mail this sheet to the agency. All information collected must

refer to the individual who receives the federal benefit payment.

Information obtained from the customer (payment recipient) for inclusion in the entry detail record.

Type of payment:

(Social Security; SSI; Veterans compensation and pension, education MGIB, education/selected

reserve, life insurance and vocational rehabilitation and employment benefits; Civil Service

retirement and survivor annuity; Railroad Retirement annuity and unemployment/sickness)

Information obtained from the customer regarding the payment recipient for inclusion in the Addenda record.

Benefit Recipient’s Social Security Number (SSN) SSN ___ ___ ___ ___ ___ ___ ___ ___ ___

(Do not include hyphens in the addenda record.)

The recipient’s own SSN may or may not be the SSN on which the benefits are drawn. However, the individual recipient’s SSN will always

be included on the addenda record. In cases such as minor children the SSN will always be the Child’s SSN and not that of the adult

account holder named on the financial institution’s records.

Benefit Recipient’s Name

___ ___ ___ ___ ___ ___ ___ ___ ___ ___ ___ ___ ___ ___ ___ ___ ___ ___ ___ ___ ___ ___

Last name (up to 15 positions) First Name (up to 7 positions)

Last name: This is the recipient’s last name excluding any suffixes such as Jr., Sr. II, III, etc. If the last name is hyphenated, the fully

hyphenated name up to 17 characters is submitted.

If the last name is comprised of two or more ‘parts’, generally, the first part is sent as the last name (i.e. Mary Jane S Public Doe). The last

name would be submitted as “PUBLIC” and the Doe would be excluded.

First name: This is the recipient’s first name excluding any prefixes such as Dr., Mrs., Miss, etc.

Middle initials are not submitted in this field. Middle initials are dropped. However, fully spelled out middle names are included as part of

the first name (i.e. Mary J Doe would be submitted as Mary, whereas, Mary Jane Doe would be submitted as Mary Jane.

The ‘parsed’ name will always be

submitted exactly as the parsed section appears on the recipient’s benefit check. Therefore, incorrectly

spelled or spaced items will be submitted as they appear on the check and not as they should be legally spelled. Example: Janie Ann Doe

is trying to enroll; however, her check is printed Jane E A Doe. The enrollment would be submitted as “Jane” and “Doe”.

Representative Payee indication NO (0)(Zero) Yes (1)

(See section on Representative Payee, page 1-33.)

Information obtained at the financial institution.

Depository F

inancial Institution routing number RTN Check Digit

Depositor Account Number __ __ __ __ __ __ __ __ __ __ __ __ __ __ __ __ __ __ __ __ __ __

(Up to 17 positions)

Transaction Type: Checking (Type Code 22) Savings (Type Code 32)

For questions about submitting

ENRs for a specific benefit payment,

please call the corresponding federal

program agency:

Federal Agency Telephone No.

Social Security Administration (for Social Security benefit

or disability and SSI payments)

(215) 597-1134

Office of Personnel Management (Civil Service annuity) (202) 606-0540

Railroad Retirement Board (RRB annuity) (312) 751-4704

Department of Veterans Affairs (VA benefits) (918) 687-2532

1. Enrollment

Green Book

A Guide to Federal Government ACH Payments

1-27

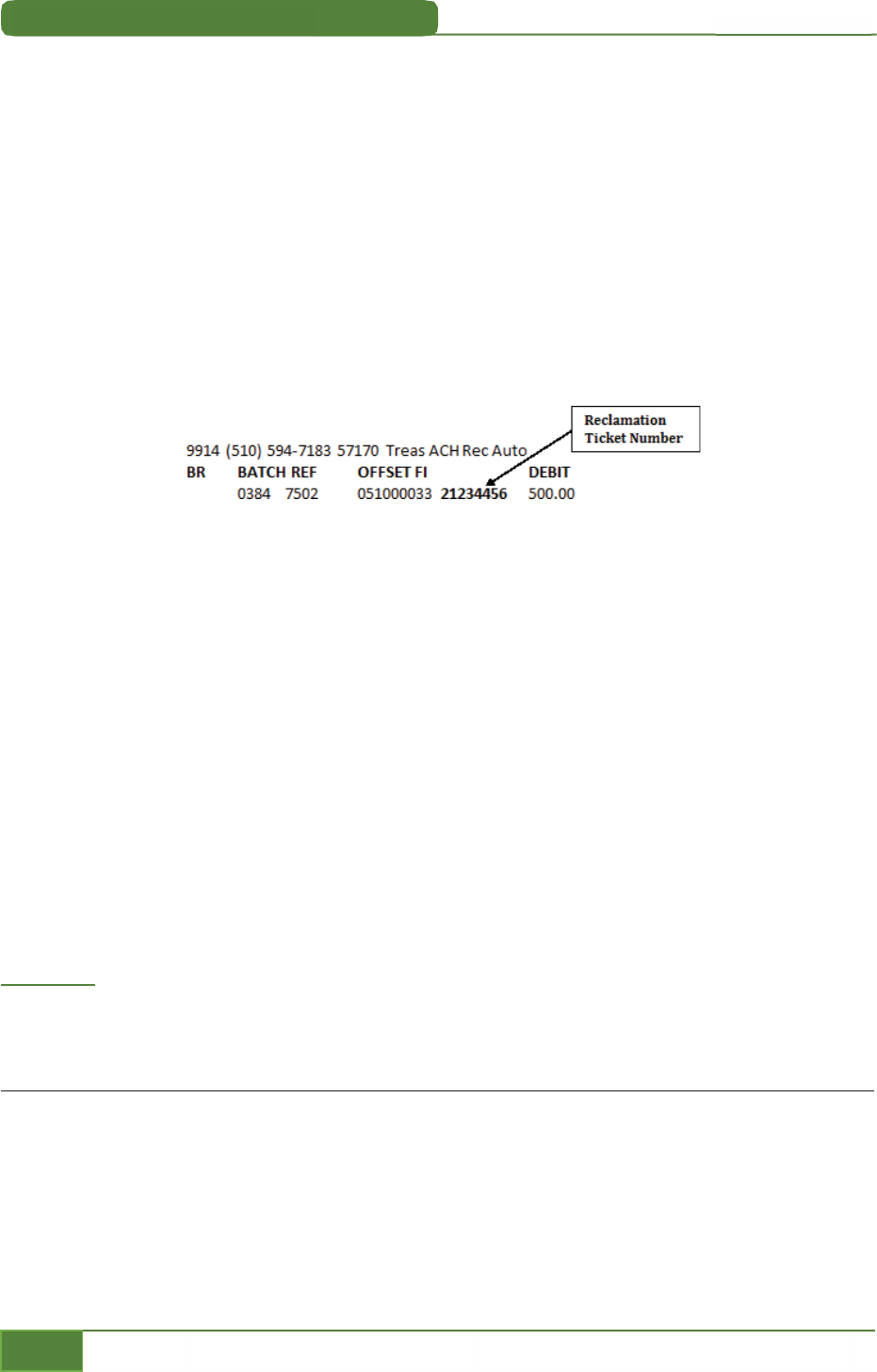

ENR (Automated Enrollment) Entry Detail Record

Field

1

2

3

4

5

6

7

8

9

10 11 12 13

Data

Element

Name

Record Type

Code

Transaction

Code

Receiving DFI

Identification

Check Digit

DFI Account

Number

Amount

Identification

Number

No. of

Addenda

Records

Receiving

Company

Name/ID

Reserved

Discretionary

Data

Field

Incursion

Requirement

M

M

M

M

R

M

O

M

R

N/A

O

M

M

Contents ‘6’ (numeric)*

(TTTTAAAA)

(numeric)

(blanks)** (all zeros) (blanks) (numeric)

(alphanumeric)

(blanks)** (blanks)** (numeric) (numeric)

Length

1

2

8

1

17

10 15

4

16

2

2

1

15

Position 01-01 02-03 04-11

12-12

13-29 30-39 40-54 55-58 59-74 76-76 77-78 79-79 80-94

*For U.S. Government use either 23 or 33 in Field 2 ** leave blank for Alphanumeric fields 5, 7,10,11

Program Payment

Field 3

Receiving DFI Routing and

Transit Number (RTN)

Field 4 Check

Digit (9

th

digit of

DFI RTN)

Field 9

Receiving Company Name/ID

The following program payments are

eligible for the enrollment service

Use the following DFI Identification

number for the corresponding program

payment

Use the following number for the

corresponding program payment

Use the following codes for the

corresponding program for which the

recipient is enrolling for Direct Deposit

Social Security

65506004

2

SOCIALbSECURITYb

Supplemental Social Security

65506004

2

SUPPbSECURITYbbb

Veterans Compensation and Pension

11173699

1

VAbCOMP/PENSION

Veterans Education MGIB

11173699

1

VAbEDUCATNbMGIB

Veterans Education/Selected Reserve

11173699

1

VAbECUDbMGIB/SR

Veterans Life Insurance

11173699

1

VAbLIFEbINSUR

Veterans Vocational Rehabilitation

and Employment Benefits

11173699

1

VAbVOCbREHABbEMP

Civil Service Retirement/Annuity 11173699

1

CIVILbSERVbCSAbb

Civil Service Survivor/Annuity

11173699

1

CIVILbSERVbCSFbb

Railroad Retirement Annuity

11173699(*)

1 (*)

RAILROADbRETbBDb

Railroad Unemployment/Sickness

11173699(*)

1 (*)

RAILROADbUISIbbb

Dependents Education Assistance

Program

11173699

1

VAbDEPbEDUbASST

Reserve Education Assistance

Program

11173699

1

VAbEDUCTNbREAP

Post 911 GI Bill

11173699

1

VAbEDUbPOSTb9/11

ENR Addenda Record

NOTE: In the codes, the letter “b”

indicates a blank space

Field

1

2

3

4

5

Data Element

Name

Record Type

Code

Addenda Type

Code

Payment Related Information

Addenda Sequence

Number

Entry Detail

Sequence Number

Field Inclusion

Requirement

M M R M M

Contents

‘7’

‘05’

‘22*12200004*3*123987654321*777777777*DOE*JOHN*0\’

(numeric)

(numeric)

Length

1

2

80

4

7

Position 01-01 02-03

04-83

84-87 88-94

Field 3 - Payment Related Information

The

following uses sample information to illustrate the required information to be included in the Addenda record to effect the ENR for Direct Deposit. The standard for

submission

of

ENR records is for all alphabetic characters anywhere in the file to be submitted in UPPER CASE. Failure to do so may result in the submission to be returned by the paying

agency. Refer

to the next page for Return Reasons Codes.

22

=

Checking

Account

32 = Savings

Account

*

12200004

3

123987654321

777777777

DOE

JOHN

0= No Rep. Payee

1= Rep. Payee

\

Contents

Delimiter

‘05’

Check

Digit

Receiver’s Acct. No. at

the

FinancialInstitution

(up to 17 positions)

Receiver’s Own

Social Security

No.

Receiver’s

Surname

(up to 15)

Receiver’s

First Name

(up to 7)

Representative

Payee Indicator

Terminator

1. Enrollment

Green Book

1-28

A Guide to Federal Government ACH Payments

Representative Payee

A representative payee is a person or institution that is legally entitled to receive payments on

behalf of a beneficiary who has been deemed incapable of handling his/her financial affairs. When a

representative payee is present, both names will appear on the benefit check. Minor children

receiving federal benefits should always have a representative payee. Some examples of

representative check payee styles are:

Mary Smith for Jane R. Doe

Harry D. Doe, Guardian for John Q. Public

Admin Sunnyvale Nursing Home for Mary T. Resident

Questions regarding the styling of representative payee names by a particular agency should be

directed to that specific agency.

In processing an enrollment, it is important for the processing financial institution and enrolling

benefit agency to know that the enrollment originated from the proper authority. In cases where

there is a representative payee, a “1” will be entered as the last data element in Field 3 of the

addenda. In instances where there is no representative payee, a “0” (zero) will be entered into this

position.

The federal government requires that the title of accounts receiving direct deposit payments bear

the name of the payment recipient. Accounts established for representative payee payments reflect

fiduciary interest of the representative payee on behalf of the beneficiary. (Example of an account

title: John Doe for Mary Smith.) This same regulation applies to institutional representative payees.

The Department of Veterans Affairs and the Office of Personnel Management do not allow

ENR enrollments for representative payees.

Note: SSA’s Guide for Representative Payees

is

a helpful guide which covers account titling

requirements for their representative payees.

Return Reason Codes

A federal agency may return an ENR entry to the financial institution as unprocessable, one of the

following codes will be indicated on the return:

R40 Non-Participant in ENR Program

The federal program agency is not a participant in the ENR automated enrollment program.

R41 Invalid Transaction Code

An incorrect or inappropriate transaction code is used in Field 3 of the Addenda record.

R42 Routing Number/Check Digit Error

The RTN and/or the Check Digit included in Field 3 of the Addenda record is incorrect.

R43 Invalid DFI Account Number

The receiver’s account number at the DFI is either missing, exceeds 17 positions, or contains invalid

characters.

R44 Invalid Individual ID Number

The receiver’s SSN provided in Field 3 of the Addenda record does not match a corresponding SSN

in the benefit agency’s records.

R45 Invalid Individual Name

The name of the receiver provided in Field 3 of the Addenda record either does not match a

1. Enrollment

Green Book

A Guide to Federal Government ACH Payments

1-29

corresponding name in the benefit agency’s records or fails to include at least one alphanumeric

character.

R46 Invalid Representative Payee Indicator

The representative payee indicator code included in Field 3 of the Addenda record has been

omitted or it is not consistent with the benefit agency’s records.

R47 Duplicate Enrollment

The federal agency has received duplicate ENR entries from the same DFI.

For more complete information concerning return reason codes and their interpretation, refer to

the current Nacha Operating Rules & Guidelines.

Note: At least one paying agency requires that any alphabetic data in an ENR record must be

submitted in all UPPER CASE. Therefore, the de facto standard for submission of ENR records is for all

alphabetic characters located anywhere in the file to be submitted in UPPER CASE. Failure to do so

may result in the submission to be returned as an R44/R45 item even though all the information is

correct.

ENR Tips and Information Checklist

General Questions/Information:

1.

Are you currently receiving Direct Deposit?

•

If yes, then an ENR should be used when the recipient is requesting to initiate direct deposit

for their federal benefits. This may include but is not limited to a first-time sign-up for Direct

Deposit, a change to an existing Direct Deposit enrollment, or a change to a new financial

institution.

•

If no, do you have, or have you opened a checking or savings account?

2.

Is the federal benefit check in the customer’s name only? If no, determine whether there is a

representative payee relationship or not.

3.

The benefit recipient or representative payee must be present in order to sign up for direct

deposit. If by phone, the recipient or representative payee must be available to give permission.

Benefit Recipient Information

4.

Benefit recipient - the person who receives the federal benefit payment.

5.

Representative payee - the benefit comes in their name on behalf of someone else.

6.