A reference manual published

by the Education Section

DEPARTMENT OF BUSINESS AND INDUSTRY

REAL ESTATE DIVISION

TRUST FUND ACCOUNTING

AND RECORD KEEPING

FOR NEVADA BROKERS

STATE OF NEVADA

Carson City Office

1179 Fairview Drive, Suite E

Carson City, NV 89701-5405

Las Vegas Office

2501 E. Sahara Avenue, Suite 101

Las Vegas, NV 89104-4137

website: www.red.state.nv.us

email: [email protected].us

Rev. March, 2012 All rights reserved. Nevada Real Estate Division

4

th

Edition

Published March, 2012

This publication is made possible through

fees paid by real estate licensees into the

Education, Research and Recovery Fund

TABLE OF CONTENTS

Introduction ................................................................................................................ 1

What Constitutes Trust Funds? ....................................................................... 1

Who Holds Trust Funds? ................................................................................. 2

Written Contract Governs ................................................................................ 2

Broker Has Ownership Interest ....................................................................... 3

Establishing a Trust Account ..................................................................................... 3

Notify the Real Estate Division of Location ................................................... 4

Service Charges ............................................................................................... 4

Interest and Other Economic Benefits ............................................................ 4

Types of Funds and Accounts .................................................................................... 5

Company (Proprietary) Operating Funds ........................................................ 6

Company (Proprietary) Operating Accounts ................................................... 6

Client Funds .................................................................................................... 6

Broker Trust Accounts ..................................................................................... 6

Out of State Brokers ........................................................................................ 7

Custodial Client Accounts ............................................................................... 7

Handling Trust Funds ................................................................................................ 8

Timely Deposits ............................................................................................... 8

Accurate Accounting ....................................................................................... 8

Record Keeping ......................................................................................................... 9

Account Records ............................................................................................. 9

Required Records ............................................................................................ 9

Cash Receipts Journal .......................................................................... 9

Cash Disbursements Journal .............................................................. 10

Client’s Ledger .................................................................................... 10

Account Reconciliation ................................................................................. 10

Embezzlement ............................................................................................... 11

Accounting to Principals ............................................................................... 12

Unclaimed Money .......................................................................................... 12

Commingling and Conversion ................................................................................. 13

Audits and Inspections ............................................................................................. 14

Indexing and Numbering ............................................................................... 15

Inspection(s) and Transactions Files .............................................................. 15

Time Requirement for Record Keeping......................................................... 17

Property Management .............................................................................................. 17

Management Account Records ...................................................................... 18

Management Agreements .............................................................................. 18

Management Files .......................................................................................... 19

Personnel and Income Tax Reports ............................................................... 20

Individual Tenant/Lease Files ........................................................................ 20

Maintenance of Records ................................................................................ 20

Cash Journal ................................................................................................... 21

Owner’s Ledger ............................................................................................. 21

Tenant’s Ledger .............................................................................................. 21

Bank Statements and Checks ......................................................................... 22

Security and Other Tenant Deposits .............................................................. 22

Management Referrals ................................................................................... 23

Closing a Bank Account and/or Broker’s Office ..................................................... 23

Bankruptcy ..................................................................................................... 23

Closing an Office ........................................................................................... 23

Conclusion ................................................................................................................ 24

Appendix

Selected Sections from NRS 645 ................................................................... 25

Selected Sections from NAC 645 .................................................................. 28

Exhibits 1-10

Trust fund Accounting and Record Keeping for Nevada Brokers

Page 1

Trust Fund Accounting and Record Keeping for Brokers

INTRODUCTION

INTRODUCTION

INTRODUCTION

Proper accounting for trust funds and adequate record keeping are basic to the

management of a brokerage office and the legal responsibility of the broker. This

booklet will assist real estate brokers to understand the statutory and regulatory

requirements of Nevada’s license law for the handling of trust funds.

Failure of a real estate broker to manage properly or account for “funds

belonging to others” can result in license revocation whether that failure is one of

ignorance or negligence, whether intentional or unintentional. A broker’s

fiduciary responsibility makes the maintenance of adequate records necessary.

The broker is personally responsible for the supervision and maintenance of the

trust fund accounts and records. Neither delegation of duties, ignorance of daily

brokerage or management activities, nor failure to establish internal control

relieves the broker of the responsibility and potential liability that can result from

a failure to account adequately for money or maintain records.

Inadequate records or failure to maintain control of the trust funds can result in

internal theft, commingling of funds, misuse of trust funds, litigation and/or

disciplinary action. The use of an outside record keeping or accounting service

does not eliminate the need for broker supervision or substitute for the broker’s

fiduciary responsibility.

> WHAT CONSTITUTES TRUST FUNDS?

Provisions of Chapter 645 of Nevada Revised Statutes (NRS 645) and

Chapter 645 of Nevada Administrative Code (NAC 645) set forth the

responsibilities of real estate brokers with regard to record keeping and the

handling of trust funds.

Trust funds are money or things of value that are received by the broker or

salesperson on behalf of a principal, or client, or other person in the performance

of duties for which a real estate license is required, which are not the property of

the broker but are being held for the benefit of others.

Trust funds do not include money relating to any property in which the broker or

his/her personnel have an ownership interest. No matter how small the

percentage of ownership, the intermingling of these funds with those of clients

would constitute commingling. A separate bank account, not a trust account,

Trust fund Accounting and Record Keeping for Nevada Brokers

Page 2

may be established to hold funds for the broker/company owned properties.

> WHO HOLDS TRUST FUNDS?

A broker may hold money or things of value for the benefit of others for many

reasons. For example, earnest money deposits are funds held pending

consummation of a sale transaction. Funds are held as payment of final

settlement costs. In the property management field, a broker may keep security

and maintenance deposits on rental properties, may hold mortgage payments for

a client/principal, or may hold rents collected but not yet disbursed to the

property owner.

The money or things of value may include a check written to a title company or a

mortgage company, a personal note made payable to the seller, title to a motor

vehicle, jewelry or other personal property. The handling and safe keeping of all

of these must be accounted for in a broker’s internal records and to a broker’s

principal.

> WRITTEN CONTRACT GOVERNS

Proper accounting for money in a transaction begins with the written contract

between the seller and buyer, between the lessor/landlord and lessee/tenant, and

the broker and client. The broker must specify in the contract how trust funds are

to be held and where they are to be deposited.

Nevada brokers are not mandated by law to maintain a bank trust account,

however, they must account for all funds. A broker may instead deposit money

directly to escrow, if the contract so specifies. He/she may also pay funds

directly to the seller or landlord in a transaction if all persons having an interest

in the money agree in writing to that arrangement. Under any circumstance, the

broker is personally responsible and liable for the deposit at all times, even if the

funds were delivered directly to the seller or landlord to hold.

When depositing funds directly to an escrow account, the licensee may not

deposit to any escrow company in which he/she or anyone associated with him/

her in the real estate business has an interest unless proper disclosures are made.

A proper disclosure must be made in writing and state the interest the broker, or

member of his/her staff, has in that escrow company. Further, the disclosure

must be acknowledged by the parties to the transaction.

Trust fund Accounting and Record Keeping for Nevada Brokers

Page 3

> BROKER HAS OWNERSHIP INTEREST

In the event that any type of trust funds are received from a cooperating broker or

other third party regarding a property in which the broker/company has an

ownership interest, full disclosure of the interest held must be made and one of

the following procedures should be followed:

1. Place the funds in the cooperating broker’s trust account;

2. Obtain the informed consent from the other principal in the transaction,

thereby permitting the funds to be held by the broker/company acting as a

principal and not held “in trust”; or

3. Deposit the funds with an escrow or title company.

Even though the broker may deposit directly to escrow, without a deposit to the

trust account, he/she must maintain a record of what happened to those funds

while in his/her custody. Minimum documentation for that record is a copy of

the check and a receipt from the escrow agent which must be held in the

transaction file. It is suggested that the Cash Receipts Journal also have a

notation that the funds were received and delivered to escrow rather than

deposited into the broker’s trust account. The client ledger for the transaction

should record the disposition of the funds.

ESTABLISHING A TRUST ACCOUNT

ESTABLISHING A TRUST ACCOUNT

ESTABLISHING A TRUST ACCOUNT

The trust account must be established in a bank in the state of Nevada and clearly

identified as a trust account. The broker must be a trustee for the funds. The

only sole signatories acceptable on a trust account would be a broker or, in the

instance of a property management account, a designated property manager.

Dual signatories on the trust account may be employees of the broker,

salespersons licensed with the broker, or the designated property manager.

Whenever possible, the broker should use an employer’s tax identification

number instead of a personal social security number to establish a trust account.

Branch offices are not required to establish a trust account separate from the

home office trust account. But, if the broker does establish a trust account for the

branch, the branch manager or designated property manager of the branch office

must be a signer on that trust account.

Trust fund Accounting and Record Keeping for Nevada Brokers

Page 4

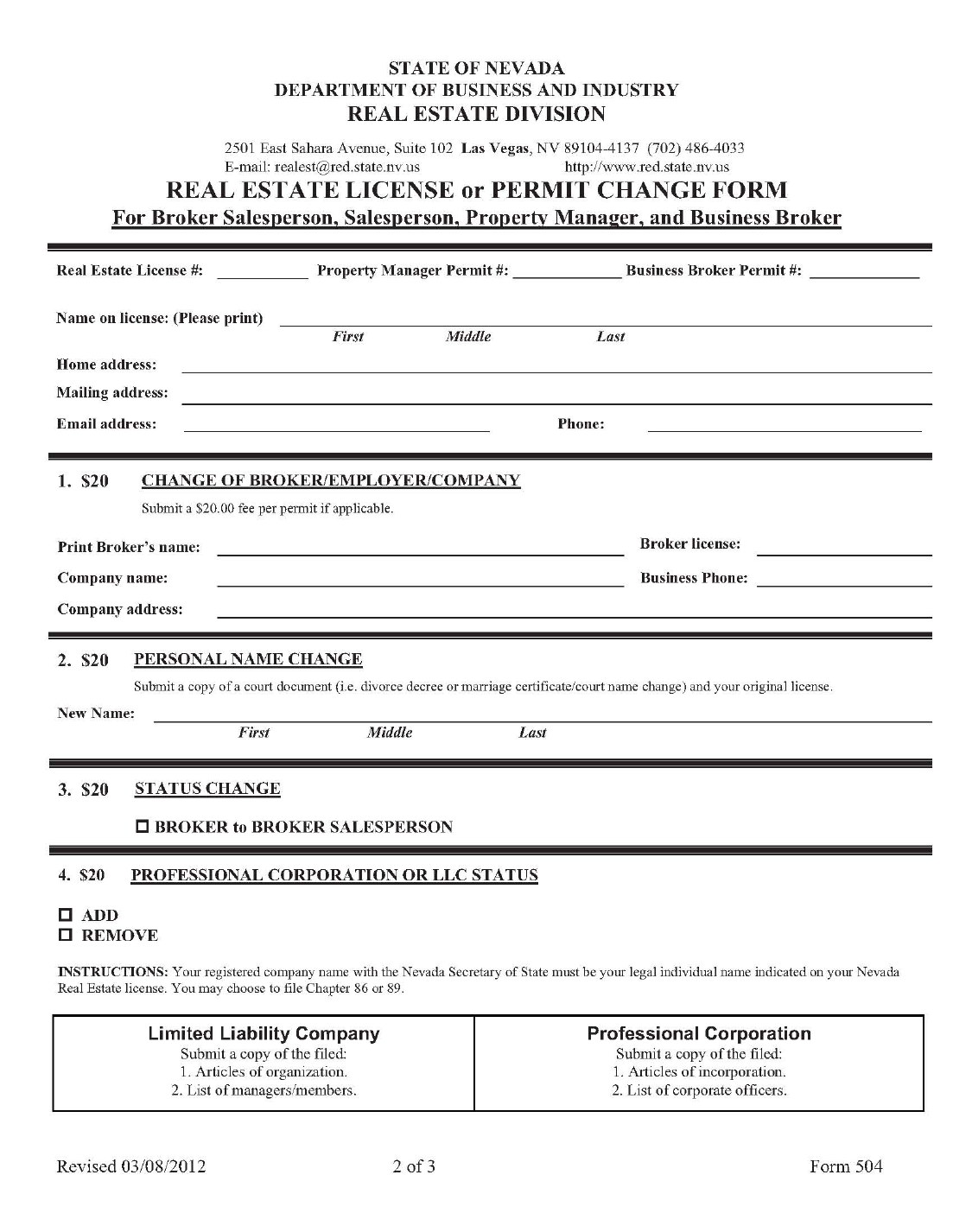

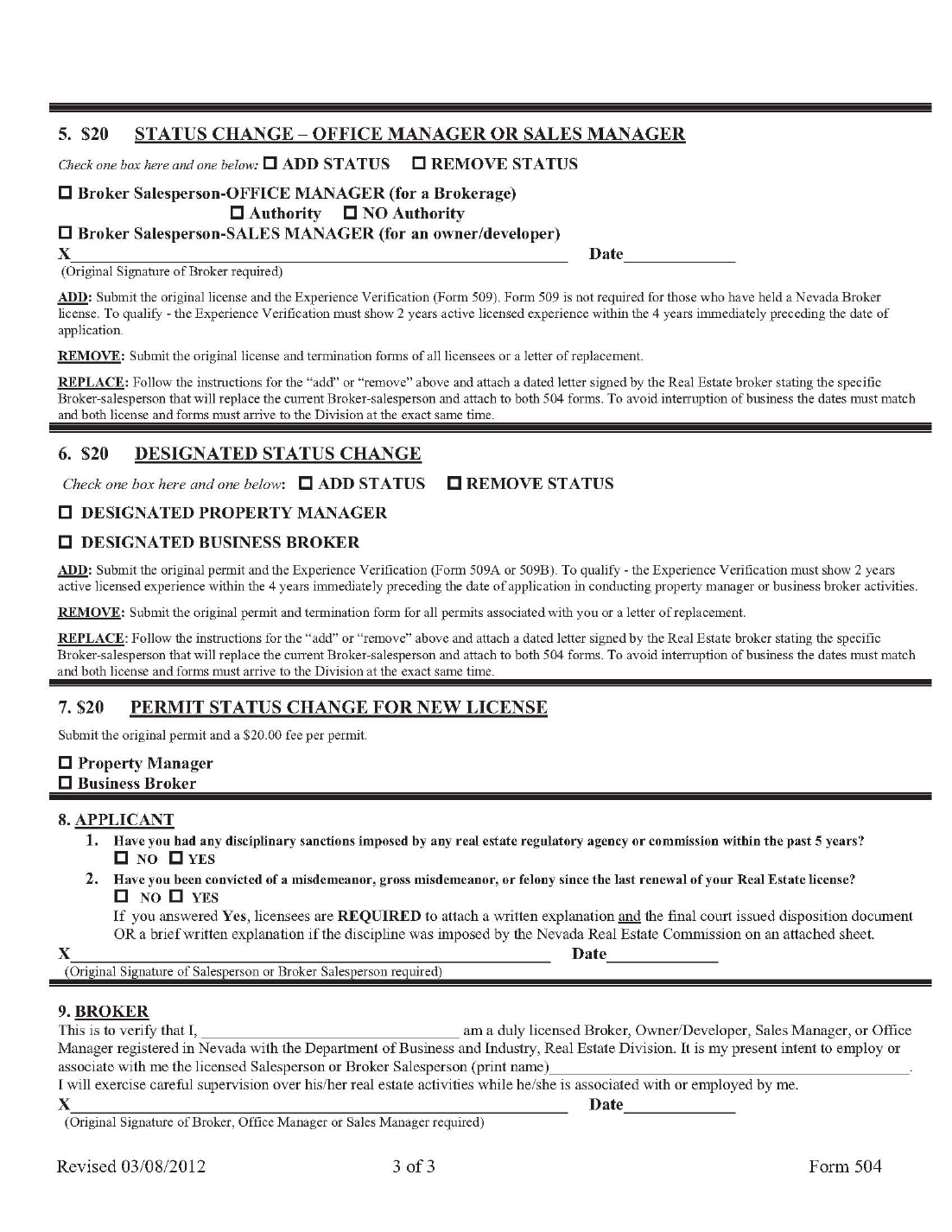

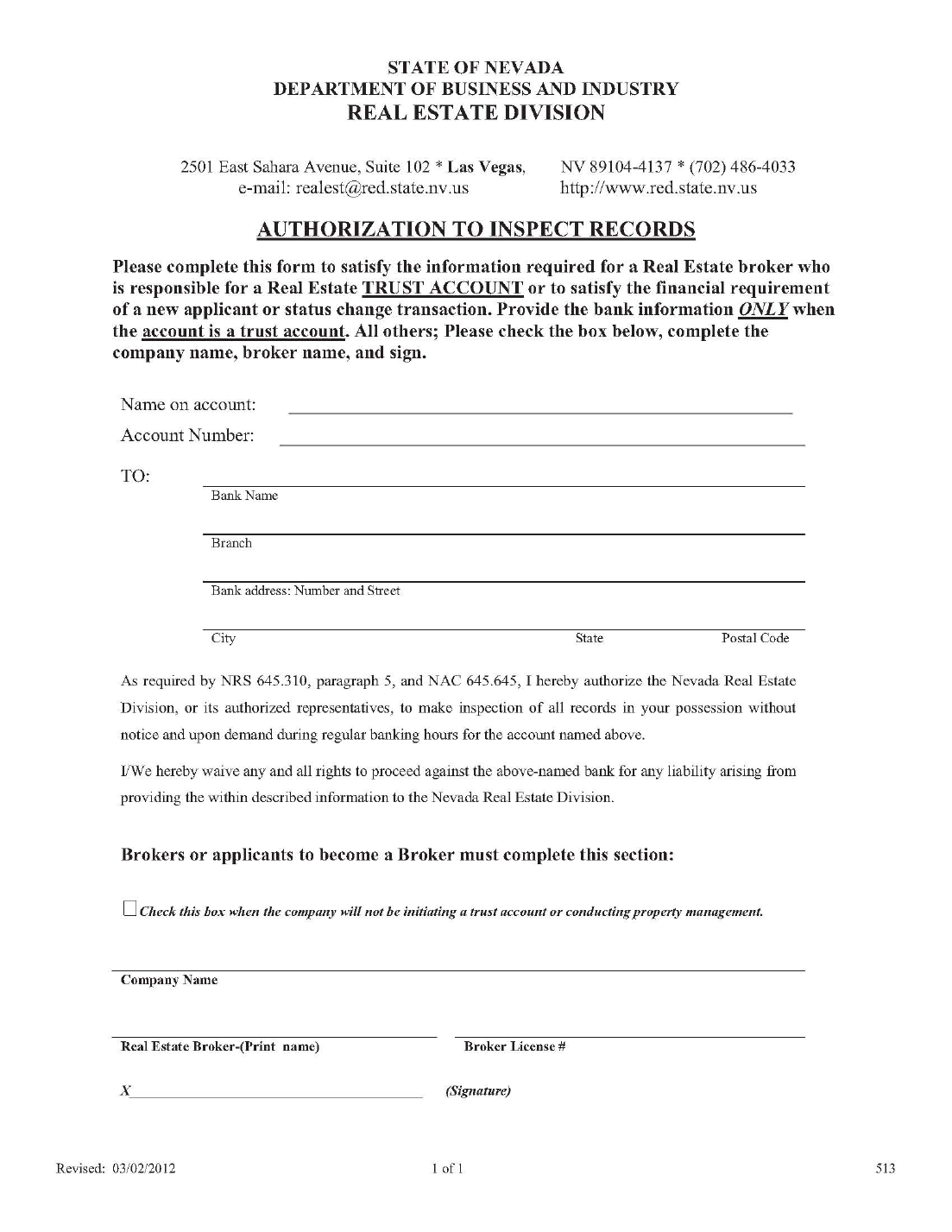

> NOTIFY THE DIVISION OF LOCATION OF TRUST ACCOUNT

Whenever a broker establishes a trust account, statutes require that he/she notify

the Division of the account number and the name and location of the depository.

Whenever a broker changes a trust account, or the broker’s bank changes name

and/or account number, the new account information must be supplied to the

Division. A form for these notices is available from the Division. The form is

also an authorization for properly identified Division representatives to inspect

the records of this account. NRS 645.310 and NAC 645.655.

A trust account must allow the broker to withdraw money from that account

without prior notice and without penalties for such withdrawals.

> SERVICE CHARGES

Because most financial institutions levy a service charge on a checking account,

the Nevada Real Estate Commission permits a broker to deposit adequate

personal funds to cover this charge. This minimal amount a broker is permitted

to deposit must be accounted for in the journals and ledgers in the same manner

as client funds but should be clearly identified as broker’s funds. Following this

procedure will not be considered commingling by the Division. The maximum

dollar amount of broker funds should not exceed $100.00.

> INTEREST AND OTHER ECONOMIC BENEFITS

Nevada law does not specifically address the establishment of interest-bearing

trust accounts to hold trust funds. Such accounts must be handled with extreme

caution because of prohibitions against commingling, conversion, breach of

fiduciary duty, and practical considerations.

Federal law generally prohibits financial institutions from paying interest on

commercial demand accounts. Interest may be paid on such accounts if the

entire beneficial interest in the account “is held by one or more individuals or by

an organization which is operated primarily for religious, philanthropic,

charitable, educational, political, or similar purposes and which is not operated

for profit”, or on deposits of public funds. See

12 United States Code, Sections

1828, 1832.

On the basis of this provision, several states have enacted legislation which

authorizes the payment of interest on real estate trust accounts to certain non-

Trust fund Accounting and Record Keeping for Nevada Brokers

Page 5

profit charitable organizations. Such authorization is typically limited to client

funds which are nominal in amount or held for a short period of time. Nevada

has not

enacted such legislation.

Since brokers are required to account for and remit client’s money “on demand”,

federal law will preclude the establishment of an interest-bearing trust account in

most situations. A discussion of the limited circumstances in which an interest-

bearing checking account may be established under federal law is beyond the

scope of this booklet.

Assuming one’s ability under federal banking law to establish an interest-bearing

trust account, additional considerations will limit or, as a practical matter,

preclude their use. There must be full disclosure and consent of the parties to the

transaction as to the disposition of any interest earned. This requires an

agreement between the broker and the parties as to who will receive interest and

how it will be remitted to the parties. If the broker is to benefit from any of the

interest earned, that money must be withdrawn from the account and separately

accounted for to prevent commingling. Such an arrangement may result in

income tax liability to the client under assignment of income rules. A tax expert

should therefore be consulted if the broker is to benefit from interest on trust

funds.

Accounting for and payment of interest must be done in accordance with the

broker/client agreement and done in a timely manner.

TYPES OF FUNDS AND ACCOUNTS

TYPES OF FUNDS AND ACCOUNTS

TYPES OF FUNDS AND ACCOUNTS

Any time that a real estate broker handles funds in his/her office there is a need to

identify the nature of the funds. All staff who handle funds in the office should

be adequately trained regarding how to distinguish the nature of the funds.

Funds can be of two types and can be placed in any of three types of bank

accounts.

The two types of funds are company funds and client funds. The three types of

bank accounts are company (proprietary) operating accounts, broker trust

accounts, and custodial client accounts.

Trust fund Accounting and Record Keeping for Nevada Brokers

Page 6

> COMPANY (PROPRIETARY) OPERATING FUNDS

Company funds are received for services rendered, such as brokerage

commissions, lease fees, property management fees, etc. These funds belong to

the company/broker and must always be maintained separately from client funds.

> COMPANY (PROPRIETARY) OPERATING ACCOUNTS

Company operating accounts are established in the name of the broker or

company and should be used to hold only broker or company funds. No client

funds should ever be deposited into these accounts. The bank records should

indicate that the account is owned by the broker or company and the records

should reflect that entity’s federal tax identification number.

> CLIENT FUNDS

Client funds are any funds received that are to be held for the benefit of a client.

Examples of client funds are earnest money deposits, security deposits, rent

receipts from management account tenants, etc. These funds MUST ALWAYS be

kept separate from company funds. Clerical or unlicensed staff may not be aware

of the distinction between the types of funds and so must be properly supervised

by the broker to avoid accidental commingling of company and client funds,

thereby placing the broker’s license in jeopardy.

> BROKER TRUST ACCOUNT

Broker’s trust accounts are established in the name of the company/broker but

must have the words “trust account” on the bank statement and on the printed

checks. The bank must clearly understand that funds in these accounts do not

belong to the broker’s company or the broker in order to eliminate the possibility

of attachment in the case of a judgment, IRS action, or other liability which may

arise to the company or broker. These accounts are used to hold client funds

only.

Trust fund Accounting and Record Keeping for Nevada Brokers

Page 7

> OUT OF STATE BROKERS

A broker licensed in another state and performing brokerage functions in the state

of Nevada under a Cooperative Broker Agreement will look to the cooperating

Nevada broker for an accounting of all money. Any money received in the

transaction shall be handled only by the Nevada broker.

> CUSTODIAL CLIENT ACCOUNTS

Custodial client accounts are bank accounts which are opened in the name of a

client and are primarily used for property management accounts. The name and

ownership of the account with the bank should be that of the client and should

show the broker only as the mailing address for statements and communications.

The client, as well as the broker, must be a signer on this type of account. If an

account holds client funds and does not have the client as a signer on the account,

it is by definition a trust account and must be treated as such.

When funds are received for a client for whom the broker is using a custodial

account, the funds are considered “trust funds” until they are actually deposited

into the custodial account at the bank. The broker has the same level of

responsibility for these funds before depositing as for any other trust funds.

Once they are deposited they are considered delivered to the client because the

client has access to the funds by his/her signature. Handling disbursements from

this type of account holds similar fiduciary responsibilities for the broker and

care must always be exercised.

There is some risk for a broker who uses a custodial account rather than a trust

account because the broker does not have exclusive control over the funds. Since

the client may withdraw funds without consent of the broker, the broker may

write checks on the account and discover that the client has withdrawn the funds

necessary to cover the checks, resulting in returned checks on the account. For

this reason brokers are urged to exercise great caution when using a custodial

account.

Trust fund Accounting and Record Keeping for Nevada Brokers

Page 8

HANDLING TRUST FUNDS

HANDLING TRUST FUNDS

HANDLING TRUST FUNDS

Handling client funds or “trust funds” is one of the most important

responsibilities that a real estate broker has. The broker’s attention to detail,

commitment to professionalism, personal and professional integrity, and ethical

conduct are all reflected in how trust funds are handled. Although the actual

processing of the administrative procedures may be delegated to staff or other

licensed broker/salespersons within the firm, the ultimate responsibility always

lies with the broker of record.

> TIMELY DEPOSITS

All trust funds are to be deposited in a timely manner, whether the funds were

received as part of a sale or lease negotiation or as a property management

function. Before the funds are actually deposited into a bank trust account, they

should be adequately secured in a locked cash box, locked filing cabinet, or other

secure location from where they are not likely to “disappear”. A broker should

have a clear office policy regarding the care of the trust funds from the time they

are received to the time they reach the bank. This policy should be carefully

monitored within the office.

Unless specifically stipulated otherwise in the written contract between the

parties to a transaction, a licensee who receives any type of trust funds on behalf

of a broker shall pay over those funds to that broker, or to the escrow company

designated in the contract, within one business day after receiving those funds.

NAC 645.657. When an offer to purchase ripens into a contract, or when the

broker receives funds related to a property management account, the broker

should deposit the trust funds into the broker’s trust account or deliver the funds

to the authorized escrow agent before the end of the next banking day. Holding

the trust funds beyond these deadlines is a violation of NRS 645 and NAC 645.

> ACCURATE ACCOUNTING

The real estate broker must maintain a sufficient “paper trail” regarding the trust

funds within his/her files so that at any future time a client, an auditor, or other

investigator can reconstruct what happened to the trust funds and when. Copies

of deposit receipts, along with a copy of the check, money order, or even a

photocopy of the cash if payment was made in cash, should be maintained in the

appropriate file. Accurate references on check book registers and trust account

Trust fund Accounting and Record Keeping for Nevada Brokers

Page 9

records regarding the identification of the parties and properties should be

maintained.

RECORD KEEPING

RECORD KEEPING

RECORD KEEPING

> ACCOUNT RECORDS

All trust account checks should be imprinted with sequential numbers and

deposit slips should be printed in duplicate with the name of the real estate

brokerage imprinted on them.

> REQUIRED RECORDS

The minimum records required for a broker’s trust account are:

- Cash receipts journal;

- Cash disbursements journal or an itemized check stub;

- Client ledger or sub-ledgers if using a consolidated trust account;

- Transaction files, numbered or indexed;

- Bank account statements and checks.

The broker must keep a record of all of the money that is received by him/her,

whether for deposit to the trust account, or for deposit directly to escrow. This

record must show:

- The date and amount of money that was received;

- The date and amount of money that was deposited;

- The dates and amounts of all withdrawals;

- Parties for whom the deposit or withdrawal was made;

- To whom the money belongs.

A cash receipts journal is the diary, or daily chronological record, of trust funds

(things of value) received for the benefit of another. This journal is used to

record the date of receipt, the amount of money or value received, and the form

of funds received (i.e., cash, check, note, etc). It also records from whom

received, for whom received, property identification, and transaction file number

Trust fund Accounting and Record Keeping for Nevada Brokers

Page 10

(see exhibit #1).

If the funds were not deposited to the broker’s trust account, the cash receipts

journal should record the location of the funds or assets.

A cash disbursements journal, like the check stubs or check register, is used to

keep track of all disbursements. It must show the date and amount of

disbursement, to whom the money was paid, on whose behalf it was paid, the

transaction file number, and the resulting balance.

Depending upon the bookkeeping used, the cash receipts and cash disbursements

journals may be combined into one journal (exhibit #1). The cash receipts

journal and disbursements journal are maintained for the entire trust account

sequentially. However, these journals do not segregate the transactions by the

various clients whose funds are held in trust. This separate, cumulative record,

for each beneficiary or transaction is the client’s ledger.

The client’s ledger is maintained for each client whose funds are held in the trust

account. When a transaction is entered into the cash receipts journal or the cash

disbursement journal, it is also entered into the individual client ledger. By

recording these transactions chronologically, and immediately, the client’s ledger

will always show the balance in the trust account belonging to the individual

client. These amounts must always match those listed in the journal. The

combined total of the balances of the client ledgers should always equal the

running balance in the trust account check book register and in the cash receipts/

disbursement journals.

The client’s ledger should contain a separate sheet or record for each transaction.

It must name the parties to the transaction, the property address or location, the

amount and dates of deposits, and withdrawals, and balances (see exhibit #2).

Transaction files, their contents and identification, are discussed in the audits and

inspections section.

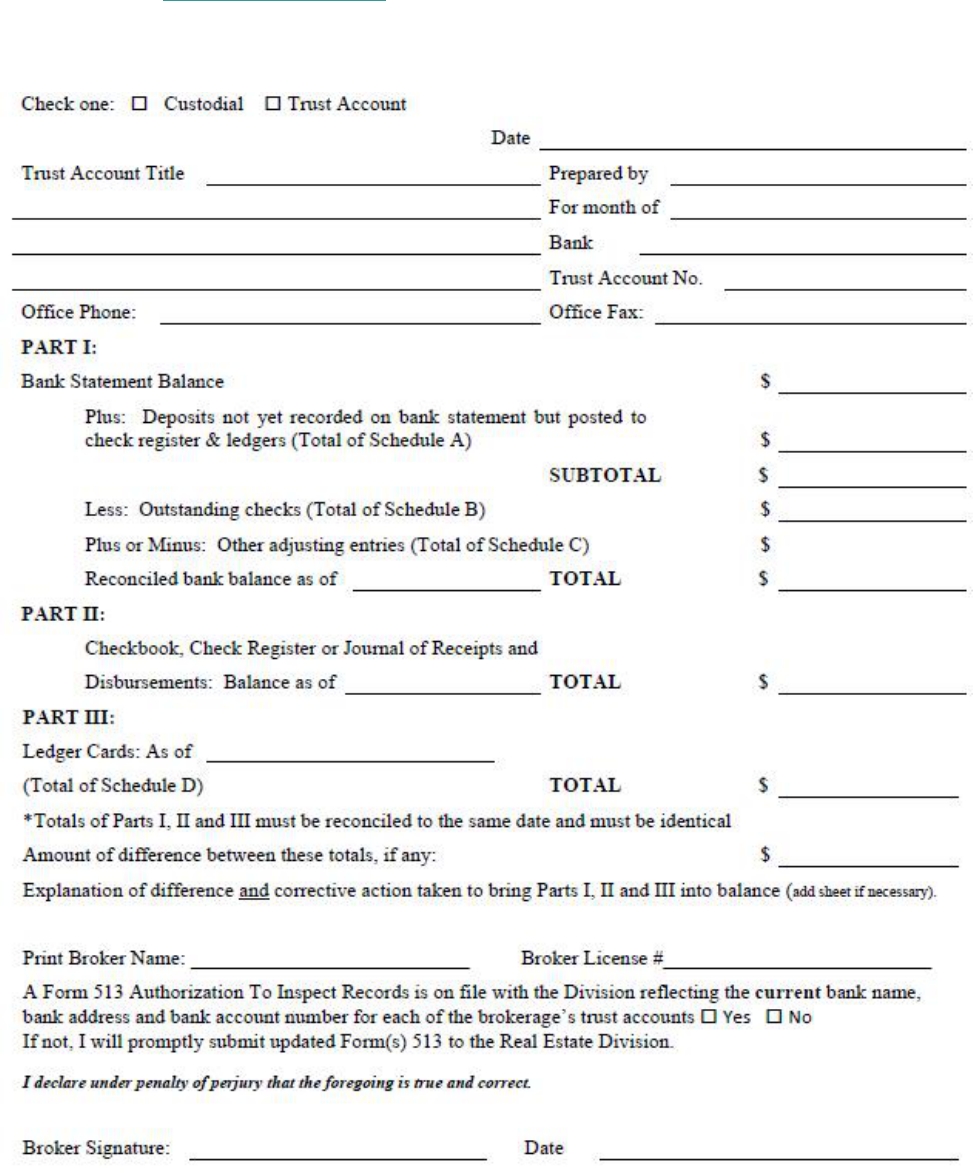

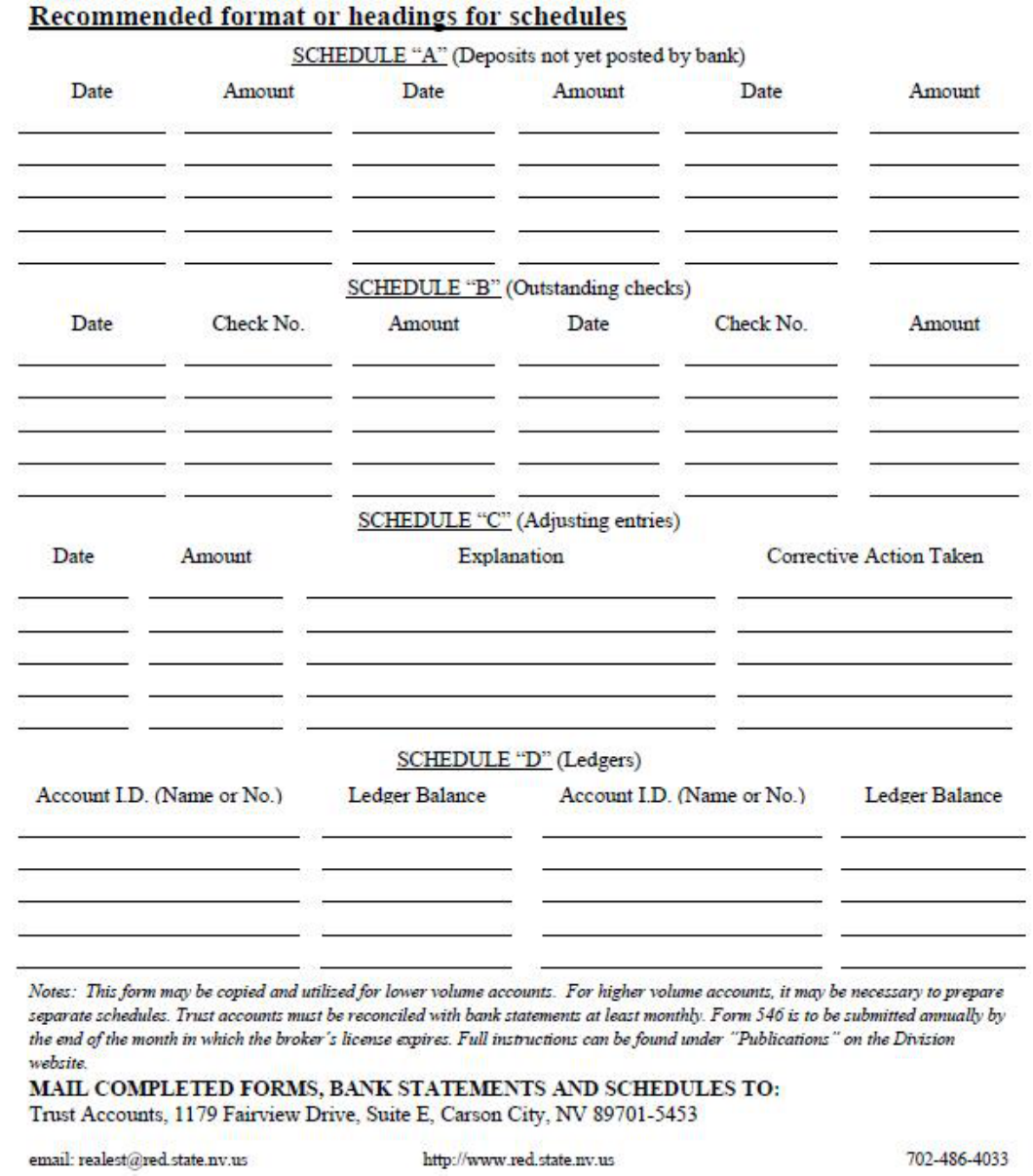

> ACCOUNT RECONCILIATION - aka KEEPING YOUR BALANCE

The broker’s trust account balance must always equal the trust liability. The

balance of the trust account bank records must equal the balance of the clients’

ledgers. The monthly statements on the bank account must be promptly

reconciled to the check register, the journals, and the client’s ledgers. In the case

of property management and real estate transaction trust accounts, bank

Trust fund Accounting and Record Keeping for Nevada Brokers

Page 11

statements must be reconciled within 30 days after receipt by the broker or his/

her designee. NAC 645.655. A monthly account reconciliation will help discover

math or posting errors before they become problems. Timely and regular account

reconciliations can prevent unpaid commissions from becoming commingled

funds.

When balancing the ledgers, only positive balances may be added. If any ledger

shows a negative balance, there is a problem which needs immediate correction.

This could show a conversion of trust funds. Keep the balance current in the

journals, ledgers, and checkbook. It will be easier to prepare a trial balance at the

end of the month.

> EMBEZZLEMENT

The stated balance on the bank statement should equal the checkbook balance

minus outstanding checks and charges plus outstanding deposits. These should

equal the balance of the clients’ ledgers. Sample forms of the required journals

and ledgers are shown in the exhibits. The examples provided are suggested

forms for the minimum records required. The complexity of business conducted

may demand more sophisticated record keeping.

In spite of the broker’s best efforts and good intentions, it is possible to have an

employee who embezzles. There are some standard procedures that may help

prevent employee theft. Remember, the broker will ultimately be held

responsible to the client and to the Real Estate Division for any shortage in the

account.

Suggested management techniques to prevent embezzlement:

Each month the broker should calculate the dollar value of the trust funds for

which he/she is responsible and then examine the bank account to ensure that

the money is there. This is the sum of the balances of all the client ledgers

and the broker funds deposited to pay bank charges.

An outside accounting firm can prepare an audited financial statement for the

trust accounts.

The broker should personally audit the trust accounts monthly.

The broker should, if possible, separate the bookkeeping responsibilities from

the office responsibilities that require access to the bank accounts.

If possible, receipts and deposits should be handled by a different staff person

Trust fund Accounting and Record Keeping for Nevada Brokers

Page 12

than the one who handles disbursements and payments.

The broker must exercise supervision over all employees and independent

contractors in his/her office.

In addition to the above, an employee fidelity bond will help the broker in

replacement of any missing funds. Persons handling money on behalf of the

broker should be bonded. The broker should exercise caution regarding the kind

of fidelity coverage obtained to be assured that the policy provisions fit his/her

needs.

> ACCOUNTING TO PRINCIPALS

All trust fund deposits that are received by a broker are the personal

responsibility of the broker and must be fully accounted for to the client. This

accounting must be done within a reasonable time. For example, in sales

transactions the complete closing statement must be provided to the client within

ten days after close of the transaction; property management reports are normally

made on a monthly basis.

The information that must be supplied to a broker’s client includes the dates and

amounts of all money received and disbursed, as well as to whom and from

whom the funds were disbursed or received. This information must also include

the purpose of each receipt or disbursement. Accounting to the client must be

done in writing and include invoices and/or disbursements.

> UNCLAIMED MONEY

Rarely, money may be held in a broker’s trust account which belongs to a person

or persons that cannot be located. A sincere effort must be made to locate that

person and such effort should be documented. For example, send written notice

of the money that must be disbursed to the party at the last known address. Send

notice by certified/return receipt mail and include a change of address request. If

the mail is returned, keep the letter intact and filed with the appropriate

transaction file.

If all efforts to locate the owner of the trust money fail, the funds must be turned

over to the Office of the State Treasurer, Unclaimed Property. For further

information contact the Office of the State Treasurer, Unclaimed Property at

(702) 486-4140 or on the Internet at www.nevadatreasurer.com/unclaimed

.

Trust fund Accounting and Record Keeping for Nevada Brokers

Page 13

COMMINGLING AND CONVERSION

COMMINGLING AND CONVERSION

COMMINGLING AND CONVERSION

A primary purpose of having a separate trust account, and for keeping detailed

records of that account, is protection of the client. A broker who commingles

the money or other property of his/her principals with their own, or who

converts the money of others to his/her own use, may be guilty of a

disciplinary violation under NRS 645 and/or a criminal offense.

Commingling can occur in unintentional ways. For example, a broker who

has earned a commission or management fee, but leaves the money in the

trust account instead of transferring the money to the general operating

account, may be guilty of commingling. When commissions or other fees for

brokerage services are earned and payable, they become the broker’s money.

Such fees should be paid to the broker’s general operating account before

disbursement of commissions payable to sales associates. However,

property management referral fees may be paid directly from a trust account

to another brokerage (see property management section). Another example

of commingling would be a broker who operates his/her personal rental

properties through his/her clients’ trust accounts.

Conversion is using money in the trust account for the benefit of anyone

other than the rightful beneficiary. This can occur when the broker

“overdraws” the account balance of a client in order to pay expenses, such as

property repairs, on behalf of another client. Any amount over the balance

belonging to the client whose property is being repaired will belong to another

client. Thus, money belonging to one client is spent on behalf of another

client, conversion occurs.

An example of conversion is shown below:

Checkbook balance $10,050.00

Cash Receipt/Disbursement Journal $10,050.00

Client Ledger

Client ‘A’ $5,000.00

Client ‘B’ $5,500.00

Client ‘C’ $(500.00)

Broker Ledger $50.00

$10,050.00

Trust fund Accounting and Record Keeping for Nevada Brokers

Page 14

In this example, the checkbook balances and the journal balances, but Client “C”

has a negative balance of $500.00, which means that money of another client has

been used to cover an expense of Client “C”, thus conversion has occurred.

Until a check clears the bank on which it was drawn, funds are not considered

deposited. If a broker refunds the earnest money, rent, or security deposit of a

buyer/tenant before that buyer’s/tenant’s check has cleared the bank on which it

was drawn, he/she is using money of one principal to benefit another. If the

check tendered is returned for insufficient funds the broker will be obligated to

make up the shortage in the account. Conversion may have occurred.

If a broker permits any trust account, including any ledger account, to fall into

deficit and remain in deficit for more than 45 consecutive days in a year, he/she

will be subject to discipline (NAC 645.655(9)).

AUDITS AND INSPECTIONS

AUDITS AND INSPECTIONS

AUDITS AND INSPECTIONS

All trust account records and transaction files are subject to audit and inspection

by authorized personnel. When Division personnel request documents and/or

access to inspect office files and money accounts, the broker is obligated to

comply. When obtaining a broker’s license, a form is submitted with the license

application that authorizes Nevada Real Estate Division representatives to inspect

bank records. The office transaction file inspection is authorized by

NAC 645.645.

The actual inspection of office files will include checking the items listed in

NAC 645.670, which are:

the office address

the office sign

the procedure used to deposit money

the trust records

the indexing or numbering system used in filing record

Advertising

the availability of current statutes and regulations in the office

any affiliation with a developer as defined in NRS chapters 119 & 119A

any documentation required by NRS chapters 119, 119A, or the Federal Land

Sales Act

Trust fund Accounting and Record Keeping for Nevada Brokers

Page 15

> INDEXING AND NUMBERING

An index is a guide or reference. It may use letters, numbers, or a combination

of both. Whatever system is used, the purpose is to identify and keep an accurate

count of the transactions that are handled in the office.

The index or numbering system can be as simple as 1-2-3, if the volume of

business allows. However, the system can be considerably more complicated.

The type and volume of business will help determine just how complex the

system needs to be. The Division recommends using separate sequences to

index listing contracts, sales contracts, and property management contracts.

Some systems include coding which details the month and year of the

transaction, the branch office that originated the transaction, as well as the actual

transaction number. For example, 08-01-B-87 indicates transaction number 87

was originated in the branch office in August of 2001. The index L129-01

indicates listing number 129, taken in 2001.

Whatever system is used, it must be sequential. NAC 645.655. It must be

consistent. It must include completed transactions and those that have cancelled.

The Division recommends that the open and closed transactions be filed

separately. The separation of finished and currently operating or pending

transactions will assist in keeping track of the activity in the office.

> INSPECTIONS AND TRANSACTION FILES

Bank records that are examined during an office inspection (NRS 645.195)

include the trust account records of:

- Cash Receipts Journal;

- Cash Disbursements Journal or itemized check stubs;

- Clients’ Ledgers;

- Bank statements.

What must be kept in the transaction files?

Office records or transaction files must include documentation for all actions that

have been taken in order to process and/or complete the performance of the

duties owed by the broker. General guidelines which help determine what must

be kept in the file are:

Trust fund Accounting and Record Keeping for Nevada Brokers

Page 16

1. Retain copies of all documents concerning the completion of any sales,

exchanges, options, purchases, rentals, or leases which have been prepared

by the broker or his/her salespersons, or where the client or customer’s

signature is required. Effective January 21, 2000 all offers not accepted

and incomplete transactions must also be retained per NAC 645.650.

2. Retain all documents received that pertain to monetary proration, charge,

or adjustment of items that appear on the closing statement, rental, or lease

agreements, or that affect the fiduciary duties of the broker.

3. Retain any additional documents necessary to show proper performance of

the broker’s duties.

The documents and records listed below provide a guideline regarding the

minimum records to be maintained by the broker. Separate lists are provided for

the transactions conducted by seller’s broker and buyer’s broker:

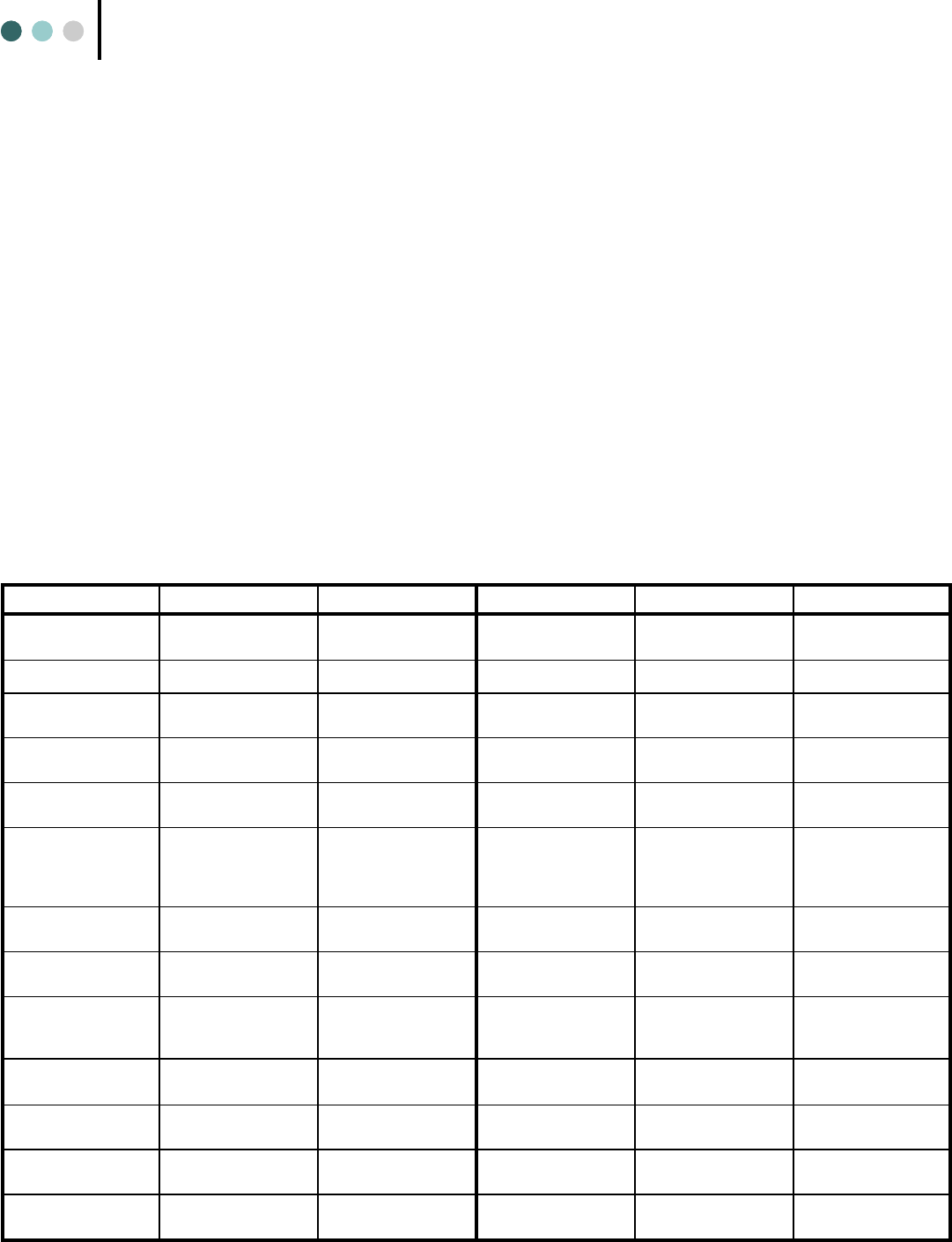

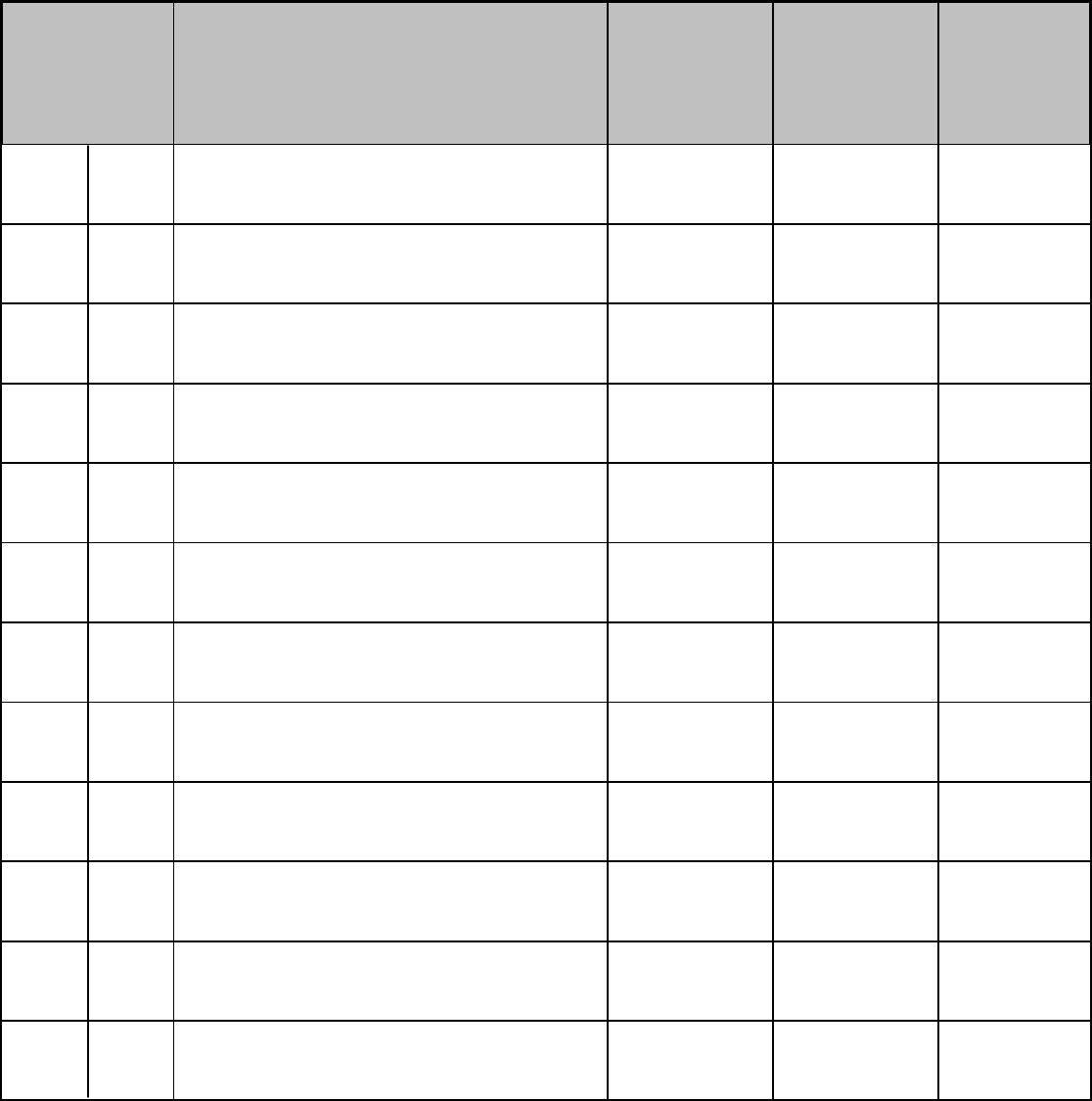

AGENCY RECORDS SELLER’S BROKER BUYER’S BROKER AGENCY RECORDS SELLER’S BROKER BUYER’S BROKER

Listing agreement Y

ES NO

Loan applications and

lender’s representations

NO NO

Buyer agency agreement N

O YES Escrow instructions YES YES

Duties Owed, Confirma-

tion, Consent to Act

Y

ES YES Preliminary title report SUGGESTED SUGGESTED

Retainer fees paid to

buyer’s broker

N

O YES

Seller Real Property Dis-

closure form (SRPD)

YES YES

Sales agreements and

related documents

Y

ES YES

Common Interest Com-

munities Disclosure (CIC)

YES YES

Amendments, extensions,

and addenda

Y

ES YES

Other Disclosures -

hazards, conditions

required by local or

federal statutes, etc.

YES YES

Earnest money promis-

sory note

C

OPY COPY

Loan application (seller

financing)

YES YES

Earnest money payments

(per contract)

C

OPY COPY Home Protection Plan YES YES

Power of Attorney, Seller Y

ES NO

Agreements to adjust

settlement statements at

closing

YES YES

Power of Attorney, Buyer S

UGGESTED YES

Promissory Note and

Deed of Trust

SUGGESTED SUGGESTED

Installment land contract Y

ES YES

Settlement statements,

buyer/seller

YES YES

Buyer’s credit statement

(seller financing)

O

PTIONAL OPTIONAL Rental/Lease agreement YES YES

Buyer’s financial informa-

tion

N

O NO

Property management

agreement

YES NO

Trust fund Accounting and Record Keeping for Nevada Brokers

Page 17

The broker must keep all original transaction/property files in his/her possession

during and after completion of the transaction. Salespersons must not be

permitted to keep the original files as this weakens, or even destroys, the broker’s

ability to control and supervise the transactions which he/she is responsible for

controlling. It also reduces the broker’s ability to detect and correct problems,

real or potential, during the course of the transaction.

The broker’s possession may include off-site storage. When the retention of

required records takes more space than is available in the office, a storage area in

the building or a rented storage unit outside of the office may be used. When this

happens, the broker must notify the Division of the location of storage. This

notice must be given to the Division before the records are moved. Records must

be accessible during normal business hours (see exhibit #8).

> TIME REQUIREMENT FOR RECORD KEEPING

NAC 645.650 Time requirement for recordkeeping involving real estate

transactions and property management. (NRS 645.190)

1. A broker shall keep complete real estate transaction and property management records for at

least 5 years after the date of the closing or the last activity involving the property, including, without

limitation, offers that were not accepted and transactions that were not completed, unless otherwise

directed by the division.

2. A salesman or broker-salesman must provide any paperwork to the broker with whom he is

associated within 5 calendar days after that paperwork is executed by all the parties. NAC

645.650.

[Real Estate Adv. Comm’n, § VII subsecs. 7 & 10 par. c, eff. 10-31-75]—(NAC A by Real Estate

Comm’n, 8-21-81; A by Real Estate Div., 3-1-96; A by Real Estate Comm’n by R186-99, 1-21-2000;

R031-04, 11-30-2004)

PROPERTY MANAGEMENT

PROPERTY MANAGEMENT

PROPERTY MANAGEMENT

In 1997, Amendments were added to the NRS 645 and NAC 645 relating to

property management activity.

According to NAC 645.655(8), a broker who is engaged in property management

for one or more clients must maintain two (2) separate property management

accounts distinct from any trust account that the broker may have for other real

estate transactions. One trust account must be used solely for rental operating

Trust fund Accounting and Record Keeping for Nevada Brokers

Page 18

activities, and the other trust account must be used solely for security deposits.

NAC 645.8005 specifies that a “designated property manager” must be a broker

or a broker-salesperson with two years of full-time active experience within the

four years immediately preceding the date the person applies for a permit to

engage in property management on behalf of a broker. NAC 645.805 states that

a broker has thirty days to replace a terminated designated property manager or

cease the property management activity. Upon termination of the designated

property manager, a reconciliation of the trust account must be submitted to the

Division to account for the thirty days immediately preceding the date that the

designated property manager ceases to be associated with the broker. This

reconciliation must be submitted no later than fifteen days after the designated

property manager ceases to be connected with the broker.

NAC 645.807 states that a broker may give a broker-salesperson permission to

be a sole signer of checks drawn on a trust account. A signature applied by use

of a rubber stamp does not constitute the signature of a real estate broker-

salesperson for the purposes of this section. NAC 645.807.

> MANAGEMENT ACCOUNT RECORDS

Records for property management accounts must include at least the property

management file containing the management agreement, tax reports, individual

tenant/lease files, cash journal, the chronological record of money received and

disbursed, an Owner’s Ledger, a Tenant’s Ledger, bank statements, and checks.

> MANAGEMENT AGREEMENTS

A written contract for services between the property owner and the

managing broker is required. NRS.645.6056. The agreement must list the

broker’s responsibility and authority, and contain at least the following

items:

1. A description of the subject property and its type, including the number

of units managed;

2. The broker’s duties to be itemized; e.g. collection of rents, holding of

deposits, payment of mortgages, physical maintenance, etc.;

3. Broker’s compensation;

Trust fund Accounting and Record Keeping for Nevada Brokers

Page 19

4. Accounting and reporting requirements;

5. Procedure for repair and payment of repair bills (both emergency and

routine);

6. Effective dates of the agreement with a specific termination date, and if

the agreement is subject to renewal, provisions clearly setting forth the

circumstances under which the agreement may be renewed and the term

of each such renewal;

7. A provision for the retention and disposition of deposits of the tenants

of the property during the term of the agreement and, if the agreement

is subject to renewal, during the term of each such renewal;

8. If the agreement is subject to cancellation by broker and/or client, with

and/or without cause, provisions stating the circumstances under which

the agreement may be cancelled; and

9. Names and signatures of the owner(s)/broker(s)/designated property

manager(s).

> MANAGEMENT FILES

A complete filing system for property management must include the information

and documentation of all transactions and business dealings of the manager,

owner, vendor, and tenant. A very small property may require only one file, but

larger properties will need several file folders to maintain this data. The file(s)

must include at least the following:

1. Property management agreement;

2. Rental/Lease agreement;

3. Duties Owed;

4. Correspondence;

5. Invoices and receipts for repairs, purchases;

6. Monthly owner reports (see exhibit #5); and

7. Other documentation that supports the discharge of the broker’s

obligation, such as insurance information, inspection reports, pictures,

advertising, etc.

Trust fund Accounting and Record Keeping for Nevada Brokers

Page 20

> PERSONNEL AND INCOME TAX REPORTS

Property managers who collect more than $600 per year for a client must provide

that client (unless a corporation) with an Internal Revenue Service (IRS) form

1099 by January 31st of the following year. Property managers who pay more

than $600 per year for services for a client must provide the service provider

(unless a corporation) with an IRS form 1099 by January 31

st

of the following

year. Property managers have to send copies of form 1099 to the IRS by

February 28

th

of that year. These forms are available from the IRS or any office

supply store.

Property managers should keep income and expense records of such detail that

the property owner can rely upon those records when preparing income tax

returns. It is recommended that the broker consult a tax accountant for

competent tax advice.

> INDIVIDUAL TENANT/LEASE FILES

It is recommended that each tenant’s records be maintained in a separate tenant/

lease file. This file should contain the rental agreement, correspondence,

documentation of charges to the tenant, legal actions, etc. When the tenant

vacates, the final security deposit reconciliation should be maintained in this file.

> MAINTENANCE OF RECORDS

The following regulation amplifies the record keeping requirement found at NAC

645.650, regarding property management records:

NAC 645.806 Trust accounts: Annual accounting required; maintenance of

records. (NRS 645.190 & NRS 645.6052)

1. On or before the date of expiration of his license as a real estate broker, a broker who engages

in property management or who associates with a property manager who engages in property

management shall provide to the division, on a form provided by the division, an annual accounting

as required by subsection 5 of NRS 645.310 which shows an annual reconciliation of each trust

account related to property management that he maintains.

2. The reconciliation required pursuant to subsection 1 must include the 30 days immediately

preceding the expiration date of his license as a real estate broker.

3. A broker who engages in property management or who associates with a property manager who

Trust fund Accounting and Record Keeping for Nevada Brokers

Page 21

engages in property management shall maintain complete accounting records of each trust account

related to property management that he maintains for at least five years after the last activity by the

broker which involved the trust account. If the records are maintained by computer, the broker

shall maintain an additional copy of the records on computer disc for at least five years after the

last activity by the broker which involved the trust account.

(Added to NAC by Real Estate Comm’n by R059-98, eff. 7-1-98; A by R092-00, 8-29-2000)

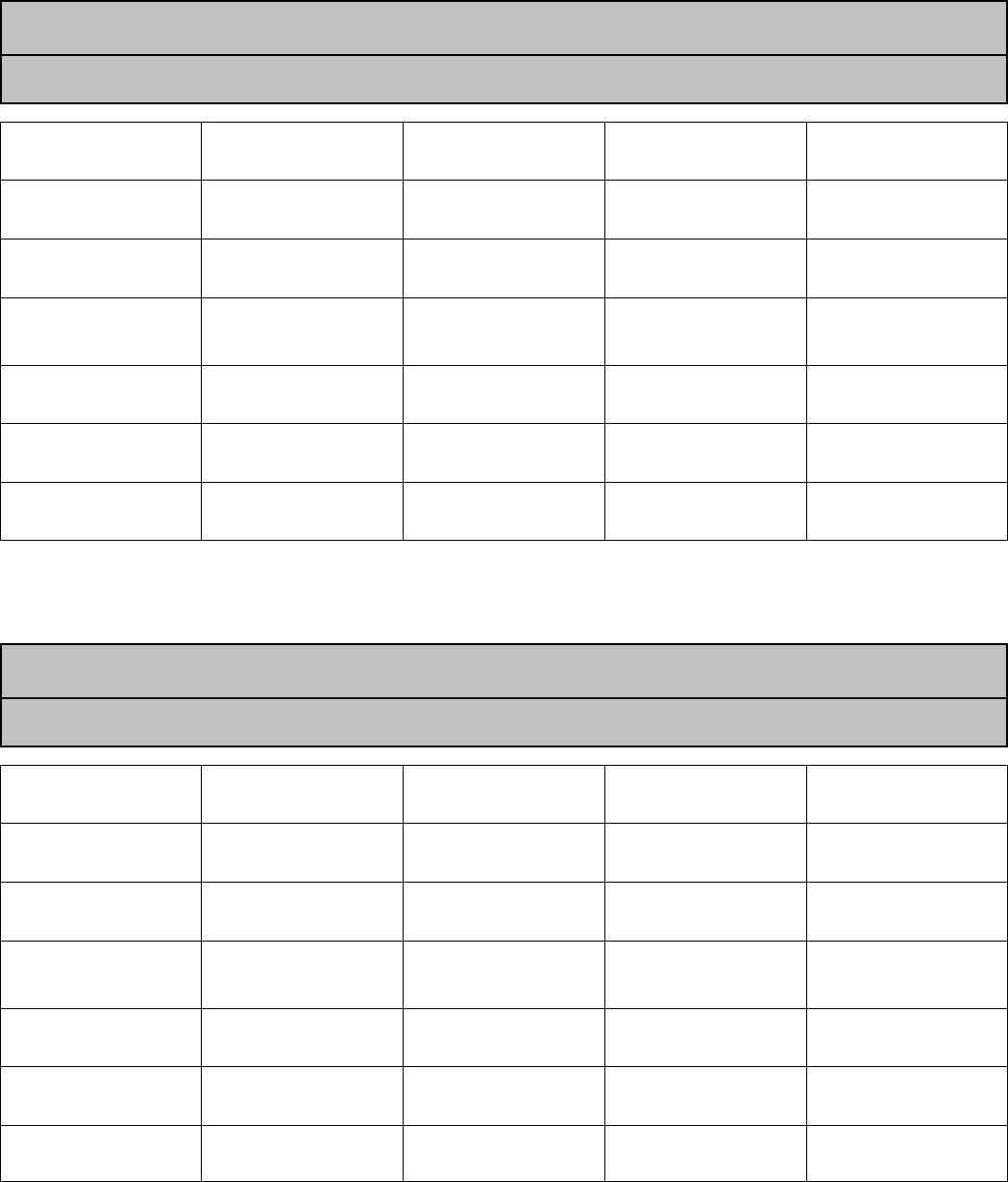

> CASH JOURNAL

The Cash Journal provides a chronological record of all funds received and

disbursed. For cash receipts it must include the date, the account, the name of

the party paying the money, name of the principal, and property identification.

Disbursement records must include the date, the amount, check number, the

payee and property identification.

The Cash Journal should keep a running balance and be reconciled with the bank

statement each month.

> OWNER’S LEDGER

The Owner’s Ledger summarizes all property income and expenses for the

property managed that are handled by the broker. Each property should have its

own ledger and must identify the property or properties for each owner.

This ledger should itemize the source of money received, such as rent or owner

funds, the use of money that is disbursed, and the current balance for this owner.

A broker must account to his/her client on a monthly basis for all money and this

ledger may be used to provide that accounting (see exhibit #3).

> TENANT’S LEDGER

The Tenant’s Ledger must identify the tenant and the property. The purpose of

the ledger is to record the amounts and dates of all charges and payments (i.e.

rent, deposits, damage fee) from a tenant.

This record should be maintained separately for each tenant (see exhibit #4).

Trust fund Accounting and Record Keeping for Nevada Brokers

Page 22

> BANK STATEMENTS AND CHECKS

Bank statements need to be reconciled each month, along with determining the

account trial balance or account liability.

To determine the trust account liability, the account balances of each sub-ledger

(Owner/Tenant’s Ledger) for the account should be listed. There should not be

ledgers with negative balances, as this would indicate conversion of trust funds

from one client’s account to another.

The account liability, the reconciled check register, and the reconciled bank

statement must all show the same balance. If these three balances do not agree,

the broker must locate the error. Errors may be from mathematical inaccuracies,

missing checks, items improperly posted, or commissions not withdrawn.

Whatever the reason, the problem needs to be corrected before it compounds.

If a staff person performs the account reconciliation, the broker must sign the

trust account reconciliation form to document that he/she has reviewed the work.

Every year a reconciliation of the property management trust account is due to

the Division on a form provided by the Division. NAC 645.806 and NRS

645.310. The due date is on or before the broker’s license anniversary month.

Example: Broker’s license renews on June 30

th

, therefore, annual trust account

reconciliation is due every year on or before June 30

th

(see exhibit #9).

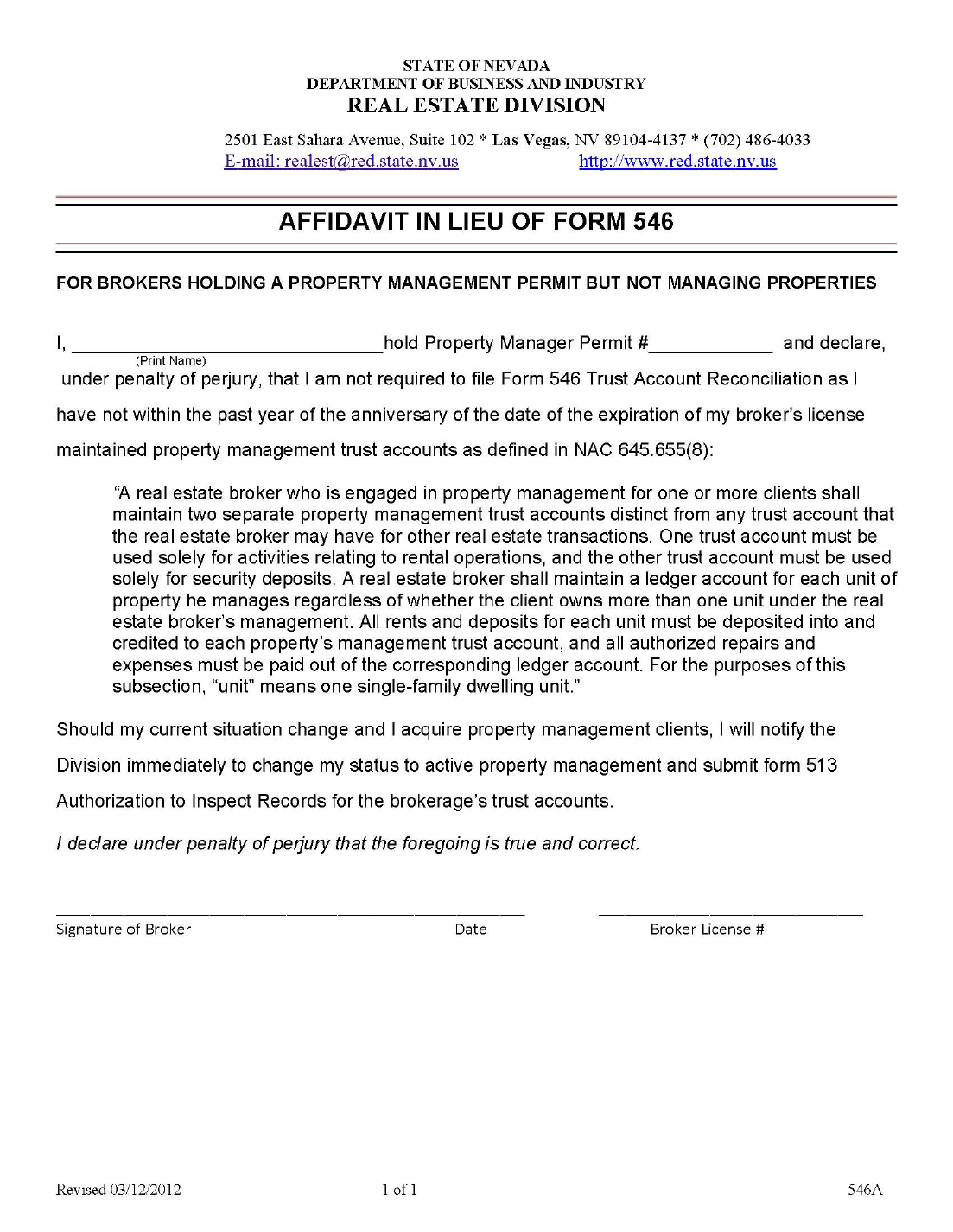

Brokers who hold a Property Management Permit, but are not required to file a

Trust Account Reconciliation Form 546 per NAC 645.655(8) because they do not

manage properties, should file Form 546A, Affidavit in Lieu of Form 546,

annually before the end of the anniversary month of their broker’s license.

Brokers with a Property Management Permit are required to file either a Form

546 or Form 546A annually (see exhibit #10).

> SECURITY AND OTHER TENANT DEPOSITS

Security deposits are most commonly held in trust by the broker. They must

be

kept in a separate security deposit trust account per NAC 645.655.

A security deposit may also be held by the property owner. If the security

deposit is transferred to the owner, the tenant and all parties to the transaction

must be notified in writing of the transfer.

Trust fund Accounting and Record Keeping for Nevada Brokers

Page 23

Deposits may be made by the tenant for security, cleaning, damage, pets, etc.

The deposit may be refundable or non-refundable as stated in Rental/Lease

Agreement. When a deposit is received or disbursed it must be accounted for to

the owner and tenant.

A deposit must be listed on the Tenant’s Ledger and must be identified as to its

purpose (i.e. security, damage). The rental or lease agreement should include a

provision authorizing the broker holding the deposit to transfer the deposit to

another owner or manager, or for refund to the tenant. In the event that a transfer

or deposit to another owner or manager does occur, it is also recommended that

the transfer be acknowledged in writing. In addition, the tenant must be notified

of such transfer in writing.

Like all trust funds, deposits must be made to the appropriate trust account by the

next banking day after receipt, unless written agreement of all parties requires

otherwise.

> MANAGEMENT REFERRALS

When paying a property management referral to an outside brokerage, a check

can be issued directly from the broker’s trust account (it does not have to flow

through the broker’s operating account). The outside broker becomes, in

essence, a vendor to the owner.

CLOSING A BANK ACCOUNT AND/OR BROKER’S OFFICE

CLOSING A BANK ACCOUNT AND/OR BROKER’S OFFICE

CLOSING A BANK ACCOUNT AND/OR BROKER’S OFFICE

> BANKRUPTCY

If a broker files for relief under the bankruptcy laws of the United States, the

broker must immediately terminate each trust account that has been established

for the operation of the real estate business. All money deposited to the trust

account must be moved or redeposited to an escrow. The escrow agent must be

given written instructions for disbursement of the funds. Those instructions must

comply with the contract that caused the trust funds to be deposited.

> CLOSING AN OFFICE

When a broker closes his/her office, a few simple steps are required to comply

with Division regulations:

Trust fund Accounting and Record Keeping for Nevada Brokers

Page 24

Broker’s license must be inactivated and surrendered to the Division;

All salesperson and broker-salesperson licensees associated with that broker

must be terminated at the same time and their licenses surrendered to the

Division;

Broker must file a notice with the Division stating the location of the office

records. Location must be within the state of Nevada in a storage facility,

home, office, or other facility. Records must be accessible during normal

business hours. Records must be maintained by the broker for a minimum of

five years (see NAC 645.650 & NAC 645.806); and

Any trust or custodial account monies must be accounted for and properly

disbursed. The accounts must then be closed.

CONCLUSION

CONCLUSION

CONCLUSION

The intent of this booklet is to clarify trust fund deposit and record keeping

requirements for real estate licensees. It is not designed nor intended to cover all

possible situations in the brokerage industry.

In all situations, however, the broker remains responsible and liable for money or

other things of value entrusted to him/her. Careful supervision of employees and

licensees who handle money is essential. Often, standardized office procedures

and management procedures will help prevent the violations of commingling and

conversion that can result in the loss of license.

Always consult the Division if you have any questions:

Nevada Real Estate Division Nevada Real Estate Division

1179 Fairview Drive, Ste E 2501 E Sahara Ave, Ste 101

Carson City, NV 89701 Las Vegas NV 89104

Voice: 775-687-4280 Voice: 702-486-4033

Fax: 775-687-4868 Fax: 702-486-4275

Internet: http://www.red.state.nv.us

Email: [email protected]

Trust fund Accounting and Record Keeping for Nevada Brokers

Page 25

SELECTED SECTIONS FROM NRS 645

SELECTED SECTIONS FROM NRS 645

SELECTED SECTIONS FROM NRS 645

NRS 645.195 Inspection of records of broker and owner-developer by

division; regulations.

1. The division shall regularly inspect the transaction files, trust records and pertinent real estate

business accounts of all real estate brokers and owner-developers to ensure compliance with the

provisions of this chapter.

2. The commission shall adopt regulations pertaining to those inspections.

(Added to NRS by 1973, 989; A 1975, 1542; 1979, 1537)

NRS 645.310 Deposits and trust accounts: Accounting; commingling;

records; inspection and audit.

1. All deposits accepted by every real estate broker or person registered as an owner-developer

pursuant to this chapter, which are retained by him pending consummation or termination of the

transaction involved, must be accounted for in the full amount at the time of the consummation or

termination.

2. Every real estate salesman or broker-salesman who receives any money on behalf of a broker

or owner-developer shall pay over the money promptly to the real estate broker or owner-developer.

3. A real estate broker shall not commingle the money or other property of his client with his

own.

4. If a real estate broker receives money, as a broker, which belongs to others, he shall promptly

deposit the money in a separate checking account located in a bank or credit union in this state

which must be designated a trust account. All down payments, earnest money deposits, rents, or

other money which he receives, on behalf of his client or any other person, must be deposited in

the account unless all persons who have any interest in the money have agreed otherwise in

writing. A real estate broker may pay to any seller or the seller’s authorized agent the whole or

any portion of such special deposit. The real estate broker is personally responsible and liable for

such deposit at all times. A real estate broker shall not permit any advance payment of money

belonging to others to be deposited in the real estate broker’s business or personal account or to be

commingled with any money he may have on deposit.

5. Every real estate broker required to maintain a separate trust account shall keep records of

Trust fund Accounting and Record Keeping for Nevada Brokers

Page 26

all money deposited therein. The records must clearly indicate the date and from whom he received

money, the date deposited, the dates of withdrawals, and other pertinent information concerning the

transaction, and must show clearly for whose account the money is deposited and to whom the money

belongs. The real estate broker shall balance each separate trust account at least monthly. The real

estate broker shall provide to the division, on a form provided by the division, an annual accounting

which shows an annual reconciliation of each separate trust account. All such records and money

are subject to inspection and audit by the division and its authorized representatives. All such

separate trust accounts must designate the real estate broker as trustee and provide for withdrawal

of money without previous notice.

6. Each real estate broker shall notify the division of the names of the banks and credit unions in

which he maintains trust accounts and specify the names of the accounts on forms provided by the

division.

7. If a real estate broker who has money in a trust account dies or becomes mentally disabled, the

division, upon application to the district court, may have a trustee appointed to administer and

distribute the money in the account with the approval of the court. The trustee may serve without

posting a bond.

[27.5:150:1947; added 1955, 76]-(NRS A 1963, 1073; 1975, 1543; 1979, 1539; 1981, 1606; 1983, 152;

1995, 2074; 1997, 958; 1999, 1538)

NRS 645.6056 Property management agreements: Requirements; contents.

1. A real estate broker who holds a permit to engage in property management shall not act as a

property manager unless the broker has first obtained a property management agreement signed by

the broker and the client for whom the broker will manage the property.

2. A property management agreement must include, without limitation:

(a) The term of the agreement and, if the agreement is subject to renewal, provisions clearly setting

forth the circumstances under which the agreement may be renewed and the term of each such

renewal;

(b) A provision for the retention and disposition of deposits of the tenants of the property during

the term of the agreement and, if the agreement is subject to renewal, during the term of each such

renewal;

(c) The fee or compensation to be paid to the broker;

(d) The extent to which the broker may act as the agent of the client; and

Trust fund Accounting and Record Keeping for Nevada Brokers

Page 27

(e) If the agreement is subject to cancellation, provisions clearly setting forth the circumstances

under which the agreement may be cancelled. The agreement may authorize the broker or the client,

or both, to cancel the agreement with cause or without cause, or both, under the circumstances set

forth in the agreement.

(Added to NRS by 1997, 955; A 2003, 932)

Trust fund Accounting and Record Keeping for Nevada Brokers

Page 28

SELECTED SECTIONS FROM NAC 645

SELECTED SECTIONS FROM NAC 645

SELECTED SECTIONS FROM NAC 645

NAC 645.645 Inspection and audit.

A broker shall, upon demand, provide the Division with the documents and the permission

necessary for the Division to complete fully an inspection and audit, including an inspection and

audit of any money accounts as provided in NRS 645.310

and 645.313. Permission may be

given on a form provided by the Division. The form must provide a bank, depositor or other holder

of information with release from liability which might result from disclosure of the information

required by the Division.

[Real Estate Adv. Comm’n, § VII subsec. 15, eff. 10-31-75]—(NAC A by Real Estate Comm’n

by R031-04, 11-30-2004)

NAC 645.650 Time requirement for recordkeeping involving real estate

transactions and property management.

1. A broker shall keep complete real estate transaction and property management records for at

least 5 years after the date of the closing or the last activity involving the property, including,

without limitation, offers that were not accepted and transactions that were not completed, unless

otherwise directed by the Division.

2. A salesman or broker-salesman must provide any paperwork to the broker with whom he is

associated within 5 calendar days after that paperwork is executed by all the parties.

[Real Estate Adv. Comm’n, § VII subsecs. 7 & 10 par. c, eff. 10-31-75]—(NAC A by Real Estate

Comm’n, 8-21-81; A by Real Estate Div., 3-1-96; A by Real Estate Comm’n by R186-99, 1-21-

2000; R031-04, 11-30-2004)

NAC 645.655 Records of transactions; trust accounts.

1. Each real estate transaction of a brokerage must be numbered consecutively or indexed to

permit audit by a representative of the Division.

2. A complete record of each real estate transaction, together with records required to be

maintained pursuant to NRS 645.310

, must be:

(a) Kept in this State; and

(b) Open to inspection and audit by the Division upon its request during its usual business hours,

Trust fund Accounting and Record Keeping for Nevada Brokers

Page 29

as well as other hours during which the licensee regularly conducts his business.

3. If any records the Division requests to inspect or audit pursuant to subsection 2 are stored

electronically, access to a computer or other equipment used to store the information must be made

available to the Division for use in its inspection or audit.

4. The real estate broker shall give written notice to the Division of the exact location of his

records and shall not remove them until he has delivered a notice which informs the Division of the

new location.

5. A licensee shall not maintain a custodial or trust account from which money may be withdrawn

without the signature of a licensee. A signature applied by use of a rubber stamp does not

constitute the signature of a licensee for the purposes of this subsection.

6. A real estate salesman may not be the only required signatory on a custodial or trust fund

account. A real estate salesman may be a cosigner of an account with his real estate broker.

7. A real estate broker who files for relief under the bankruptcy laws of the United States shall

immediately terminate each trust account established pursuant to NRS 645.310

and deposit all

money from each trust account into escrow with executed instructions to the escrow agent or officer to

disburse the money pursuant to the agreement under which it was originally deposited.

8. A real estate broker who is engaged in property management for one or more clients shall

maintain two separate property management trust accounts distinct from any trust account that the

real estate broker may have for other real estate transactions. One trust account must be used solely

for activities relating to rental operations, and the other trust account must be used solely for security

deposits. A real estate broker shall maintain a ledger account for each unit of property he manages

regardless of whether the client owns more than one unit under the real estate broker’s management.

All rents and deposits for each unit must be deposited into and credited to each property’s

management trust account, and all authorized repairs and expenses must be paid out of the

corresponding ledger account. For the purposes of this subsection, “unit” means one single-family

dwelling unit.

9. Property management and real estate transaction trust accounts must be reconciled monthly by

the real estate broker or his designee within 30 days after receipt of the bank statement. A real

estate broker who permits any trust account, including any ledger account, to fall into deficit and

remain in deficit for more than 45 consecutive days in 1 year is subject to discipline pursuant to

paragraph (h) of subsection 1 of NRS 645.633

or other applicable charges, or both.

[Real Estate Adv. Comm’n, § VII subsec. 10 pars. a, b, d & e, eff. 10-31-75]—(NAC A by Real

Estate Comm’n, 6-3-86; A by Real Estate Div., 3-1-96; A by Real Estate Comm’n by R111-01, 12-

Trust fund Accounting and Record Keeping for Nevada Brokers

Page 30

17-2001; R031-04, 11-30-2004, eff. 7-1-2005)

NAC 645.657 Payment of deposit to broker or owner-developer.

A licensee who receives a deposit on any transaction in which he is engaged on behalf of a broker

or owner-developer shall pay over the deposit to that broker or owner-developer, or to the escrow

business or company designated in the contract, within 1 business day after receiving a fully executed

contract.

(Added to NAC by Real Estate Comm’n, eff. 8-21-81; A 12-16-82; R031-04, 11-30-2004; R123-06, 6

-1-2006)

NAC 645.660 Disclosure of certain interests required before deposit of

money.

A licensee shall not deposit money received by him in any escrow business or company in which he

or anyone associated with him in the real estate or time-share business has an interest without

disclosing this association to all parties to the transaction.

[Real Estate Adv. Comm’n, § VII subsec. 11, eff. 10-31-75]—(NAC A by Real Estate Comm’n, 8

-21-81; 4-27-84; R031-04, 11-30-2004)

NAC 645.670 Inspections.

1. The Division may use a form of its design to conduct any inspection and require the broker or

office manager in charge of the office being inspected to sign such a form.

2. Such an inspection must include, but need not be limited to:

(a) The address of the real estate office or time-share office.

(b) The sign identifying the office.

(c) The procedure used to deposit money.

(d) The trust records.

(e) The indexing or numbering system used in filing records.

(f) Advertising.

(g) The availability of current statutes and regulations at the place of business.

(h) Any affiliation with a developer as defined in chapter 119

or 119A of NRS.

Trust fund Accounting and Record Keeping for Nevada Brokers

Page 31

(i) Any documentation required by chapter 119 or 119A of NRS or the federal Land Sales Act.

[Real Estate Adv. Comm’n, § VII subsec. 17, eff. 10-31-75]—(NAC A by Real Estate Comm’n, 8

-21-81; 4-27-84)

NAC 645.805 Termination of association of designated property manager;

reconciliation of trust accounts; extension of time to designate another

property manager.

1. Except as otherwise provided in subsection 4, if a person to whom a permit is issued pursuant

to NRS 645.6054 ceases to be connected or associated with the partnership, corporation, limited-

liability company or sole proprietor for whom he is acting as a property manager, the partnership,

corporation, limited-liability company or sole proprietor shall not engage in the business of property

management unless, not later than 30 days after that person ceases to be connected or associated

with the partnership, corporation, limited-liability company or sole proprietor, the partnership,

corporation, limited-liability company or sole proprietor designates another person to hold the permit

on behalf of the partnership, corporation, limited-liability company or sole proprietor pursuant to

the requirements set forth in subsection 3 of NRS 645.6054.

2. The real estate broker of a partnership, corporation, limited-liability company or sole

proprietorship who is required pursuant to NRS 645.310 to maintain a trust account for money

received for property management shall:

(a) Request a statement from the bank in which the trust account is being held not later than 5

days after the date that the designated property manager ceases to be connected or associated with the

partnership, corporation, limited-liability company or sole proprietor; and

(b) Submit to the division, on a form provided by the division, a reconciliation of the trust account

for the 30 days immediately preceding the date that the designated property manager ceases to be

connected or associated with the partnership, corporation, limited-liability company or sole

proprietor.

3. A reconciliation required pursuant to paragraph (b) of subsection 2 must be submitted to the

division not later than 15 days after the designated property manager ceases to be connected or

associated with the partnership, corporation, limited-liability company or sole proprietor or by the

end of the month in which the designated property manager ceases to be connected or associated with

the partnership, corporation, limited-liability company or sole proprietor, whichever occurs later.

4. A partnership, corporation, limited-liability company or sole proprietor may petition, in writing,

the administrator for an extension of time in which to designate another property manager after the

Trust fund Accounting and Record Keeping for Nevada Brokers

Page 32

designated property manager ceases to be connected or associated with the partnership, corporation,

limited-liability company or sole proprietor. The administrator may grant such an extension, in

writing, if he finds the partnership, corporation, limited-liability company or sole proprietor has a

severe hardship resulting from circumstances beyond the control of the partnership, corporation,

limited-liability company or sole proprietor which has prevented the partnership, corporation,

limited-liability company or sole proprietor from meeting the requirements of subsection 1.

(Added to NAC by Real Estate Comm’n by R059-98, eff. 7-1-98)

NAC 645.806 Trust accounts: Annual accounting required; maintenance of

records.

1. On or before the date of expiration of his license as a real estate broker, a broker who engages

in property management or who associates with a property manager who engages in property

management shall provide to the division, on a form provided by the division, an annual accounting

as required by subsection 5 of NRS 645.310 which shows an annual reconciliation of each trust

account related to property management that he maintains.